Question

QUESTION Mahkota Oil Sdn Bhd has been involved in the palm oil processing industry for several years. It has a steady market and competing

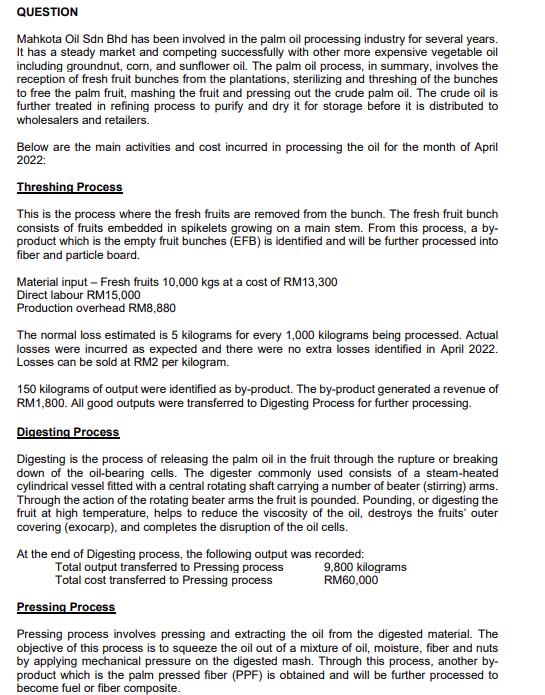

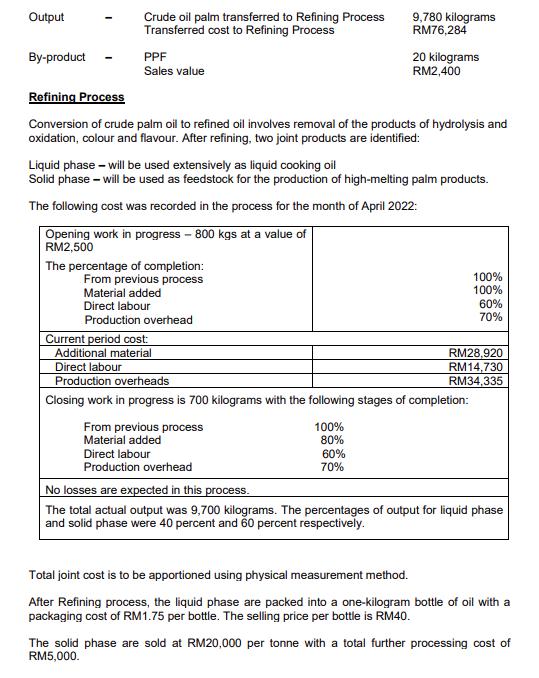

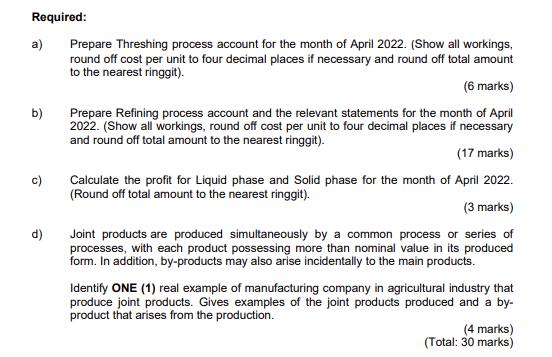

QUESTION Mahkota Oil Sdn Bhd has been involved in the palm oil processing industry for several years. It has a steady market and competing successfully with other more expensive vegetable oil including groundnut, corn, and sunflower oil. The palm oil process, in summary, involves the reception of fresh fruit bunches from the plantations, sterilizing and threshing of the bunches to free the palm fruit, mashing the fruit and pressing out the crude palm oil. The crude oil is further treated in refining process to purify and dry it for storage before it is distributed to wholesalers and retailers. Below are the main activities and cost incurred in processing the oil for the month of April 2022: Threshing Process This is the process where the fresh fruits are removed from the bunch. The fresh fruit bunch consists of fruits embedded in spikelets growing on a main stem. From this process, a by- product which is the empty fruit bunches (EFB) is identified and will be further processed into fiber and particle board. Material input- Fresh fruits 10,000 kgs at a cost of RM13,300 Direct labour RM15,000 Production overhead RM8,880 The normal loss estimated is 5 kilograms for every 1,000 kilograms being processed. Actual losses were incurred as expected and there were no extra losses identified in April 2022. Losses can be sold at RM2 per kilogram. 150 kilograms of output were identified as by-product. The by-product generated a revenue of RM1,800. All good outputs were transferred to Digesting Process for further processing. Digesting Process Digesting is the process of releasing the palm oil in the fruit through the rupture or breaking down of the oil-bearing cells. The digester commonly used consists of a steam-heated cylindrical vessel fitted with a central rotating shaft carrying a number of beater (stirring) arms. Through the action of the rotating beater arms the fruit is pounded. Pounding, or digesting the fruit at high temperature, helps to reduce the viscosity of the oil, destroys the fruits' outer covering (exocarp), and completes the disruption of the oil cells. At the end of Digesting process, the following output was recorded: Total output transferred to Pressing process Total cost transferred to Pressing process 9,800 kilograms RM60,000 Pressing Process Pressing process involves pressing and extracting the oil from the digested material. The objective of this process is to squeeze the oil out of a mixture of oil, moisture, fiber and nuts by applying mechanical pressure on the digested mash. Through this process, another by- product which is the palm pressed fiber (PPF) is obtained and will be further processed to become fuel or fiber composite. Output By-product Crude oil palm transferred to Refining Process Transferred cost to Refining Process PPF Sales value Refining Process Conversion of crude palm oil to refined oil involves removal of the products of hydrolysis and oxidation, colour and flavour. After refining, two joint products are identified: Opening work in progress - 800 kgs at a value of RM2,500 Liquid phase - will be used extensively as liquid cooking oil Solid phase - will be used as feedstock for the production of high-melting palm products. The following cost was recorded in the process for the month of April 2022: The percentage of completion: From previous process Material added Direct labour Production overhead 9,780 kilograms RM76,284 From previous process Material added Direct labour Production overhead 20 kilograms RM2,400 Current period cost: Additional material Direct labour Production overheads Closing work in progress is 700 kilograms with the following stages of completion: 100% 80% 60% 70% 100% 100% 60% 70% RM28,920 RM14,730 RM34,335 No losses are expected in this process. The total actual output was 9,700 kilograms. The percentages of output for liquid phase and solid phase were 40 percent and 60 percent respectively. Total joint cost is to be apportioned using physical measurement method. After Refining process, the liquid phase are packed into a one-kilogram bottle of oil with a packaging cost of RM1.75 per bottle. The selling price per bottle is RM40. The solid phase are sold at RM20,000 per tonne with a total further processing cost of RM5,000. Required: a) b) c) d) Prepare Threshing process account for the month of April 2022. (Show all workings, round off cost per unit to four decimal places if necessary and round off total amount to the nearest ringgit). (6 marks) Prepare Refining process account and the relevant statements for the month of April 2022. (Show all workings, round off cost per unit to four decimal places if necessary and round off total amount to the nearest ringgit). (17 marks) Calculate the profit for Liquid phase and Solid phase for the month of April 2022. (Round off total amount to the nearest ringgit). (3 marks) Joint products are produced simultaneously by a common process or series of processes, with each product possessing more than nominal value in its produced form. In addition, by-products may also arise incidentally to the main products. Identify ONE (1) real example of manufacturing company in agricultural industry that produce joint products. Gives examples of the joint products produced and a by- product that arises from the production. (4 marks) (Total: 30 marks)

Step by Step Solution

3.28 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Threshing process account for the month of April 2022 Output Good output 9850 kgs RM200kg RM19700 ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started