Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Simon transferred a house owned by him to his wife, Sally, for RM378,000 on 3 March 2020. Simon incurred valuation fees on RM1,800 in

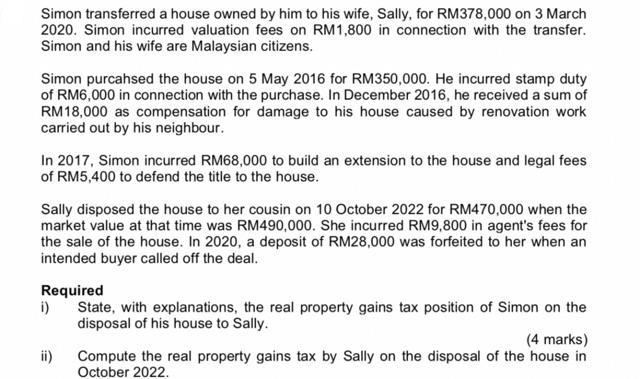

Simon transferred a house owned by him to his wife, Sally, for RM378,000 on 3 March 2020. Simon incurred valuation fees on RM1,800 in connection with the transfer. Simon and his wife are Malaysian citizens. Simon purcahsed the house on 5 May 2016 for RM350,000. He incurred stamp duty of RM6,000 in connection with the purchase. In December 2016, he received a sum of RM18,000 as compensation for damage to his house caused by renovation work carried out by his neighbour. In 2017, Simon incurred RM68,000 to build an extension to the house and legal fees of RM5,400 to defend the title to the house. Sally disposed the house to her cousin on 10 October 2022 for RM470,000 when the market value at that time was RM490,000. She incurred RM9,800 in agent's fees for the sale of the house. In 2020, a deposit of RM28,000 was forfeited to her when an intended buyer called off the deal. Required i) State, with explanations, the real property gains tax position of Simon on the disposal of his house to Sally. ii) (4 marks) Compute the real property gains tax by Sally on the disposal of the house in October 2022.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

i Simon made a gift of the house to Sally on 3 March 2020 and as such there is no real property gain...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started