Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Ltd is offered three investment proposals: (i) to acquire 70% of the shares of B Ltd on 3 March 20x3, (ii) to acquire

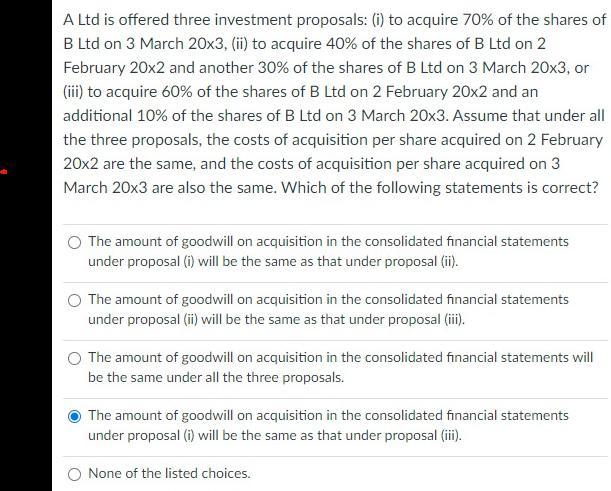

A Ltd is offered three investment proposals: (i) to acquire 70% of the shares of B Ltd on 3 March 20x3, (ii) to acquire 40% of the shares of B Ltd on 2 February 20x2 and another 30% of the shares of B Ltd on 3 March 20x3, or (iii) to acquire 60% of the shares of B Ltd on 2 February 20x2 and an additional 10% of the shares of B Ltd on 3 March 20x3. Assume that under all the three proposals, the costs of acquisition per share acquired on 2 February 20x2 are the same, and the costs of acquisition per share acquired on 3 March 20x3 are also the same. Which of the following statements is correct? The amount of goodwill on acquisition in the consolidated financial statements under proposal (i) will be the same as that under proposal (ii). The amount of goodwill on acquisition in the consolidated financial statements under proposal (ii) will be the same as that under proposal (iii). The amount of goodwill on acquisition in the consolidated financial statements will be the same under all the three proposals. The amount of goodwill on acquisition in the consolidated financial statements under proposal (i) will be the same as that under proposal (iii). None of the listed choices.

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided bel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started