Question: Suppose that the risk-free rate of return is 5%, and the expected rate of return on the market portfolio (with a beta of 1)

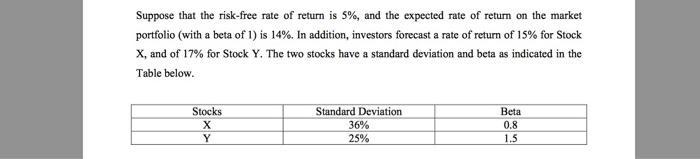

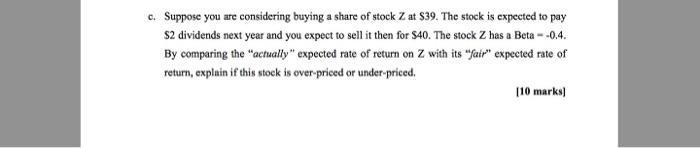

Suppose that the risk-free rate of return is 5%, and the expected rate of return on the market portfolio (with a beta of 1) is 14%. In addition, investors forecast a rate of return of 15% for Stock X, and of 17% for Stock Y. The two stocks have a standard deviation and beta as indicated in the Table below. Stocks X Y Standard Deviation 36% 25% Beta. 0.8 1.5 c. Suppose you are considering buying a share of stock Z at $39. The stock is expected to pay $2 dividends next year and you expect to sell it then for $40. The stock Z has a Beta - -0.4. By comparing the "actually" expected rate of return on Z with its "fair" expected rate of return, explain if this stock is over-priced or under-priced. [10 marks]

Step by Step Solution

3.53 Rating (173 Votes )

There are 3 Steps involved in it

The fair expected rate of return on Z can be calculated using th... View full answer

Get step-by-step solutions from verified subject matter experts