Question

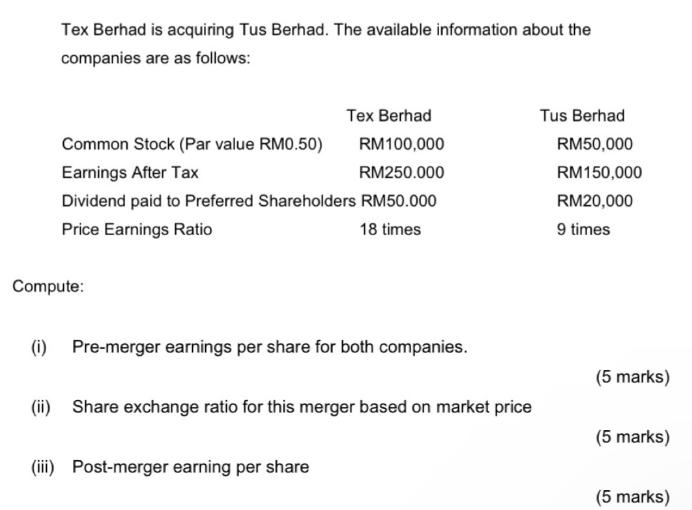

Tex Berhad is acquiring Tus Berhad. The available information about the companies are as follows: Common Stock (Par value RM0.50) Earnings After Tax RM250.000

Tex Berhad is acquiring Tus Berhad. The available information about the companies are as follows: Common Stock (Par value RM0.50) Earnings After Tax RM250.000 Dividend paid to Preferred Shareholders RM50.000 Price Earnings Ratio 18 times Compute: Tex Berhad RM100,000 (i) Pre-merger earnings per share for both companies. (iii) Post-merger earning per share (ii) Share exchange ratio for this merger based on market price Tus Berhad RM50,000 RM150,000 RM20,000 9 times (5 marks) (5 marks) (5 marks)

Step by Step Solution

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

i Premerger earnings per share for both companies Tex Berhad Common stock outstanding RM100000RM050 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managing Business Ethics Making Ethical Decisions

Authors: Alfred A. Marcus, Timothy J. Hargrave

1st Edition

1506388590, 978-1506388595

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App