Answered step by step

Verified Expert Solution

Question

1 Approved Answer

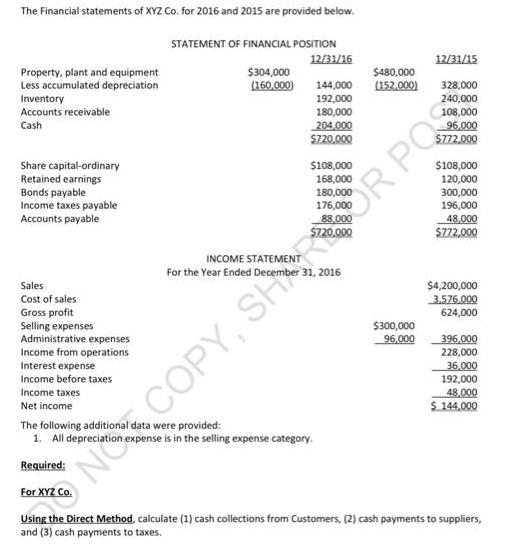

The Financial statements of XYZ Co. for 2016 and 2015 are provided below. Property, plant and equipment Less accumulated depreciation Inventory Accounts receivable Cash

The Financial statements of XYZ Co. for 2016 and 2015 are provided below. Property, plant and equipment Less accumulated depreciation Inventory Accounts receivable Cash Share capital-ordinary Retained earnings Bonds payable Income taxes payable Accounts payable Sales Cost of sales Gross profit Selling expenses Administrative expenses Income from operations Interest expense Income before taxes Income taxes Net income STATEMENT OF FINANCIAL POSITION 12/31/16 $304,000 (160,000) 144,000 192,000 180,000 204,000 $720,000 $108,000 168,000 INCOME STATEMENT For the Year Ended December 31, 2016 The following additional data were provided: 1. All depreciation expense is in the selling expense category. Required: $480,000 (152,000) $300,000 96,000 12/31/15 328,000 240,000 108,000 $772,000 $108,000 120,000 300,000 196,000 48,000 $772,000 $4,200,000 3.576.000 624,000 396,000 228,000 36,000 192,000 48,000 $ 144,000 NO COPY, SHIROR POS Using the Direct Method, calculate (1) cash collections from Customers, (2) cash payments to suppliers, and (3) cash payments to taxes. The Financial statements of XYZ Co. for 2016 and 2015 are provided below. Property, plant and equipment Less accumulated depreciation Inventory Accounts receivable Cash Share capital-ordinary Retained earnings Bonds payable Income taxes payable Accounts payable Sales Cost of sales Gross profit Selling expenses Administrative expenses Income from operations Interest expense Income before taxes Income taxes Net income STATEMENT OF FINANCIAL POSITION 12/31/16 $304,000 (160,000) 144,000 192,000 180,000 204,000 $720,000 $108,000 168,000 INCOME STATEMENT For the Year Ended December 31, 2016 The following additional data were provided: 1. All depreciation expense is in the selling expense category. Required: $480,000 (152,000) $300,000 96,000 12/31/15 328,000 240,000 108,000 $772,000 $108,000 120,000 300,000 196,000 48,000 $772,000 $4,200,000 3.576.000 624,000 396,000 228,000 36,000 192,000 48,000 $ 144,000 NO COPY, SHIROR POS Using the Direct Method, calculate (1) cash collections from Customers, (2) cash payments to suppliers, and (3) cash payments to taxes.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the cash collections from customers cash payments to suppliers and cash payments to tax...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started