Question: Taking Please PRINT the following information on your assignment -- Last Name, First Name, Student ID. and Homework number. Please use a scanner app to

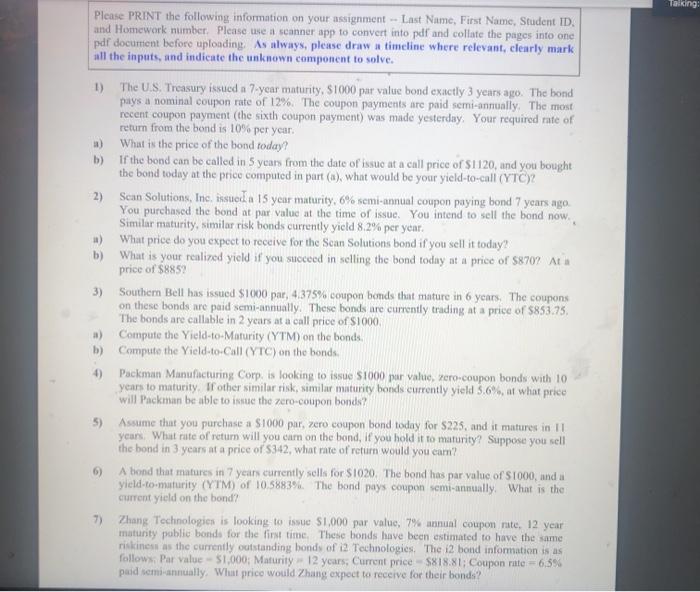

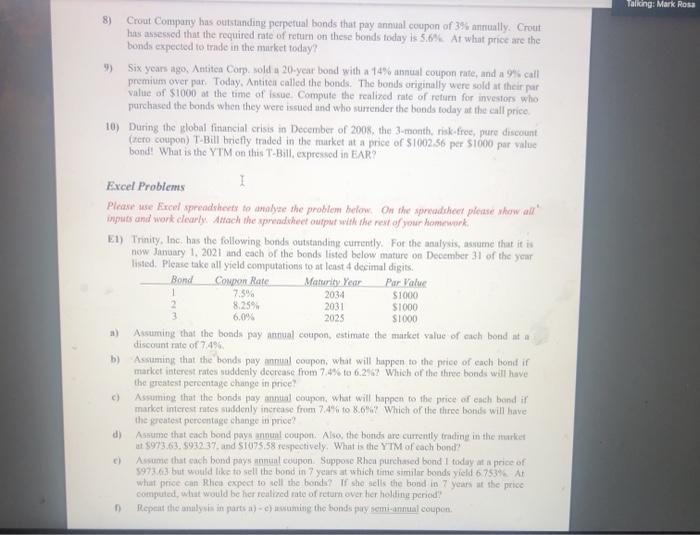

Taking Please PRINT the following information on your assignment -- Last Name, First Name, Student ID. and Homework number. Please use a scanner app to convert into pdf and collate the pages into one pdf document before uploading As always, please draw timeline where relevant, clearly mark all the inputs, and indicate the unknown component to solve. 2) 1) The U.S. Treasury issued a 7-year maturity, S1000 par value bond exactly 3 years ago. The bond pays a nominal coupon rate of 12%. The coupon payments are paid semi-annually. The most recent coupon payment (the sixth coupon payment) was made yesterday. Your required rate of return from the bond is 10% per year. a) What is the price of the bond today? b) If the bond can be called in 5 years from the date of issue at a call price of $1120, and you bought the bond today at the price computed in part (a), what would be your yield-to-call (YTC)2 ) Scan Solutions, Inc. issued 15 year maturity, 6% semi-annual coupon paying bond 7 years ago You purchased the bond at par value at the time of issue. You intend to sell the bond now. Similar maturity, similar risk bonds currently yield 8.2% per year. a) What price do you expect to receive for the Scan Solutions bond if you sell it today? b) What is your realized yield if you succeed in selling the bond today at a price of $8707 Ath price of $885 3) Southern Bell has issued $1000 par, 4.375% coupon bonds that mature in 6 years. The coupons on these bonds are paid semi-annually. These bonds are currently trading at a price of $853.75 The bonds are callable in 2 years at a call price of $1000 #) Compute the Yield-to-Maturity (YTM) on the bonds, b) Compute the Yield-to-Call (YTC) on the bonds 4) Packman Manufacturing Corp. is looking to issue S1000 par value, zero-coupon bonds with 10 years to maturity. If other similar risk, similar maturity bonds currently yield 5.6%, at what price will Packman be able to inue the zero-coupon bonds? 5) Assume that you purchase a $1000 par, zero coupon bond today for $225, and it matures in 1 years What rate of retum will you can on the bond, if you hold it to maturity? Suppose you sell the bond in 3 years at a price of 5342, what rate of return would you eam? A bond that matures in 7 years currently sells for S1020. The band has par value of S1000, and a yield to maturity (YTM) of 10.5883%. The bond pays coupon semi-annually. What is the current yield on the bond? 7) Zhang Technologies is looking to issue $1,000 par value, 7% annual coupon rate, 12 year maturity public bonds for the first time. These bonds have been estimated to have the same riskies as the currently outstanding bonds of 12 Technologies. The 2 bond information is as follows. Par value $1,000; Maturity 12 years. Current price $818.81: Coupon rate = 6,5% paid semi-annually. What price would Zhang expect to receive for their bonds? Taling: Mark Rosa 8) Crout Company has outstanding perpetual bonds that pay annual coupon of 3% anually. Crout has assessed that the required rate of return on these bonds today is 5.6% At what price are the bonds expected to trade in the market today? Six years ingo, Antton Corp. sold a 20-year bond with a 14% annual coupon rate, and a call premium over par. Today, Antiter called the bonds. The bonds originally were sold at their par value of $1000 at the time of issue. Compute the realized rate of retum for investors who purchased the bonds when they were issued and who surrender the bonds today at the call price 10) During the global financial crisis in December of 2008, the 3-month, risk-free, pure discount (tero coupon) T-Bill briefly traded in the market at a price of $100236 per $1000 par value bond! What is the YTM on this T-Bill, expressed in EAR? Excel Problems 1 Please use Excel spreadsheet to analyze the problem below. On the spreadsheet please show all inputs and work clearly. Attach the spreadsheet output with the rest of your homework E1) Trinity, Inc. has the following bonds outstanding currently. For the analysis, assume that it is now January 1, 2021 and each of the bonds listed below mature on December 31 of the year listed. Please take all yield computations to at least 4 decimal digits. Bond COM Nare Maturity Year Par Valur 1 7.5% 2034 51000 8.25% 2031 $1000 3 6,0% 2025 S1000 Artiming that the bonds pay annual coupon, estimate the market value of aach bondata discount rate of 7496 b) Assuming that the bonds payal coupon, what will happen to the price of each tiondir market interest rates suddenly decrease from 7.4% to 6.2567 Which of the three bonds will have the greatest percentage change in price! Assuming that the bondi payant coupon, what will happen to the price of each bond ir market interest rates suddenly increase from 7.4% to 8.67 Which of the three bonds will have the greatest percentage change in price? d) Assume that each bond pay anul coupont. Also, the bonds are currently trading in the Turket at $973.63.592.37. and S1075,58 respectively. What is the YTM of cach bond Assume that each bond pays onun coupon Suppose Rhon purchased bond I today at a price of 5973. but would like to sell the bond in 7 years at which time similar bonds yield 6753% At what price can Rhica expect to tell the bonda? If she tells the bond in 7 years at the price computed what would be her realized rate of return over her holding period! Repeat the wind in parts a) c) Huming the bondspy semi-annual coupon Taking Please PRINT the following information on your assignment -- Last Name, First Name, Student ID. and Homework number. Please use a scanner app to convert into pdf and collate the pages into one pdf document before uploading As always, please draw timeline where relevant, clearly mark all the inputs, and indicate the unknown component to solve. 2) 1) The U.S. Treasury issued a 7-year maturity, S1000 par value bond exactly 3 years ago. The bond pays a nominal coupon rate of 12%. The coupon payments are paid semi-annually. The most recent coupon payment (the sixth coupon payment) was made yesterday. Your required rate of return from the bond is 10% per year. a) What is the price of the bond today? b) If the bond can be called in 5 years from the date of issue at a call price of $1120, and you bought the bond today at the price computed in part (a), what would be your yield-to-call (YTC)2 ) Scan Solutions, Inc. issued 15 year maturity, 6% semi-annual coupon paying bond 7 years ago You purchased the bond at par value at the time of issue. You intend to sell the bond now. Similar maturity, similar risk bonds currently yield 8.2% per year. a) What price do you expect to receive for the Scan Solutions bond if you sell it today? b) What is your realized yield if you succeed in selling the bond today at a price of $8707 Ath price of $885 3) Southern Bell has issued $1000 par, 4.375% coupon bonds that mature in 6 years. The coupons on these bonds are paid semi-annually. These bonds are currently trading at a price of $853.75 The bonds are callable in 2 years at a call price of $1000 #) Compute the Yield-to-Maturity (YTM) on the bonds, b) Compute the Yield-to-Call (YTC) on the bonds 4) Packman Manufacturing Corp. is looking to issue S1000 par value, zero-coupon bonds with 10 years to maturity. If other similar risk, similar maturity bonds currently yield 5.6%, at what price will Packman be able to inue the zero-coupon bonds? 5) Assume that you purchase a $1000 par, zero coupon bond today for $225, and it matures in 1 years What rate of retum will you can on the bond, if you hold it to maturity? Suppose you sell the bond in 3 years at a price of 5342, what rate of return would you eam? A bond that matures in 7 years currently sells for S1020. The band has par value of S1000, and a yield to maturity (YTM) of 10.5883%. The bond pays coupon semi-annually. What is the current yield on the bond? 7) Zhang Technologies is looking to issue $1,000 par value, 7% annual coupon rate, 12 year maturity public bonds for the first time. These bonds have been estimated to have the same riskies as the currently outstanding bonds of 12 Technologies. The 2 bond information is as follows. Par value $1,000; Maturity 12 years. Current price $818.81: Coupon rate = 6,5% paid semi-annually. What price would Zhang expect to receive for their bonds? Taling: Mark Rosa 8) Crout Company has outstanding perpetual bonds that pay annual coupon of 3% anually. Crout has assessed that the required rate of return on these bonds today is 5.6% At what price are the bonds expected to trade in the market today? Six years ingo, Antton Corp. sold a 20-year bond with a 14% annual coupon rate, and a call premium over par. Today, Antiter called the bonds. The bonds originally were sold at their par value of $1000 at the time of issue. Compute the realized rate of retum for investors who purchased the bonds when they were issued and who surrender the bonds today at the call price 10) During the global financial crisis in December of 2008, the 3-month, risk-free, pure discount (tero coupon) T-Bill briefly traded in the market at a price of $100236 per $1000 par value bond! What is the YTM on this T-Bill, expressed in EAR? Excel Problems 1 Please use Excel spreadsheet to analyze the problem below. On the spreadsheet please show all inputs and work clearly. Attach the spreadsheet output with the rest of your homework E1) Trinity, Inc. has the following bonds outstanding currently. For the analysis, assume that it is now January 1, 2021 and each of the bonds listed below mature on December 31 of the year listed. Please take all yield computations to at least 4 decimal digits. Bond COM Nare Maturity Year Par Valur 1 7.5% 2034 51000 8.25% 2031 $1000 3 6,0% 2025 S1000 Artiming that the bonds pay annual coupon, estimate the market value of aach bondata discount rate of 7496 b) Assuming that the bonds payal coupon, what will happen to the price of each tiondir market interest rates suddenly decrease from 7.4% to 6.2567 Which of the three bonds will have the greatest percentage change in price! Assuming that the bondi payant coupon, what will happen to the price of each bond ir market interest rates suddenly increase from 7.4% to 8.67 Which of the three bonds will have the greatest percentage change in price? d) Assume that each bond pay anul coupont. Also, the bonds are currently trading in the Turket at $973.63.592.37. and S1075,58 respectively. What is the YTM of cach bond Assume that each bond pays onun coupon Suppose Rhon purchased bond I today at a price of 5973. but would like to sell the bond in 7 years at which time similar bonds yield 6753% At what price can Rhica expect to tell the bonda? If she tells the bond in 7 years at the price computed what would be her realized rate of return over her holding period! Repeat the wind in parts a) c) Huming the bondspy semi-annual coupon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts