Question

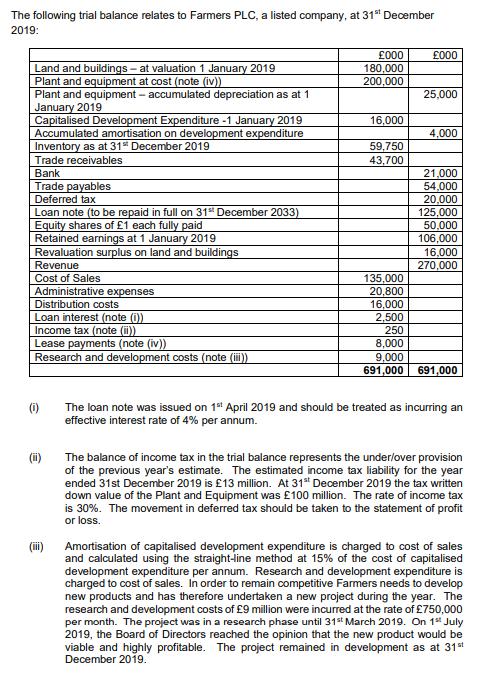

The following trial balance relates to Farmers PLC, a listed company, at 31 December 2019: 000 Land and buildings - at valuation 1 January

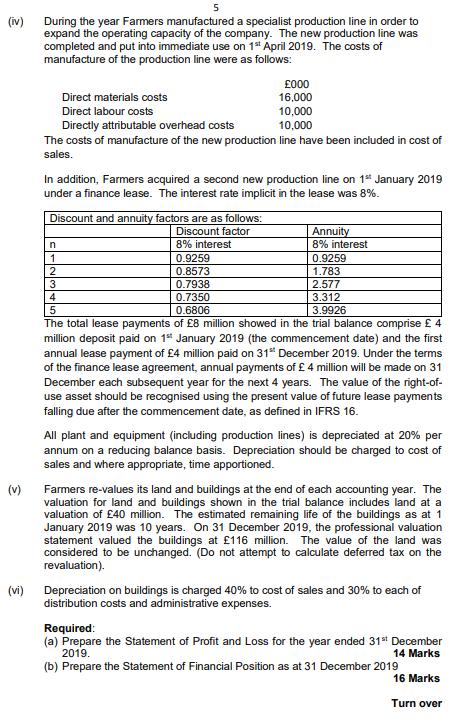

The following trial balance relates to Farmers PLC, a listed company, at 31 December 2019: 000 Land and buildings - at valuation 1 January 2019 Plant and equipment at cost (note (iv) Plant and equipment - accumulated depreciation as at 1 January 2019 Capitalised Development Expenditure -1 January 2019 Accumulated amortisation on development expenditure Inventory as at 31" December 2019 Trade receivables 180,000 200,000 25,000 16,000 4,000 59,750 43,700 Bank Trade payables Deferred tax Loan note (to be repaid in full on 31" December 2033) Equity shares of 1 each fully paid Retained earnings at 1 January 2019 Revaluation surplus on land and buildings 21,000 54,000 20,000 125,000 50,000 106,000 16,000 270,000 Revenue Cost of Sales Administrative expenses Distribution costs Loan interest (note (i)) Income tax (note (i)) Lease payments (note (iv)) Research and development costs (note (i) 135,000 20,800 16,000 2,500 250 8,000 9,000 691,000 691,000 The loan note was issued on 1t April 2019 and should be treated as incurring an effective interest rate of 4% per annum. (i) (i) The balance of income tax in the trial balance represents the underlover provision of the previous year's estimate. The estimated income tax liability for the year ended 31st December 2019 is 13 million. At 31 December 2019 the tax written down value of the Plant and Equipment was 100 million. The rate of income tax is 30%. The movement in deferred tax should be taken to the statement of profit or loss. (ii) Amortisation of capitalised development expenditure is charged to cost of sales and calculated using the straight-line method at 15% of the cost of capitalised development expenditure per annum. Research and development expenditure is charged to cost of sales. In order to remain competitive Farmers needs to develop new products and has therefore undertaken a new project during the year. The research and development costs of 9 million were incurred at the rate of 750,000 per month. The project was in a research phase until 31t March 2019. On 14 July 2019, the Board of Directors reached the opinion that the new product would be viable and highly profitable. The project remained in development as at 31st December 2019. 5 (iv) During the year Farmers manufactured a specialist production line in order to expand the operating capacity of the company. The new production line was completed and put into immediate use on 1* April 2019. The costs of manufacture of the production line were as follows: 000 16,000 10,000 10,000 Direct materials costs Direct labour costs Directly attributable overhead costs The costs of manufacture of the new production line have been included in cost of sales. In addition, Farmers acquired a second new production line on 1* January 2019 under a finance lease. The interest rate implicit in the lease was 8%. Discount and annuity factors are as follows: Discount factor Annuity 8% interest 8% interest 0.9259 1.783 1 0.9259 0.8573 0.7938 2.577 4 0.7350 0.6806 3.312 3.9926 The total lease payments of 8 million showed in the trial balance comprise 4 million deposit paid on 1 January 2019 (the commencement date) and the first annual lease payment of 4 million paid on 31* December 2019. Under the terms of the finance lease agreement, annual payments of 4 million will be made on 31 December each subsequent year for the next 4 years. The value of the right-of- use asset should be recognised using the present value of future lease payments falling due after the commencement date, as defined in IFRS 16. All plant and equipment (including production lines) is depreciated at 20% per annum on a reducing balance basis. Depreciation should be charged to cost of sales and where appropriate, time apportioned. (v) Farmers re-values its land and buildings at the end of each accounting year. The valuation for land and buildings shown in the trial balance includes land at a valuation of 40 million. The estimated remaining life of the buildings as at 1 January 2019 was 10 years. On 31 December 2019, the professional valuation statement valued the buildings at 116 million. The value of the land was considered to be unchanged. (Do not attempt to calculate deferred tax on the revaluation). (vi) Depreciation on buildings is charged 40% to cost of sales and 30% to each of distribution costs and administrative expenses. Required: (a) Prepare the Statement of Profit and Loss for the year ended 31" December 2019. 14 Marks (b) Prepare the Statement of Financial Position as at 31 December 2019 16 Marks Turn over

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Profit and Loss Particulars Amount Revenue 27000000 Cost of Sales 13500000 Depreciation ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started