Question: Question: A firm with a book value of $18.80 per share and 100 percent dividend payout is expected to have a return on common equity

Question: A firm with a book value of $18.80 per share and 100 percent dividend payout is expected to have a return on common equity of 15 percent per year indefinitely in the future. Its cost of equity capital is 10 percent.

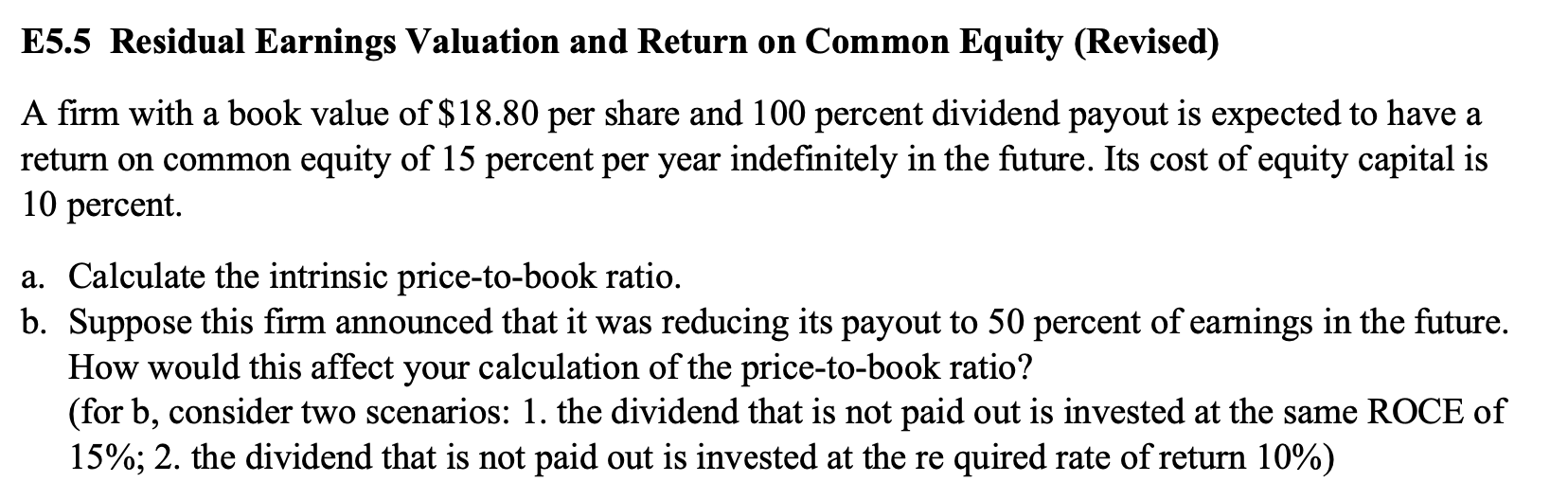

E5.5 Residual Earnings Valuation and Return on Common Equity (Revised) A firm with a book value of $18.80 per share and 100 percent dividend payout is expected to have a return on common equity of 15 percent per year indefinitely in the future. Its cost of equity capital is 10 percent. a a. Calculate the intrinsic price-to-book ratio. b. Suppose this firm announced that it was reducing its payout to 50 percent of earnings in the future. How would this affect your calculation of the price-to-book ratio? (for b, consider two scenarios: 1. the dividend that is not paid out is invested at the same ROCE of 15%; 2. the dividend that is not paid out is invested at the re quired rate of return 10%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts