Answered step by step

Verified Expert Solution

Question

1 Approved Answer

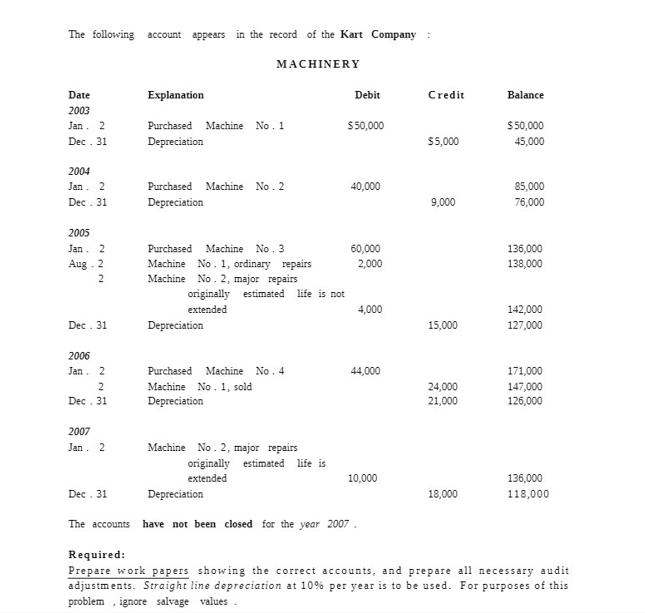

The following account appears in the record of the Kart Company MACHINERY Date 2003 Jan. 2 Dec. 31 2004 Jan 2 Dec. 31 2005

The following account appears in the record of the Kart Company MACHINERY Date 2003 Jan. 2 Dec. 31 2004 Jan 2 Dec. 31 2005 Jan. 2 Aug 2 2 Dec. 31 2006 Jan. 2 2 Dec. 31 2007 Jan 2 Dec. 31 Explanation Purchased Machine No. 1 Depreciation Purchased Machine No. 2 Depreciation Purchased Machine No. 3 Machine No. 1, ordinary repairs Machine No. 2, major repairs originally estimated life is not extended Depreciation Purchased Machine No. 4 Machine No. 1, sold Depreciation Machine No. 2, major repairs originally estimated life is extended Debit $50,000 40,000 60,000 2,000 4,000 44,000 Depreciation The accounts have not been closed for the year 2007. 10,000 Credit $5,000 9,000 15,000 24,000 21,000 18,000 Balance $50,000 45,000 85,000 76,000 136,000 138,000 142,000 127,000 171,000 147,000 126,000 136,000 118,000 Required: Prepare work papers showing the correct accounts, and prepare all necessary audit adjustments. Straight line depreciation at 10% per year is to be used. For purposes of this problem ignore salvage values.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To prepare the work papers and necessary audit adjustments for the Machinery account we need to calculate the correct balances for each year and make the appropriate adjustments Here are the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started