Question: Question #1 (25 points) Consider the following two assets. Returns on asset 1 has a mean of in and standard deviation of oi. Returns on

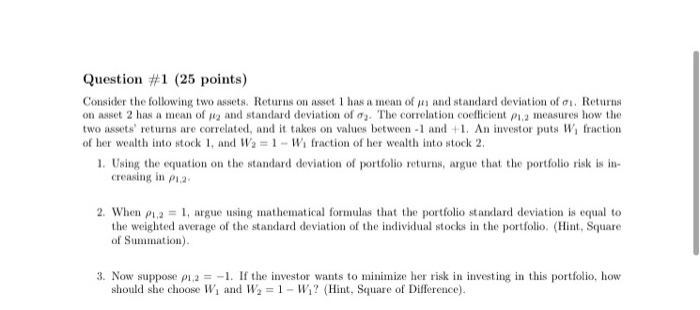

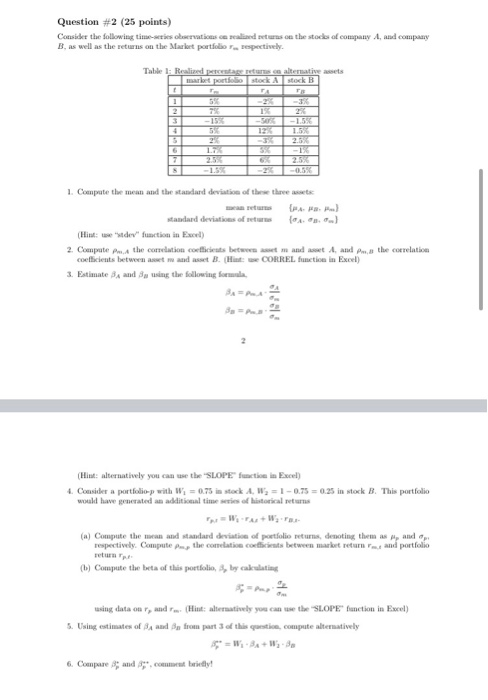

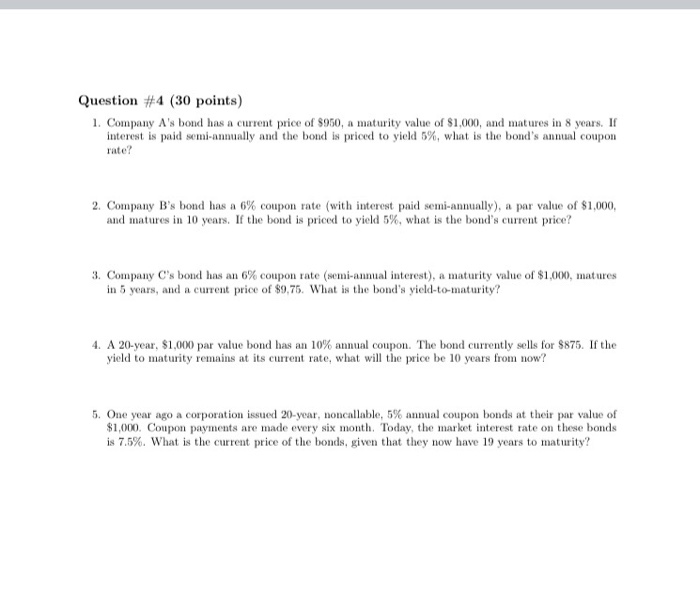

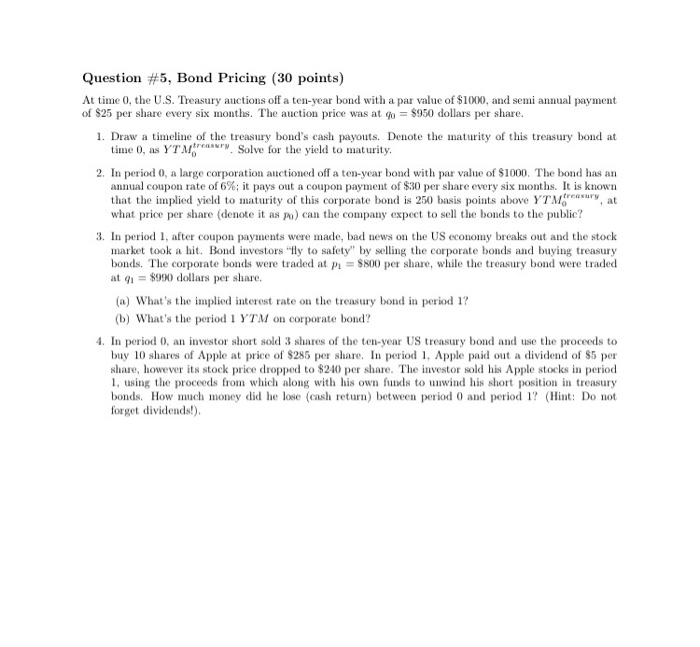

Question #1 (25 points) Consider the following two assets. Returns on asset 1 has a mean of in and standard deviation of oi. Returns on asset 2 has a mean of 2 and standard deviation of 2. The correlation coefficient P1.2 measures how the two assets' returns are correlated, and it takes on values between 1 and +1. An investor puts W fraction of her wealth into stock 1. and W2 = 1 - W fraction of her wealth into stock 2. 1. Using the equation on the standard deviation of portfolio returns, argue that the portfolio risk is in- creasing in P1.2 2. When P1.2 = 1, argue using mathematical formulas that the portfolio standard deviation is equal to the weighted average of the standard deviation of the individual stocks in the portfolio. (Hint, Square of Summation). 3. Now suppose 12 = -1. If the investor wants to minimize her risk in investing in this portfolio, how should she choose W, and W2 = 1 - W,? (Hint, Square of Difference). Question #2 (25 points) Come the followe B as well as the return on the d the cow .com port spectively Tal Real - -05 1. Compute the man and the standard deviation of these three standard deviations of the c the correlati 2. Compute cob 3. Estimate i co ww BH using the following for w CORREL fii Excel) and (Hint: alternatively you can use the "SLOPE faction in Excel Considera pop with 0.75k W , 10 .15 in B The portfolio (a) Compute them respective and standard deviation of poo , the conce r dating them p and t C e the best of this profily calling in Excel) wing datar, Hot wheels you the SLOPE 5. Using estimates of andere part of this gratis compute alternatively 6. Compare and comment biety Question #3 (40 points) Download monthly adjusted close price data for Apple and Google (Alphabet Inc.). for the period of Jan. 2010 through Jan, 2020 (use Finance. Yahoo.com). Use Excel for this question. Stock returns are computed PL+1-P T + 1P 1. Assume that you are constructing portfolios with Apple and Google such that WA+UG = 1. Create a column in Excel and apply a range of weights between - 1 and +1 (with step size of 0.1) to Apple (WA) to construct a portfolio consisting of the two shares (remember that the sum of weights should be one, so you can easily calculate the weight for Google once you know the weight for Apple. Don't worry if it geta larger than 1!). Plot a scatter-plot graph showing average return and the stan- dard deviation of the portfolio under alternative values of wa 2. Now apply a constraint on weights: eliminate negative values of weights and change the weight only between 0 and 1 (with step size of 0.05) and re-plot the scatter plot of average return and variance of portfolio 3. Eliminating negative weight is called short sales constraints. Compare the results of parts (1) and (2) and discuss the effects of imposing short-sales constraints on a market. 4. Use the SP500 index as a proxy for the market portfolio. Create a returns scatterplot (the way we did in the class) and calculate Apple's beta. (Hint: you can either use the "SLOPE" function in excel or apply the procedures described in Question #2) Question #4 (30 points) 1. Company A's bond has a current price of $950, a maturity value of $1,000, and matures in 8 years. If Interest is paid semi-annually and the bond is priced to yield 5%, what is the bond's annual coupon 2. Company B's bond has a 6% coupon rate (with interest paid semi-annually), a par value of $1,000, and matures in 10 years. If the bond is priced to yield 5%, what is the bond's current price? 3. Company C's bond has an 6% coupon rate (semi-annual interest), a maturity value of $1.000, matures in 5 years, and a current price of $9.75. What is the bond's yield-to-maturity? 4. A 20-year, $1,000 par value bond has an 10% annual coupon. The bond currently sells for $875. If the yield to maturity remains at its current rate, what will the price be 10 years from now? 5. One year ago a corporation issued 20-year, noncallable, 5% annual coupon bonds at their par value of $1,000. Coupon payments are made every six month. Today, the market interest rate on these bonds is 7.5%. What is the current price of the bonds, given that they now have 19 years to maturity? Question #5, Bond Pricing (30 points) At time 0, the U.S. Treasury auctions off a ten-year bond with a par value of $1000, and semi annual payment of $25 per share every six months. The auction price was at go = $950 dollars per share. 1. Draw a timeline of the treasury bond's cash payouts. Denote the maturity of this treasury bond at time 0, as YTMreasury. Solve for the yield to maturity. 2. In period 0, a large corporation auctioned off a ten-year bond with par value of $1000. The bond has an annual coupon rate of 6%; it pays out a coupon payment of $30 per share every six months. It is known that the implied yield to maturity of this corporate bond is 250 basis points above YTM resury, at what price per share (denote it as po) can the company expect to sell the bonds to the public? 3. In period 1. after coupon payments were made, bad news on the US economy breaks out and the stock market took a hit. Bond investors "Ily to safety" by selling the corporate bonds and buying treasury bonds. The corporate bonds were traded at Pi = $800 per share, while the treasury bond were traded at 9 = $990 dollars per share. (a) What's the implied interest rate on the treasury bond in period 1? (b) What's the period 1 YTM on corporate bond? 4. In period 0, an investor short sold 3 shares of the ten-year US treasury bond and use the proceeds to buy 10 shares of Apple at price of $285 per share. In period 1, Apple paid out a dividend of $5 per share, however its stock price dropped to $240 per share. The investor sold his Apple stocks in period 1, using the proceeds from which along with his own funds to unwind his short position in treasury bonds. How much money did he lose (cash return) between period 0 and period 1? (Hint: Do not forget dividends!). Question #1 (25 points) Consider the following two assets. Returns on asset 1 has a mean of in and standard deviation of oi. Returns on asset 2 has a mean of 2 and standard deviation of 2. The correlation coefficient P1.2 measures how the two assets' returns are correlated, and it takes on values between 1 and +1. An investor puts W fraction of her wealth into stock 1. and W2 = 1 - W fraction of her wealth into stock 2. 1. Using the equation on the standard deviation of portfolio returns, argue that the portfolio risk is in- creasing in P1.2 2. When P1.2 = 1, argue using mathematical formulas that the portfolio standard deviation is equal to the weighted average of the standard deviation of the individual stocks in the portfolio. (Hint, Square of Summation). 3. Now suppose 12 = -1. If the investor wants to minimize her risk in investing in this portfolio, how should she choose W, and W2 = 1 - W,? (Hint, Square of Difference). Question #2 (25 points) Come the followe B as well as the return on the d the cow .com port spectively Tal Real - -05 1. Compute the man and the standard deviation of these three standard deviations of the c the correlati 2. Compute cob 3. Estimate i co ww BH using the following for w CORREL fii Excel) and (Hint: alternatively you can use the "SLOPE faction in Excel Considera pop with 0.75k W , 10 .15 in B The portfolio (a) Compute them respective and standard deviation of poo , the conce r dating them p and t C e the best of this profily calling in Excel) wing datar, Hot wheels you the SLOPE 5. Using estimates of andere part of this gratis compute alternatively 6. Compare and comment biety Question #3 (40 points) Download monthly adjusted close price data for Apple and Google (Alphabet Inc.). for the period of Jan. 2010 through Jan, 2020 (use Finance. Yahoo.com). Use Excel for this question. Stock returns are computed PL+1-P T + 1P 1. Assume that you are constructing portfolios with Apple and Google such that WA+UG = 1. Create a column in Excel and apply a range of weights between - 1 and +1 (with step size of 0.1) to Apple (WA) to construct a portfolio consisting of the two shares (remember that the sum of weights should be one, so you can easily calculate the weight for Google once you know the weight for Apple. Don't worry if it geta larger than 1!). Plot a scatter-plot graph showing average return and the stan- dard deviation of the portfolio under alternative values of wa 2. Now apply a constraint on weights: eliminate negative values of weights and change the weight only between 0 and 1 (with step size of 0.05) and re-plot the scatter plot of average return and variance of portfolio 3. Eliminating negative weight is called short sales constraints. Compare the results of parts (1) and (2) and discuss the effects of imposing short-sales constraints on a market. 4. Use the SP500 index as a proxy for the market portfolio. Create a returns scatterplot (the way we did in the class) and calculate Apple's beta. (Hint: you can either use the "SLOPE" function in excel or apply the procedures described in Question #2) Question #4 (30 points) 1. Company A's bond has a current price of $950, a maturity value of $1,000, and matures in 8 years. If Interest is paid semi-annually and the bond is priced to yield 5%, what is the bond's annual coupon 2. Company B's bond has a 6% coupon rate (with interest paid semi-annually), a par value of $1,000, and matures in 10 years. If the bond is priced to yield 5%, what is the bond's current price? 3. Company C's bond has an 6% coupon rate (semi-annual interest), a maturity value of $1.000, matures in 5 years, and a current price of $9.75. What is the bond's yield-to-maturity? 4. A 20-year, $1,000 par value bond has an 10% annual coupon. The bond currently sells for $875. If the yield to maturity remains at its current rate, what will the price be 10 years from now? 5. One year ago a corporation issued 20-year, noncallable, 5% annual coupon bonds at their par value of $1,000. Coupon payments are made every six month. Today, the market interest rate on these bonds is 7.5%. What is the current price of the bonds, given that they now have 19 years to maturity? Question #5, Bond Pricing (30 points) At time 0, the U.S. Treasury auctions off a ten-year bond with a par value of $1000, and semi annual payment of $25 per share every six months. The auction price was at go = $950 dollars per share. 1. Draw a timeline of the treasury bond's cash payouts. Denote the maturity of this treasury bond at time 0, as YTMreasury. Solve for the yield to maturity. 2. In period 0, a large corporation auctioned off a ten-year bond with par value of $1000. The bond has an annual coupon rate of 6%; it pays out a coupon payment of $30 per share every six months. It is known that the implied yield to maturity of this corporate bond is 250 basis points above YTM resury, at what price per share (denote it as po) can the company expect to sell the bonds to the public? 3. In period 1. after coupon payments were made, bad news on the US economy breaks out and the stock market took a hit. Bond investors "Ily to safety" by selling the corporate bonds and buying treasury bonds. The corporate bonds were traded at Pi = $800 per share, while the treasury bond were traded at 9 = $990 dollars per share. (a) What's the implied interest rate on the treasury bond in period 1? (b) What's the period 1 YTM on corporate bond? 4. In period 0, an investor short sold 3 shares of the ten-year US treasury bond and use the proceeds to buy 10 shares of Apple at price of $285 per share. In period 1, Apple paid out a dividend of $5 per share, however its stock price dropped to $240 per share. The investor sold his Apple stocks in period 1, using the proceeds from which along with his own funds to unwind his short position in treasury bonds. How much money did he lose (cash return) between period 0 and period 1? (Hint: Do not forget dividends!)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts