Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Southern Chemical Sdn Bhd (SC) is pharmaceutical manufacturer, it has the following assets: a) SC has the following items in its office: RM Printer

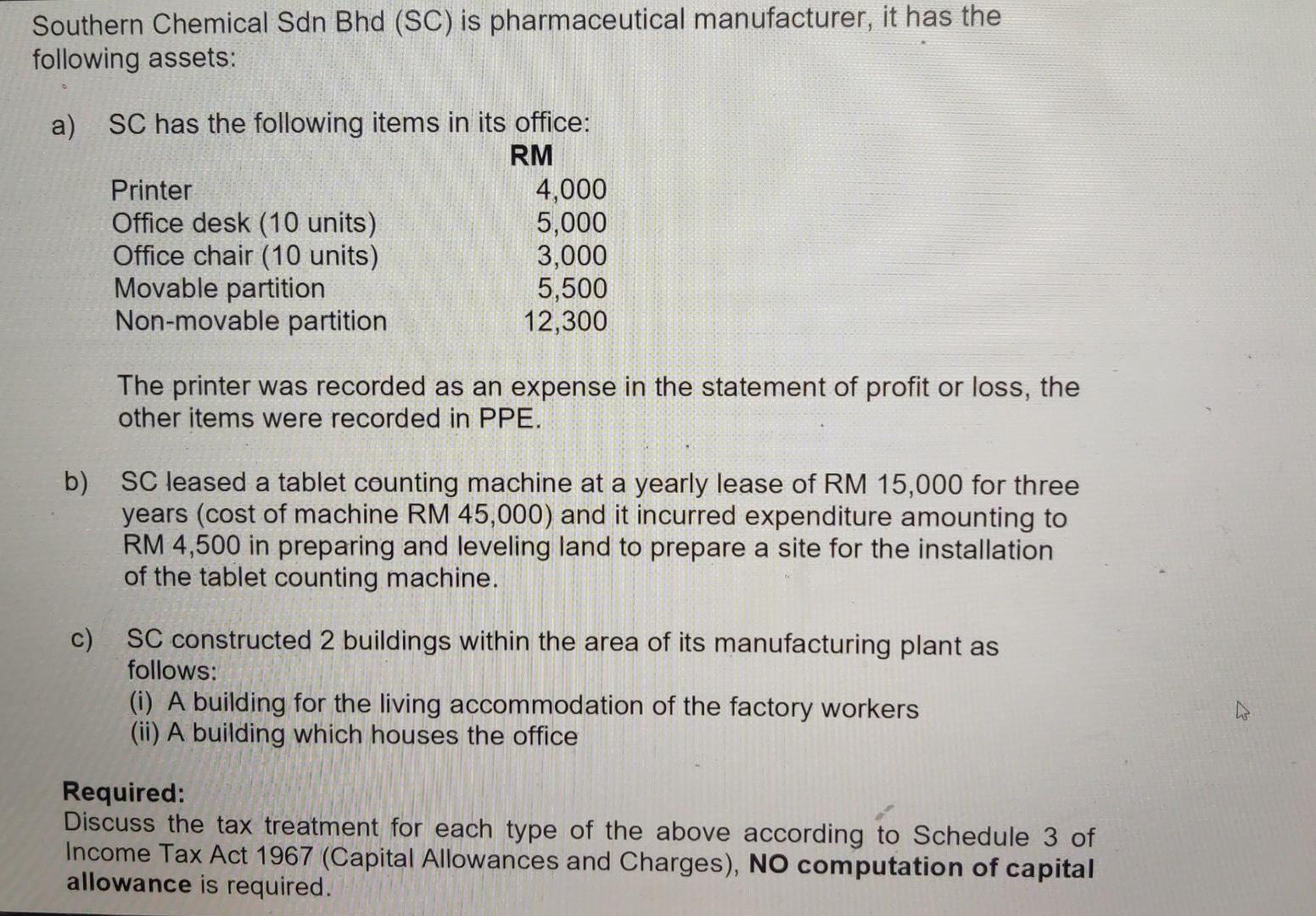

Southern Chemical Sdn Bhd (SC) is pharmaceutical manufacturer, it has the following assets: a) SC has the following items in its office: RM Printer 4,000 5,000 Office desk (10 units) Office chair (10 units) Movable partition 3,000 5,500 Non-movable partition 12,300 The printer was recorded as an expense in the statement of profit or loss, the other items were recorded in PPE. b) SC leased a tablet counting machine at a yearly lease of RM 15,000 for three years (cost of machine RM 45,000) and it incurred expenditure amounting to RM 4,500 in preparing and leveling land to prepare a site for the installation of the tablet counting machine. c) SC constructed 2 buildings within the area of its manufacturing plant as follows: (i) A building for the living accommodation of the factory workers (ii) A building which houses the office Required: Discuss the tax treatment for each type of the above according to Schedule 3 of Income Tax Act 1967 (Capital Allowances and Charges), NO computation of capital allowance is required.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer Answer As per the details given in the question Southern Chemi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started