Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The city of Alma has been operating a cafeteria for its employees, but is considering converting it to a completely automated set of vending

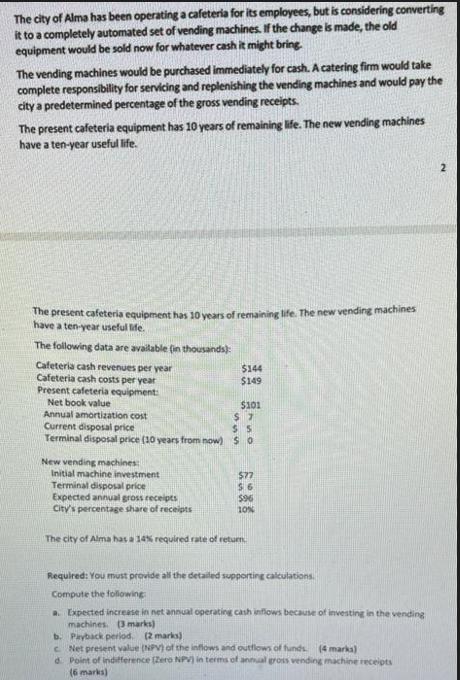

The city of Alma has been operating a cafeteria for its employees, but is considering converting it to a completely automated set of vending machines. If the change is made, the old equipment would be sold now for whatever cash it might bring. The vending machines would be purchased immediately for cash. A catering firm would take complete responsibility for servicing and replenishing the vending machines and would pay the city a predetermined percentage of the gross vending receipts. The present cafeteria equipment has 10 years of remaining life. The new vending machines have a ten-year useful life. The present cafeteria equipment has 10 years of remaining life. The new vending machines have a ten-year useful life. The following data are available (in thousands): Cafeteria cash revenues per year Cafeteria cash costs per year Present cafeteria equipment: Net book value Annual amortization cost $144 $149 New vending machines: Initial machine investment Terminal disposal price Expected annual gross receipts City's percentage share of receipts $101 $7 Current disposal price $5 Terminal disposal price (10 years from now) $0 $77 $6 $96 10% The city of Alma has a 14% required rate of return Required: You must provide all the detailed supporting calculations. Compute the following: a. Expected increase in net annual operating cash inflows because of investing in the vending machines. (3 marks) b. Payback period. (2 marks) c. Net present value (NPV) of the inflows and outflows of funds. (4 marks) d. Point of indifference [Zero NPV) in terms of annual gross vending machine receipts (6 marks) 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER a Expected increase in net annual operating cash inflows First lets calculate the net cash inflows from the present cafeteria equipment Net cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started