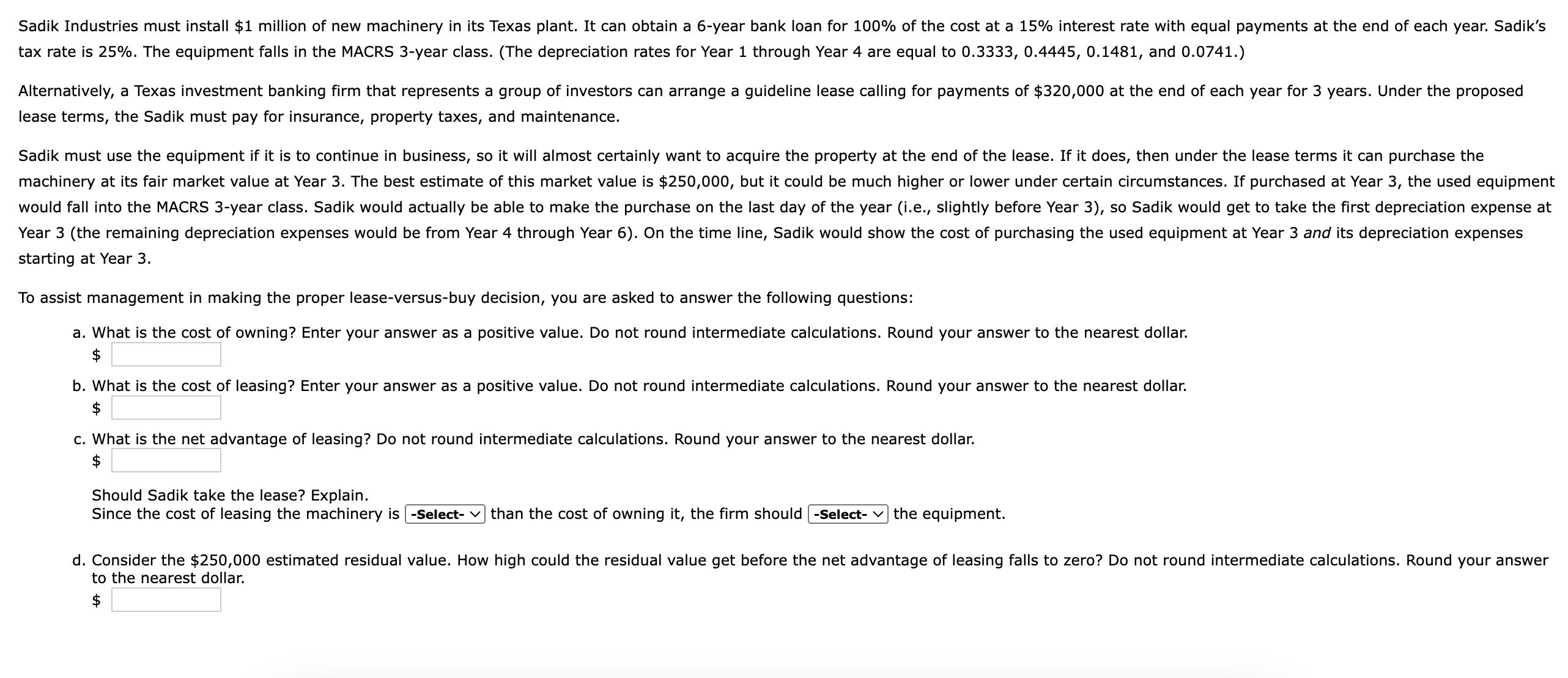

Question: tax rate is ( 2 5 % ) . The equipment falls in the MACRS 3 - year class. ( The depreciation

tax rate is The equipment falls in the MACRS year class. The depreciation rates for Year through Year are equal to and lease terms, the Sadik must pay for insurance, property taxes, and maintenance. starting at Year To assist management in making the proper leaseversusbuy decision, you are asked to answer the following questions: a What is the cost of owning? Enter your answer as a positive value. Do not round intermediate calculations. Round your answer to the nearest dollar. $ b What is the cost of leasing? Enter your answer as a positive value. Do not round intermediate calculations. Round your answer to the nearest dollar. $ c What is the net advantage of leasing? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Should Sadik take the lease? Explain. Since the cost of leasing the machinery is than the cost of owning it the firm should the equipment. to the nearest dollar. $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock