Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solution: A step-up bond can be constructed by summing annuities and adding a zero-coupon bond representing the principal payment at the end. To simplify

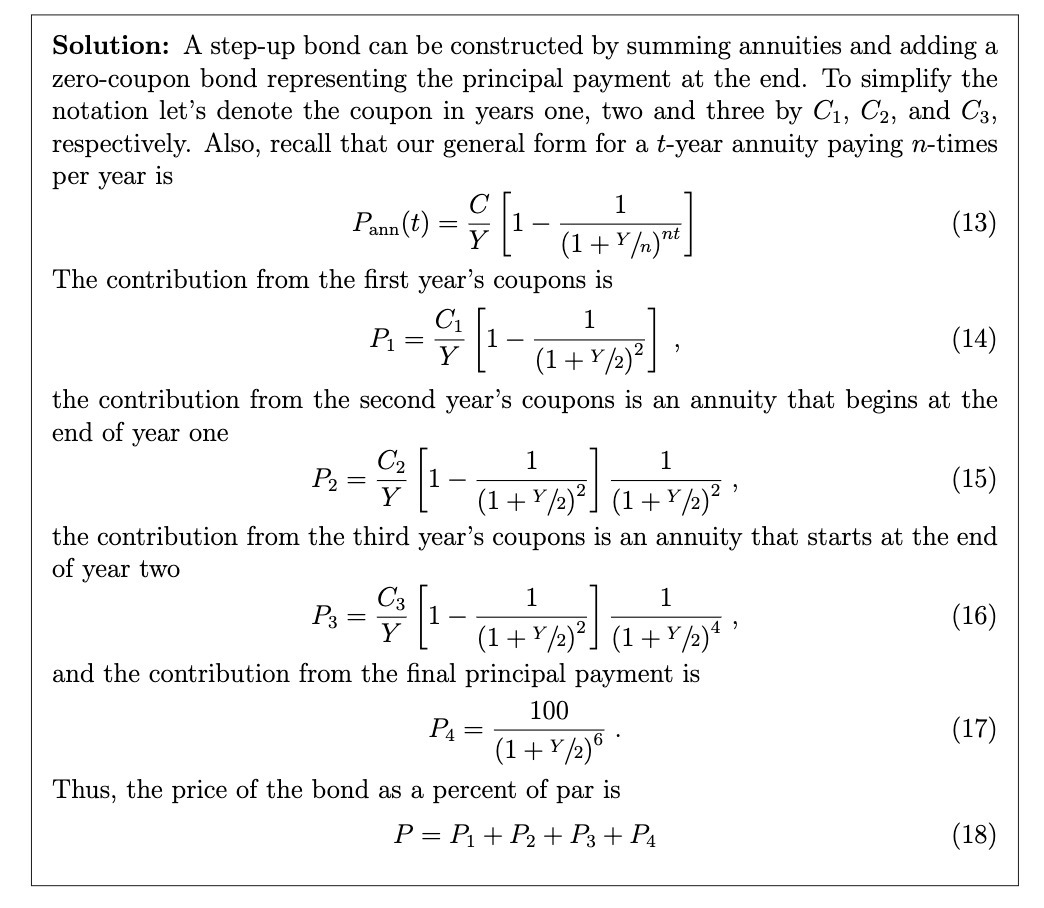

Solution: A step-up bond can be constructed by summing annuities and adding a zero-coupon bond representing the principal payment at the end. To simplify the notation let's denote the coupon in years one, two and three by C1, C2, and C3, respectively. Also, recall that our general form for a t-year annuity paying n-times per year is C Pan(t) = [1 (1 + 1/m) Y (1+ Y/n)nt The contribution from the first year's coupons is P - - (1+ 1 " (13) (14) the contribution from the second year's coupons is an annuity that begins at the end of year one C2 P2 = 1 1 (1+Y/2) (1+Y/2) 2 (15) the contribution from the third year's coupons is an annuity that starts at the end of year two C3 1 1 P3 = 1 (16) (1 + 2) (1+Y/2) 4' and the contribution from the final principal payment is 100 P = (1+Y/2) (17) Thus, the price of the bond as a percent of par is P = P+ P2 P3 + P4 (18)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started