Answered step by step

Verified Expert Solution

Question

1 Approved Answer

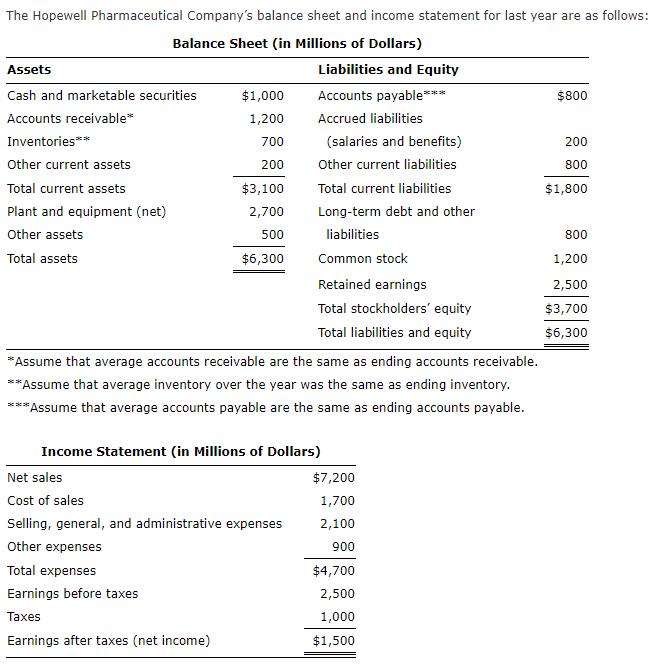

The Hopewell Pharmaceutical Company's balance sheet and income statement for last year are as follows: Balance Sheet (in Millions of Dollars) Assets Cash and

![]()

The Hopewell Pharmaceutical Company's balance sheet and income statement for last year are as follows: Balance Sheet (in Millions of Dollars) Assets Cash and marketable securities Accounts receivable* Inventories** Other current assets Total current assets Plant and equipment (net) Other assets Total assets $1,000 1,200 700 200 $3,100 2,700 500 $6,300 *Assume that average accounts receivable are the same as ending accounts receivable. **Assume that average inventory over the year was the same as ending inventory. ***Assume that average accounts payable are the same as ending accounts payable. Earnings before taxes Taxes Earnings after taxes (net income) Liabilities and Equity Accounts payable*** Accrued liabilities (salaries and benefits) Other current liabilities Total current liabilities Long-term debt and other liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and equity Income Statement (in Millions of Dollars) Net sales Cost of sales Selling, general, and administrative expenses Other expenses Total expenses $7,200 1,700 2,100 900 $4,700 2,500 1,000 $1,500 $800 200 800 $1,800 800 1,200 2,500 $3,700 $6,300 Determine Hopewell's cash conversion cycle. Assume that there are 365 days per year.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The cash conversion cycle is number of days to convert resou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started