Question

Q. No. 5. In the current year, Phillip Hard earned the following income: Employment income Property income Gains: Shares of Corporation X $12,000 Personal-use

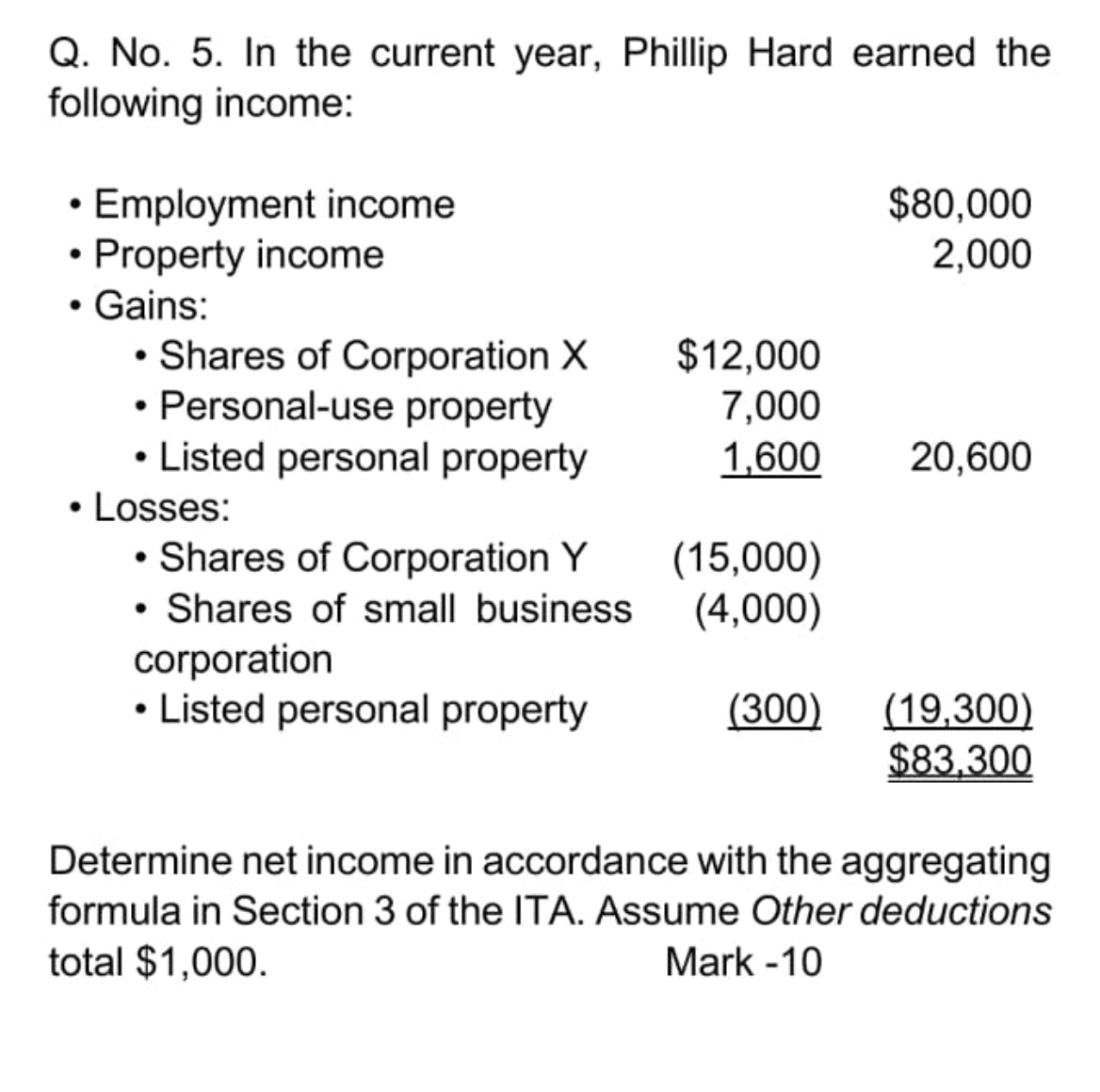

Q. No. 5. In the current year, Phillip Hard earned the following income: Employment income Property income Gains: Shares of Corporation X $12,000 Personal-use property $80,000 2,000 7,000 Listed personal property 1,600 20,600 Losses: Shares of Corporation Y (15,000) Shares of small business corporation (4,000) Listed personal property (300) (19,300) $83,300 Determine net income in accordance with the aggregating formula in Section 3 of the ITA. Assume Other deductions total $1,000. Mark -10

Step by Step Solution

3.27 Rating (127 Votes )

There are 3 Steps involved in it

Step: 1

To determine Phillip Hards net income in accordance with the aggregating formula in Section 3 of the ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started