Question

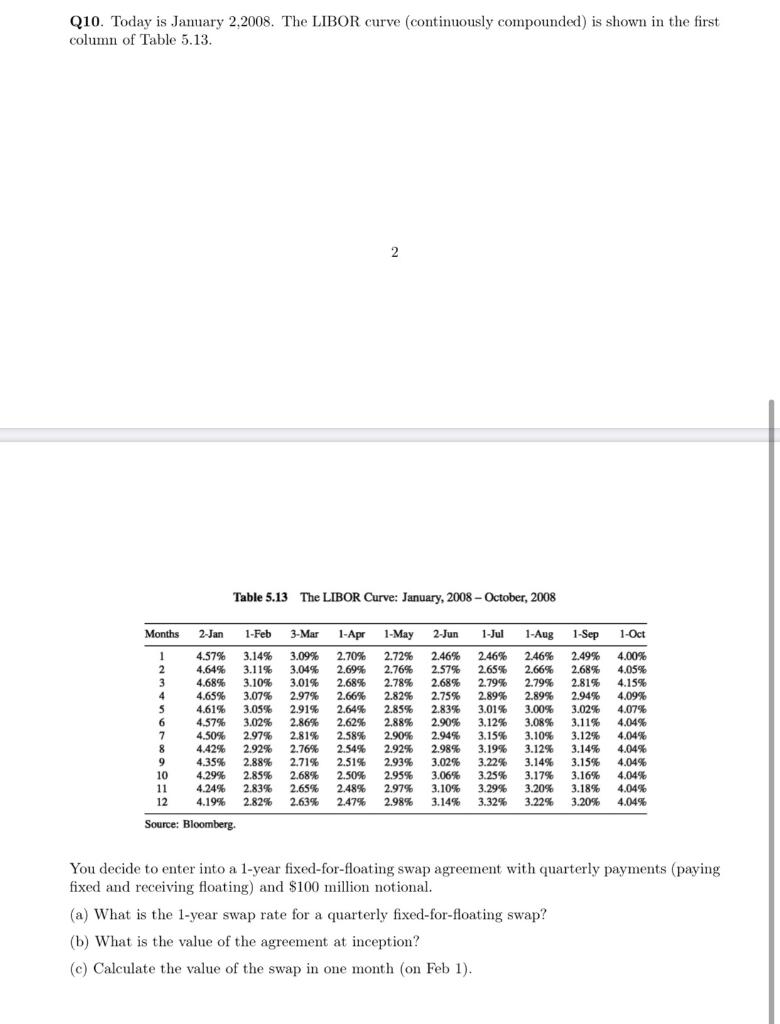

Q10. Today is January 2,2008. The LIBOR curve (continuously compounded) is shown in the first column of Table 5.13. 2 Table 5.13 The LIBOR

Q10. Today is January 2,2008. The LIBOR curve (continuously compounded) is shown in the first column of Table 5.13. 2 Table 5.13 The LIBOR Curve: January, 2008-October, 2008 Months 1 2 3 4 5 2-Jan 1-Feb 3-Mar 1-Apr 1-May 2-Jun 1-Jul 1-Aug 1-Sep 1-Oct 4.57% 3.14% 3.09% 2.70% 2.72% 2.46% 2.46% 2.46% 2.49% 4.00% 4.64% 3.11% 3.04% 2.69% 2.76% 2.57% 2.65% 2.66% 2.68% 4.05% 4.68% 3.10% 3.01% 2.68% 2.78% 2.68% 2.79% 2,79% 2.81% 4.15% 4.65% 3.07% 2.97% 2.66% 2.82% 2.75% 2.89% 2.89% 2.94% 4.09% 4.61% 3.05% 2.91% 2.64% 2.85% 2.83% 3.01% 3.00% 3.02% 4.07% 4.57% 3.02% 2.86% 2.62% 2.88% 2.90% 3.12% 3.08% 3.11% 4.04% 4.50% 2.97% 2.81% 2.58% 2.90% 2.94% 3.15% 3.10% 3.12% 4.04% 4.42% 2.92% 2.76% 2.54% 2.92% 2.98% 3.19% 3.12% 3.14% 4.04% 4.35% 2.88% 2,71% 2.51% 2.93% 3.02% 3.22% 3.14% 3.15% 4.04% 4.29% 2.85% 2.68% 2.50% 2.95% 3.06% 3.25% 3.17 % 3.16% 4.04% 4.24% 2.83% 2.65% 2.48% 2.97% 3.10% 3.29% 3.20% 3.18% 6 7 8 9 10 11 4.04% 12 4.19% 2.82% 2.63% 2.47% 2.98% 3.14% 3.32% 3.22% 3.20% 4.04% Source: Bloomberg. You decide to enter into a 1-year fixed-for-floating swap agreement with quarterly payments (paying fixed and receiving floating) and $100 million notional. (a) What is the 1-year swap rate for a quarterly fixed-for-floating swap? (b) What is the value of the agreement at inception? (c) Calculate the value of the swap in one month (on Feb 1).

Step by Step Solution

3.32 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Part a time in months Quarter Spot rate ZCB Discount Factor Read from LIBOR Curve under 2Jan date r ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started