Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Cessna Aircraft Company has issued 4% convertible bonds that mature October 1, 2029. Suppose the bonds are issued October 1, 2021, and pay

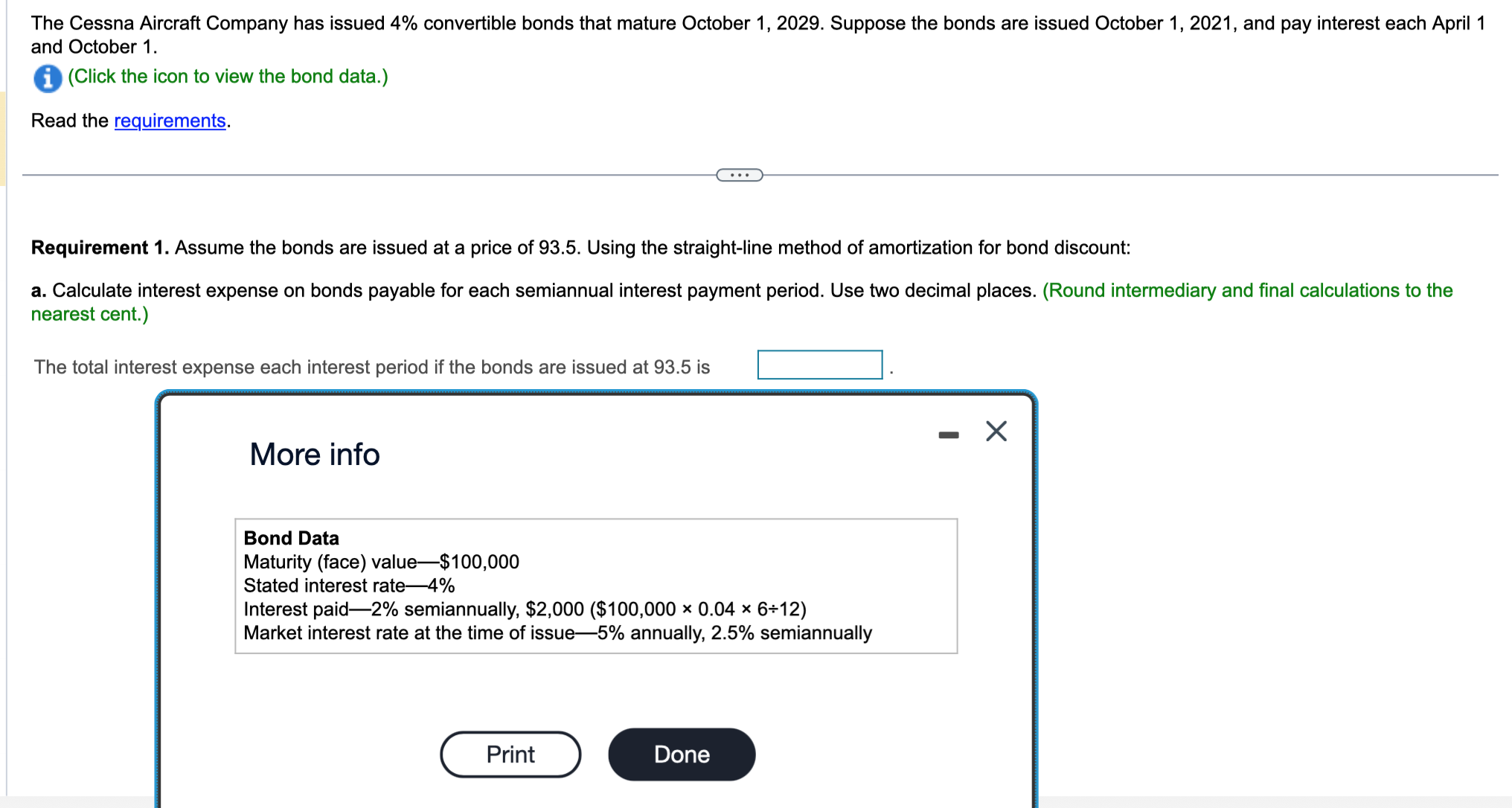

The Cessna Aircraft Company has issued 4% convertible bonds that mature October 1, 2029. Suppose the bonds are issued October 1, 2021, and pay interest each April 1 and October 1. i (Click the icon to view the bond data.) Read the requirements. Requirement 1. Assume the bonds are issued at a price of 93.5. Using the straight-line method of amortization for bond discount: a. Calculate interest expense on bonds payable for each semiannual interest payment period. Use two decimal places. (Round intermediary and final calculations to the nearest cent.) The total interest expense each interest period if the bonds are issued at 93.5 is More info Bond Data Maturity (face) value-$100,000 Stated interest rate-4% Interest paid 2% semiannually, $2,000 ($100,000 0.04 612) Market interest rate at the time of issue-5% annually, 2.5% semiannually Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the interest expense on the bonds payable for each semiannual interest payment period u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e054dc811a_960553.pdf

180 KBs PDF File

663e054dc811a_960553.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started