Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Real World Analysis Super Valu Stores Inc. is a large food-marketing company. Information from the company's Year 5 annual report follows. Independent retailers use

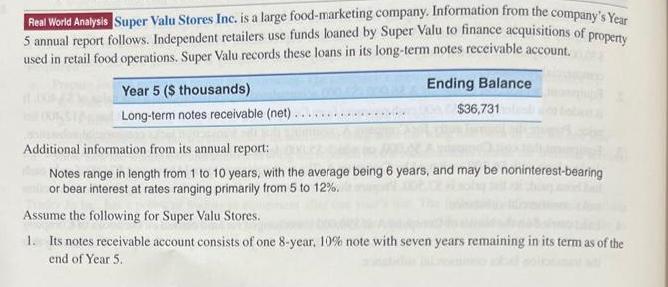

Real World Analysis Super Valu Stores Inc. is a large food-marketing company. Information from the company's Year 5 annual report follows. Independent retailers use funds loaned by Super Valu to finance acquisitions of property used in retail food operations. Super Valu records these loans in its long-term notes receivable account. Ending Balance $36,731 Year 5 ($ thousands) Long-term notes receivable (net)... Additional information from its annual report: Notes range in length from 1 to 10 years, with the average being 6 years, and may be noninterest-bearing or bear interest at rates ranging primarily from 5 to 12%. Assume the following for Super Valu Stores. 1. Its notes receivable account consists of one 8-year, 10% note with seven years remaining in its term as of the end of Year 5. 2. Super Valu finances 100% of the asset acquisitions for the retailers. 3. Annual payments on the note are received at each year-end, include principal and interest, and are a constant amount each year. Required Determine the fair value of the assets financed by Super Valu at the date of acquisition by the retailers (debtors).

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the fair value of the assets financed by Super Valu at the date of acquisition by the retailers we need to use the present value formula to discount the future cash flows from th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started