Question

Review module readings and viewings studied thus far in the course. When complete, answer the following questions thoroughly and completely. 1. Describe the elements of

Review module readings and viewings studied thus far in the course. When complete, answer the following questions thoroughly and completely.

1. Describe the elements of the balanced scorecard and explain the role of the balanced scorecard approach in measuring supply chain performance.

2. Describe the key performance indicators which can be used to evaluate continuous improvement, waste elimination, and improved customer satisfaction.

3. Describe lean principles and processes and their impact on business operations. Apply them to identify value streams and opportunities to eliminate waste and improve customer satisfaction.

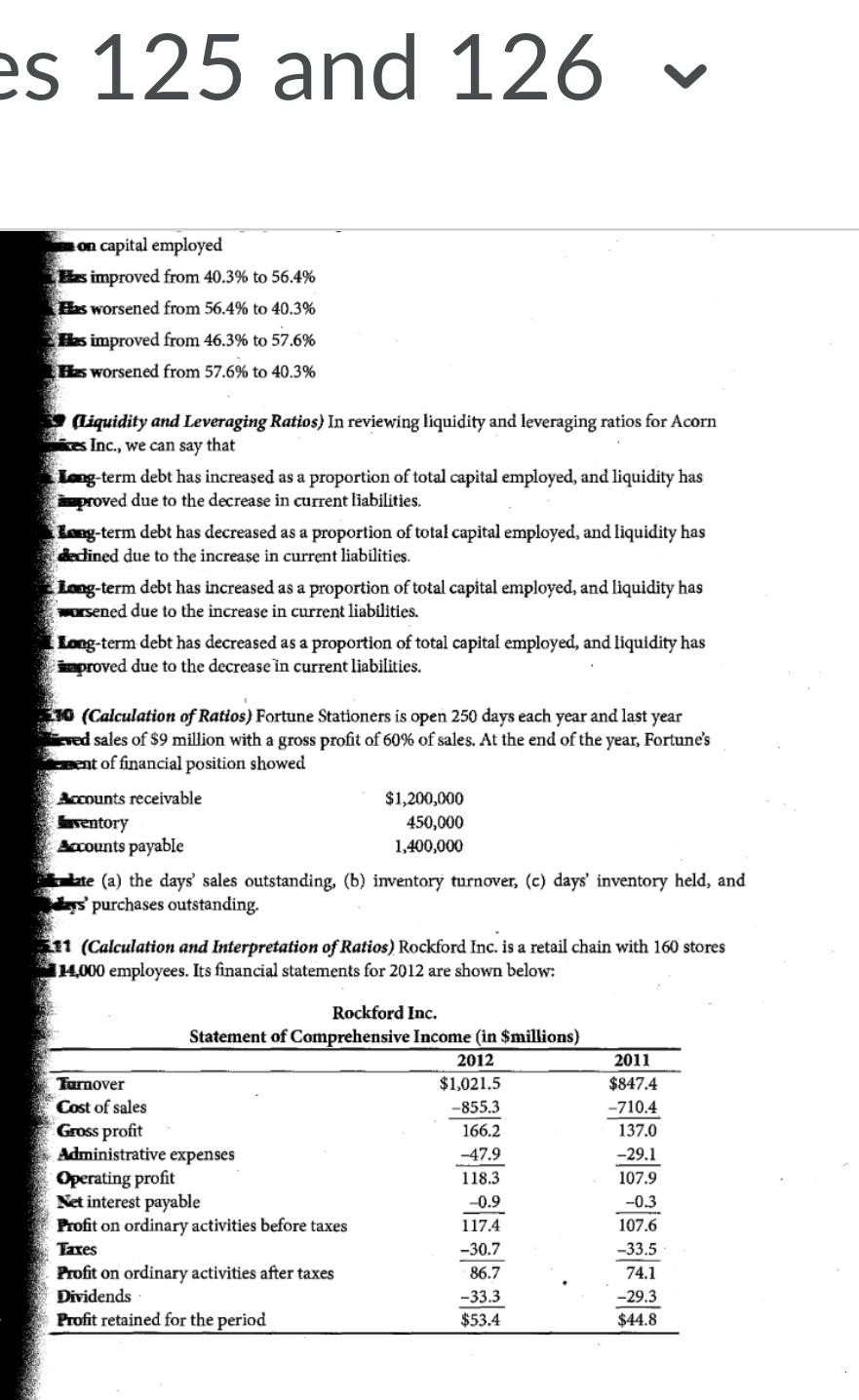

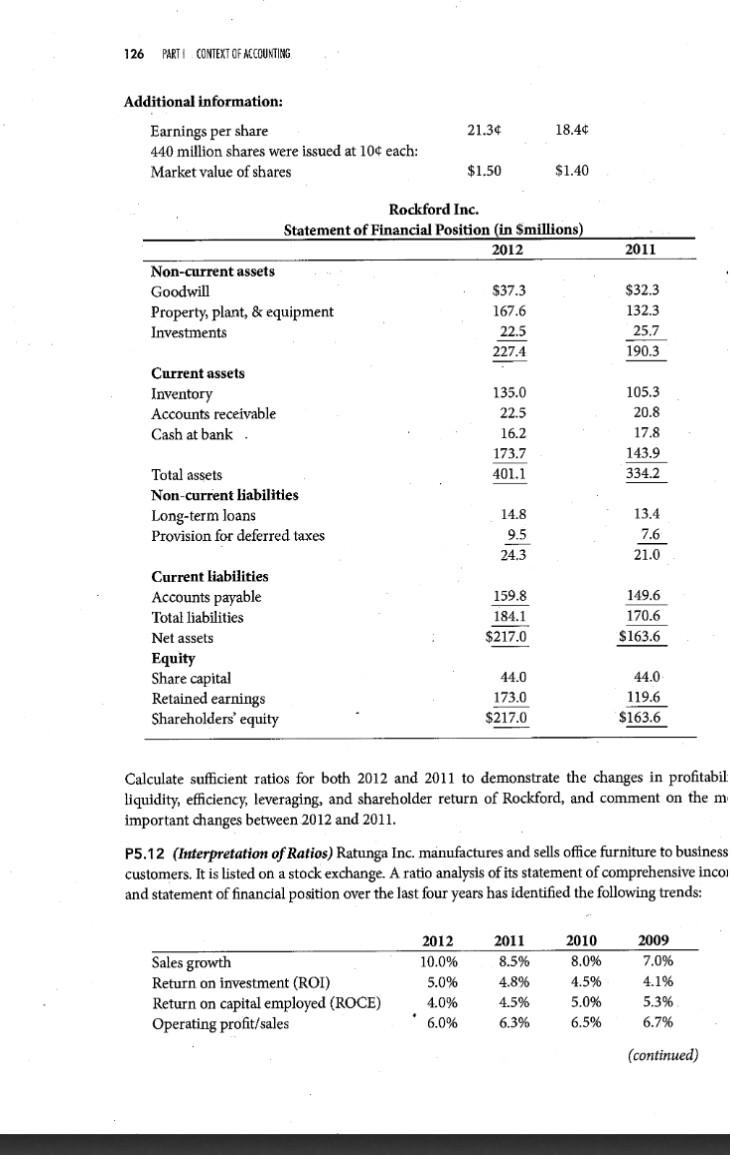

4. Using the financial statements for Rockford Inc. on page 125-126 of the textbook, choose five financial ratios to calculate for 2012 to evaluate the current financial performance of the organization. Show your calculations using the appropriate formulas, interpret the results, and explain why you chose to use those ratios as indicators of financial performance.

5. Using Porter's Five Forces (Strategic Management Accounting), conduct a strategic analysis of an industry that you are familiar with. From your analysis, highlight two key facts which would help to shape your strategy as a new entrant in your chosen industry.

6. Describe, in detail, the five business functions addressed by the SCOR model. Explain the potential benefits of implementing this framework to analyze your organization's supply chain.

es 125 and 126 on capital employed Has improved from 40.3% to 56.4% Has worsened from 56.4% to 40.3% 57.6% Has improved from 46.3% to Has worsened from 57.6% to 40.3% (Liquidity and Leveraging Ratios) In reviewing liquidity and leveraging ratios for Acorn es Inc., we can say that Long-term debt has increased as a proportion of total capital employed, and liquidity has proved due to the decrease in current liabilities. Long-term debt has decreased as a proportion of total capital employed, and liquidity has dedined due to the increase in current liabilities. Long-term debt has increased as a proportion of total capital employed, and liquidity has worsened due to the increase in current liabilities. Long-term debt has decreased as a proportion of total capital employed, and liquidity has proved due to the decrease in current liabilities. 30 (Calculation of Ratios) Fortune Stationers is open 250 days each year and last year ved sales of $9 million with a gross profit of 60% of sales. At the end of the year, Fortune's ent of financial position showed Accounts receivable ventory Accounts payable $1,200,000 450,000 1,400,000 te (a) the days' sales outstanding, (b) inventory turnover, (c) days' inventory held, and purchases outstanding. 11 (Calculation and Interpretation of Ratios) Rockford Inc. is a retail chain with 160 stores 14,000 employees. Its financial statements for 2012 are shown below: Rockford Inc. Statement of Comprehensive Income (in $millions) 2012 $1,021.5 -855.3 Turnover Cost of sales Gross profit Administrative expenses Operating profit Net interest payable Profit on ordinary activities before taxes Taxes Profit on ordinary activities after taxes Dividends Profit retained for the period 166.2 -47.9 118.3 -0.9 117.4 -30.7 86.7 -33.3 $53.4 2011 $847.4 -710.4 137.0 -29.1 107.9 -0.3 107.6 -33.5 74.1 -29.3 $44.8

Step by Step Solution

3.49 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

Balanced Scorecard and Its Role in Measuring Supply Chain Performance The balanced scorecard is a strategic management tool used to measure and manage the performance of an organization across multipl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started