Answered step by step

Verified Expert Solution

Question

1 Approved Answer

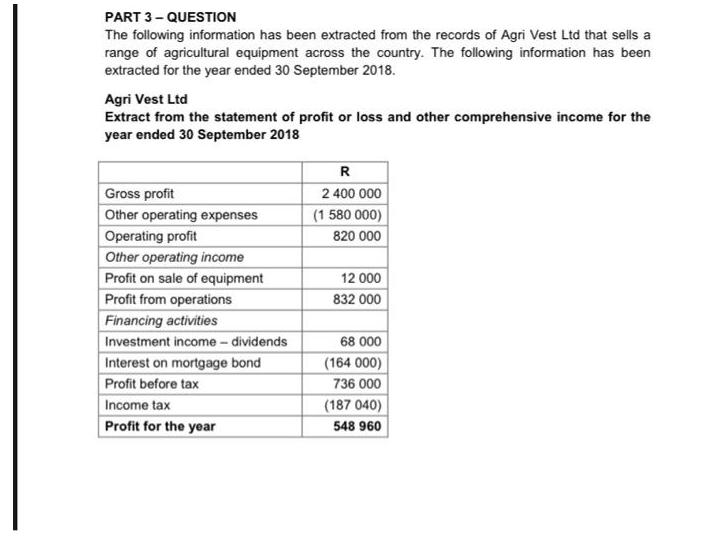

The following information has been extracted from the records of Agri Vest Ltd that sells a range of agricultural equipment across the country. The

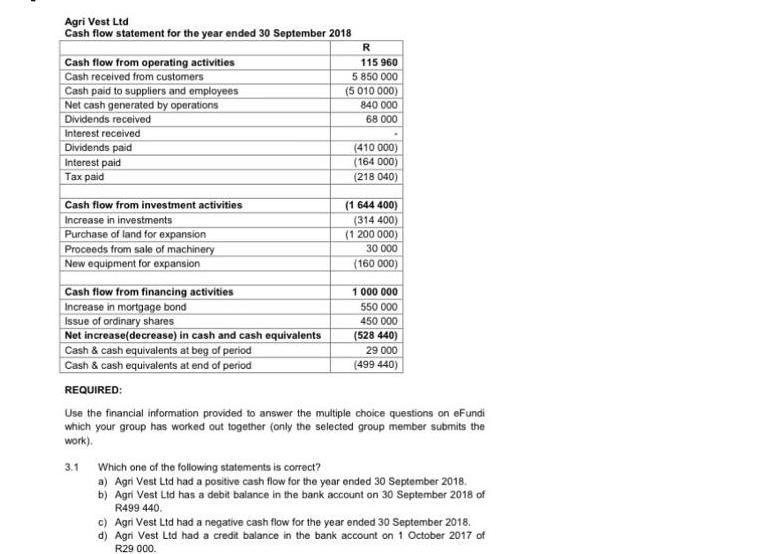

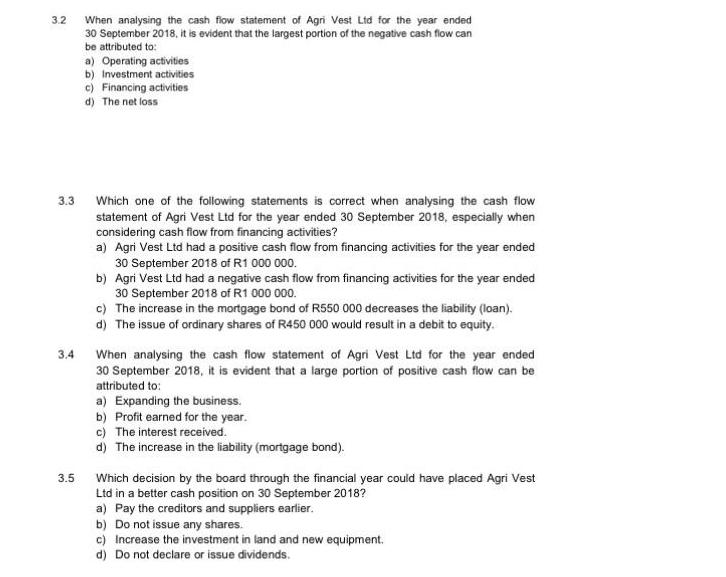

The following information has been extracted from the records of Agri Vest Ltd that sells a range of agricultural equipment across the country. The following information has been extracted for the year ended 30 September 2018. Agri Vest Ltd Extract from the statement of profit or loss and other comprehensive income for the year ended 30 September 2018 Gross profit Other operating expenses Operating profit Other operating income Profit on sale of equipment Profit from operations Financing activities Investment income - dividends Interest on mortgage bond Profit before tax Income tax Profit for the year R 2 400 000 (1 580 000) 820 000 12 000 832 000 68 000 (164 000) 736 000 (187 040) 548 960 Agri Vest Ltd Cash flow statement for the year ended 30 September 2018 Cash flow from operating activities Cash received from customers Cash paid to suppliers and employees Net cash generated by operations Dividends received Interest received Dividends paid Interest paid Tax paid Cash flow from investment activities Increase in investments Purchase of land for expansion Proceeds from sale of machinery New equipment for expansion Cash flow from financing activities Increase in mortgage bond R 115 960 5 850 000 (5 010 000) 840 000 68 000 3.1 (410 000) (164 000) (218 040) (1 644 400) (314 400) (1 200 000) 30 000 (160 000) 1 000 000 550 000 450 000 Issue of ordinary shares Net increase(decrease) in cash and cash equivalents Cash & cash equivalents at beg of period Cash & cash equivalents at end of period REQUIRED: Use the financial information provided to answer the multiple choice questions on eFundi which your group has worked out together (only the selected group member submits the work). (528 440) 29 000 (499 440) Which one of the following statements is correct? a) Agri Vest Ltd had a positive cash flow for the year ended 30 September 2018. b) Agri Vest Ltd has a debit balance in the bank account on 30 September 2018 of R499 440. c) Agri Vest Ltd had a negative cash flow for the year ended 30 September 2018. d) Agri Vest Ltd had a credit balance in the bank account on 1 October 2017 of R29 000. 3.2 3.3 3.4 3.5 When analysing the cash flow statement of Agri Vest Ltd for the year ended 30 September 2018, it is evident that the largest portion of the negative cash flow can be attributed to: a) Operating activities b) Investment activities c) Financing activities d) The net loss Which one of the following statements is correct when analysing the cash flow statement of Agri Vest Ltd for the year ended 30 September 2018, especially when considering cash flow from financing activities? a) Agri Vest Ltd had a positive cash flow from financing activities for the year ended 30 September 2018 of R1 000 000. b) Agri Vest Ltd had a negative cash flow from financing activities for the year ended 30 September 2018 of R1 000 000. c) The increase in the mortgage bond of R550 000 decreases the liability (loan). d) The issue of ordinary shares of R450 000 would result in a debit to equity. When analysing the cash flow statement of Agri Vest Ltd for the year ended 30 September 2018, it is evident that a large portion of positive cash flow can be attributed to: a) Expanding the business. b) Profit earned for the year. c) The interest received. d) The increase in the liability (mortgage bond). Which decision by the board through the financial year could have placed Agri Vest Ltd in a better cash position on 30 September 2018? a) Pay the creditors and suppliers earlier. b) Do not issue any shares. c) Increase the investment in land and new equipment. d) Do not declare or issue dividends.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started