Answered step by step

Verified Expert Solution

Question

1 Approved Answer

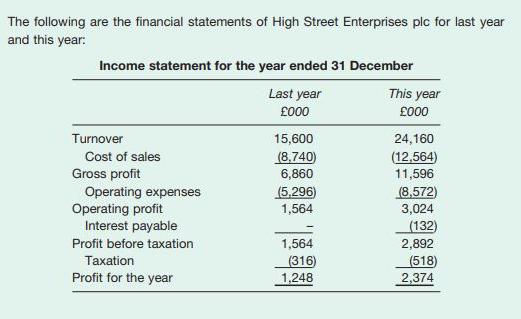

The following are the financial statements of High Street Enterprises plc for last year and this year: Income statement for the year ended 31

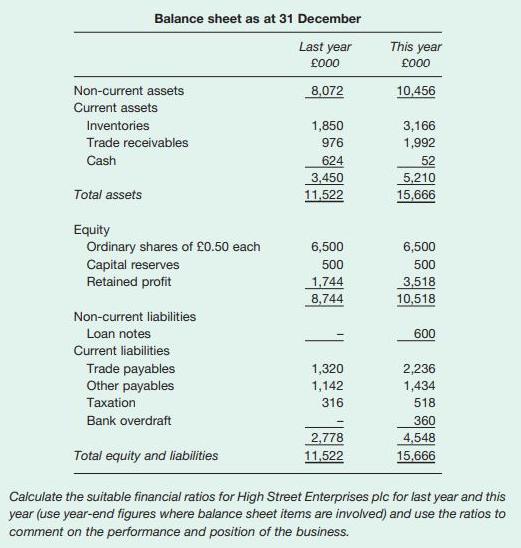

The following are the financial statements of High Street Enterprises plc for last year and this year: Income statement for the year ended 31 December Last year 000 Turnover Cost of sales Gross profit Operating expenses Operating profit Interest payable Profit before taxation Taxation Profit for the year 15,600 (8,740) 6,860 (5,296) 1,564 1,564 (316) 1,248 This year 000 24,160 (12,564) 11,596 (8,572) 3,024 (132) 2,892 (518) 2,374 Balance sheet as at 31 December Last year 000 8,072 Non-current assets Current assets Inventories Trade receivables Cash Total assets Equity Ordinary shares of 0.50 each Capital reserves Retained profit Non-current liabilities Loan notes Current liabilities Trade payables Other payables Taxation Bank overdraft Total equity and liabilities 1,850 976 624 3,450 11,522 6,500 500 1,744 8,744 1,320 1,142 316 2,778 11,522 This year 000 10,456 3,166 1,992 52 5,210 15,666 6,500 500 3,518 10,518 600 2,236 1,434 518 360 4,548 15,666 Calculate the suitable financial ratios for High Street Enterprises plc for last year and this year (use year-end figures where balance sheet items are involved) and use the ratios to comment on the performance and position of the business.

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 Gross Profit Margin Gross Profit Margin Gross Profit Turnover x 100 Last year 6860 15600 x 100 439...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started