Answered step by step

Verified Expert Solution

Question

1 Approved Answer

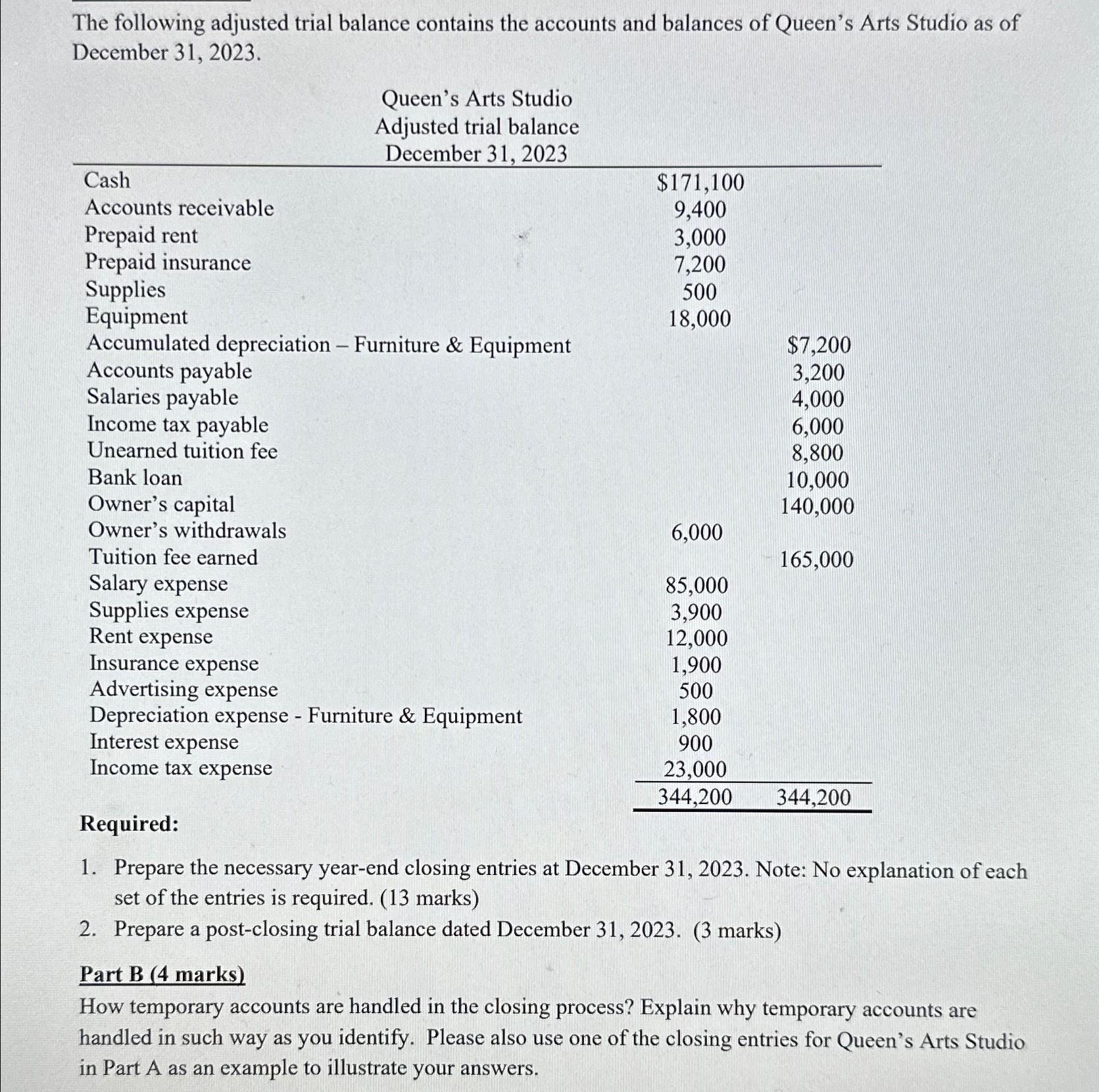

The following adjusted trial balance contains the accounts and balances of Queen's Arts Studio as of December 31, 2023. Queen's Arts Studio Adjusted trial

The following adjusted trial balance contains the accounts and balances of Queen's Arts Studio as of December 31, 2023. Queen's Arts Studio Adjusted trial balance December 31, 2023 Cash $171,100 Accounts receivable Prepaid rent Prepaid insurance Supplies Equipment 9,400 3,000 7,200 500 18,000 Accumulated depreciation - Furniture & Equipment $7,200 Accounts payable Salaries payable Income tax payable 3,200 4,000 6,000 Unearned tuition fee Bank loan Owner's capital Owner's withdrawals Tuition fee earned Salary expense Supplies expense Rent expense 8,800 10,000 140,000 6,000 165,000 85,000 3,900 12,000 Insurance expense 1,900 Advertising expense Depreciation expense - Furniture & Equipment Interest expense 500 1,800 Income tax expense Required: 900 23,000 344,200 344,200 1. Prepare the necessary year-end closing entries at December 31, 2023. Note: No explanation of each set of the entries is required. (13 marks) 2. Prepare a post-closing trial balance dated December 31, 2023. (3 marks) Part B (4 marks) How temporary accounts are handled in the closing process? Explain why temporary accounts are handled in such way as you identify. Please also use one of the closing entries for Queen's Arts Studio in Part A as an example to illustrate your answers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started