Question: The Individual financial statements for Gibson Company and Keller Company for the year ending December 31, 2021, follow. Gibson acquired a 60 percent Interest in

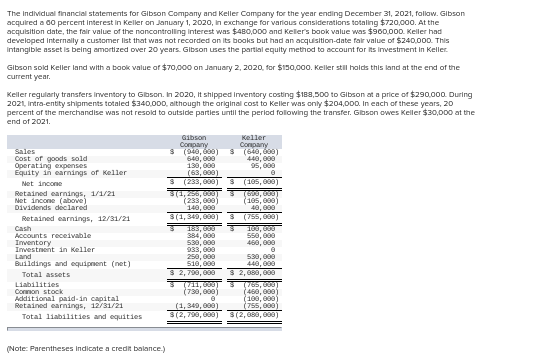

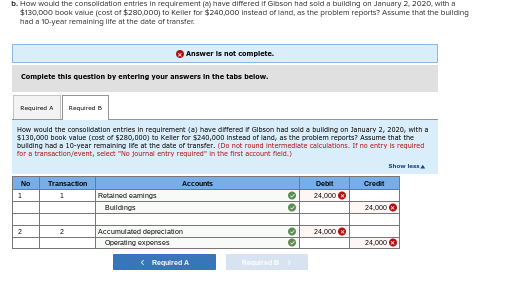

The Individual financial statements for Gibson Company and Keller Company for the year ending December 31, 2021, follow. Gibson acquired a 60 percent Interest in Keller on January 1, 2020, in exchange for various considerations totaling $720,000. At the acquisition date, the fair value of the noncontrolling interest was $480,000 and Keller's book value was $900,000. Keller had developed Internally a customer list that was not recorded on its books but had an acquisition date fair value of $240.000. This Intangible asset is being amortized over 20 years. Gibson uses the partial equity method to account for its investment in Keller Gibson sold Keller land with a book value of $70,000 on January 2, 2020, for $150,000. Keller still holds this land at the end of the current year Keller regularly transfers Inventory to Gibson. In 2020, It shipped Inventory costing $183,500 to Gibson at a price of $290.000. During 2021, Intra-entity shipments totaled $340,000, although the original cost to Keller was only $204,000. In each of these years, 20 percent of the merchandise was not resold to outside parties until the period following the transfer. Glason owes Keller $30,000 at the end of 2021. Gibson Keller Company Company Sales $ (940,600) $ (640,000 Cost of goods sold 640,000 446,000 Operating expenses 138,888 95,888 Equity in earnings of Keller (63, 088) S (233,000 $ Net income (165,699) Retained earnings, 1/1/21 S181,250,00 (603,699 Net inconte (above) (233,000) 105,690) Dividends declared 140,000 40,000 Retained earnings, 12/31/21 $(1,340, 608) (755,698) 183, 180,000 Accounts receivable 384,000 550,000 Inventory 530,000 450,000 Investment in Keller 933,000 Land 250,000 530,000 Buildings and equipment (net) 510,000 440, 688 Total assets $ 2,790,000 $ 2,680,000 Liabilities 3 (71.630) 765, 883 Common stock (730,000) (450,000 Additional paid in capital 100,000 Retained earnings, 12/31/21 (1, 349,000) (755,600 Total liabilities and equities $(2,790,000) S(2,680,000 (Note: Parentheses Indicate a credit balance.) b. How would the consolidation entries in requirement (a) have differed if Gibson had sold a bullding on January 2 2020 with a $130,000 book value (cost of $280,000 to Keller for $240,000 Instead of land, as the problem reports? Assume that the building had a 10-year remaining life at the date of transfer. Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required How would the consolidation entries in requirement (a) have differed Gibson had sold a building on January 2, 2020, with a $130,000 book value (cost of $280,000) to Keller for $240,000 Instead of land, as the problem reports? Assume that the building had a 10-year remaining life at the date of transfer. (Do not round Intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required in the first account field.) Show less Accounts Credit No 1 Transaction 1 Debat 24.000 Retained camings Buildings 24.000 Oo oo 2 2 24.000 Accumulated depreciation Operating expenses 24.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts