Question: Question 2 of 1 0 . Alex, an avid woodeorker, started creating custom furniture pleces and selling them to his friends and family. Aumough he

Question of

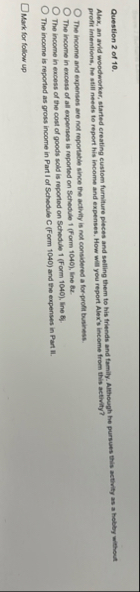

Alex, an avid woodeorker, started creating custom furniture pleces and selling them to his friends and family. Aumough he pursues this activity as a hobby without profit intentions, he still needs to report his income and expenses. How will you report Alex's income from this activity?

The income and expenses are not reportatie since the activity is not considered a forprofit business.

The income in excess of all expenses is reported on Schedule Foms Ine Bz

The income in excess of the cost of goods sold is reported on Schedule Form Ine B

The income is reported as gross income in Part I of Schedule C Form and the expenses in Part II

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock