Question

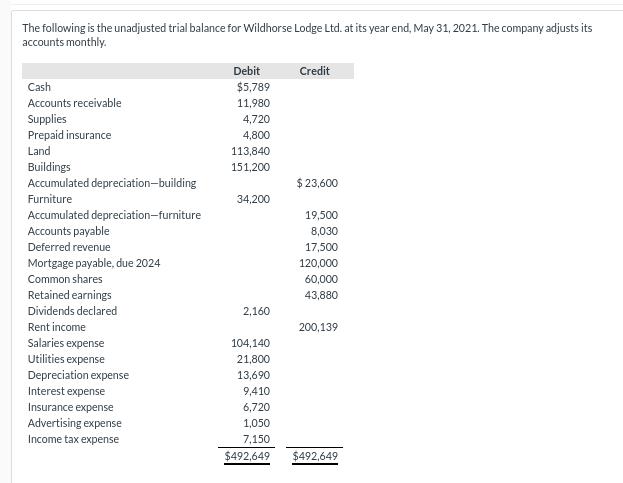

The following is the unadjusted trial balance for Wildhorse Lodge Ltd. at its year end, May 31, 2021. The company adjusts its accounts monthly.

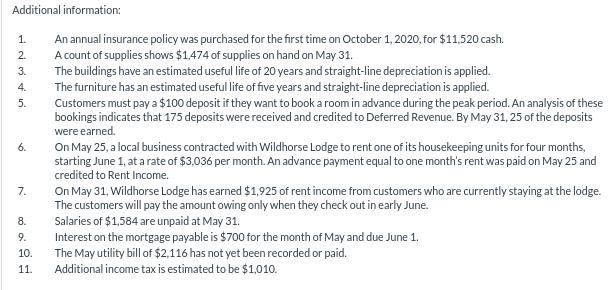

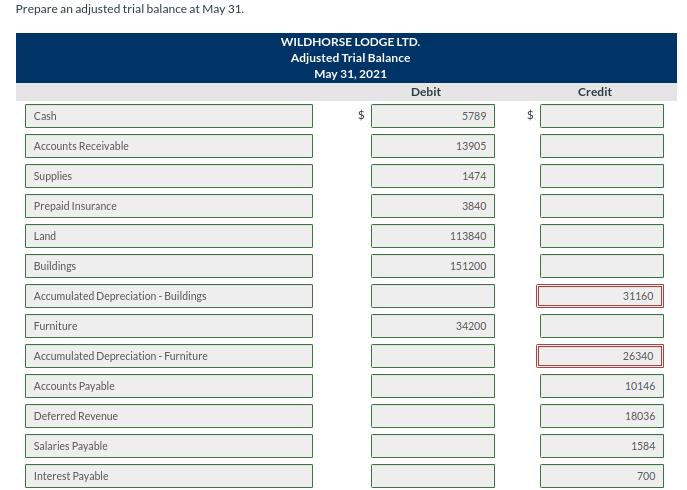

The following is the unadjusted trial balance for Wildhorse Lodge Ltd. at its year end, May 31, 2021. The company adjusts its accounts monthly. Debit Credit Cash $5,789 Accounts receivable 11,980 Supplies 4,720 Prepaid insurance 4,800 Land 113,840 Buildings 151,200 Accumulated depreciation-building $ 23,600 Furniture 34,200 Accumulated depreciation-furniture 19,500 Accounts payable 8,030 Deferred revenue 17,500 Mortgage payable, due 2024 120,000 Common shares 60,000 Retained earnings 43,880 Dividends declared 2,160 Rent income 200,139 Salaries expense 104,140 21,800 Utilities expense Depreciation expense 13,690 Interest expense 9,410 Insurance expense 6,720 Advertising expense 1,050 Income tax expense 7,150 $492,649 $492,649 Additional information: 1. An annual insurance policy was purchased for the first time on October 1, 2020, for $11,520 cash. A count of supplies shows $1,474 of supplies on hand on May 31. 2. 3. 4. 5. The buildings have an estimated useful life of 20 years and straight-line depreciation is applied. The furniture has an estimated useful life of five years and straight-line depreciation is applied. Customers must pay a $100 deposit if they want to book a room in advance during the peak period. An analysis of these bookings indicates that 175 deposits were received and credited to Deferred Revenue. By May 31, 25 of the deposits were earned. 6. On May 25, a local business contracted with Wildhorse Lodge to rent one of its housekeeping units for four months, starting June 1, at a rate of $3,036 per month. An advance payment equal to one month's rent was paid on May 25 and credited to Rent Income. 7. On May 31, Wildhorse Lodge has earned $1,925 of rent income from customers who are currently staying at the lodge. The customers will pay the amount owing only when they check out in early June. 8. Salaries of $1,584 are unpaid at May 31. 9. Interest on the mortgage payable is $700 for the month of May and due June 1. The May utility bill of $2,116 has not yet been recorded or paid. 10. 11. Additional income tax is estimated to be $1,010. Prepare an adjusted trial balance at May 31. Cash Accounts Receivable Supplies Prepaid Insurance Land Buildings Accumulated Depreciation - Buildings Furniture Accumulated Depreciation - Furniture Accounts Payable Deferred Revenue Salaries Payable Interest Payable WILDHORSE LODGE LTD. Adjusted Trial Balance May 31, 2021 Debit 5789 13905 1474 3840 113840 151200 34200 $ Credit 31160 26340 10146 18036 1584 700 Income Tax Payable Mortgage Payable Common Shares Retained Earnings Dividends Declared Rent Income Salaries Expense Utilities Expense Depreciation Expense Interest Expense Insurance Expense Supplies Expense Advertising Expense Income Tax Expense Totals $ 2160 105724 23916 28090 10110 7680 3246 1050 8160 514384 $ 1010 120000 60000 43880 201528 514384

Step by Step Solution

3.35 Rating (118 Votes )

There are 3 Steps involved in it

Step: 1

Adjusting Entries No Date Account title and explanation Debit Credit 1 May 31 Insurance expense 1152...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started