Answered step by step

Verified Expert Solution

Question

1 Approved Answer

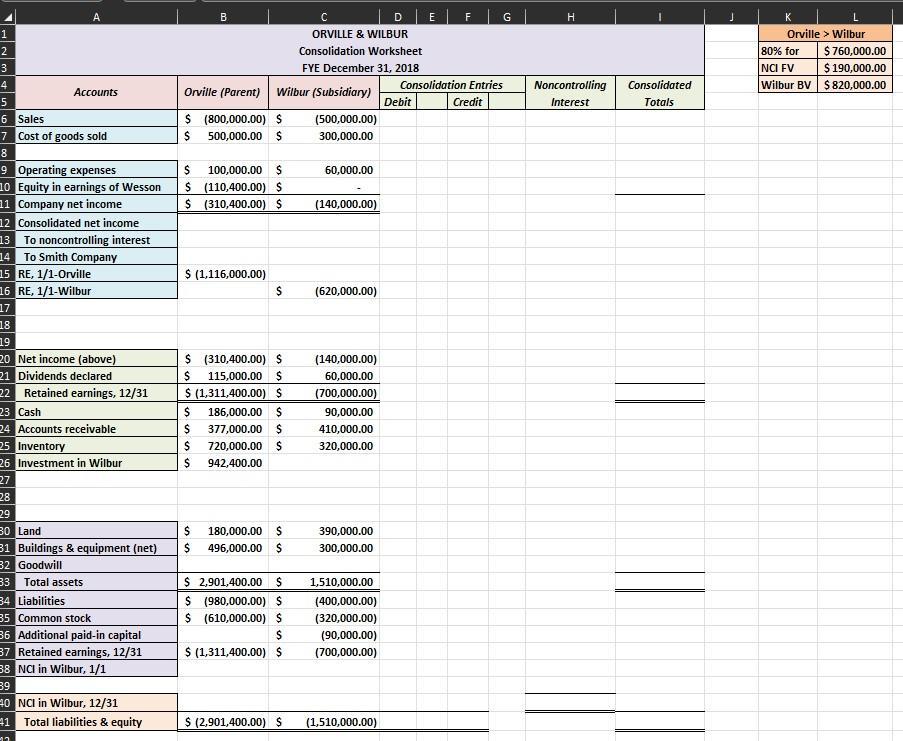

The individual financial statements for Orville Company and Wilbur Company for the year ending December 31, 2018, follow. Orville acquired an 80 percent interest in

| The individual financial statements for Orville Company and Wilbur Company for the year ending December 31, 2018, follow. Orville acquired an 80 percent interest in Wilbur on January 1, 2017, in exchange for various considerations totaling $760,000. At the acquisition date, the fair value of the noncontrolling interest was $190,000 and Wilbur’s book value was $820,000. Any excess over book value is attributed entirely to goodwill. |

| Required – |

| Prepare a list of your journal entries as they would appear in your General Journal and then post the entries to the consolidation worksheet. Label your entries in your General Journal and the consolidation worksheet as appropriate. |

1 2 3 4 5 6 Sales 7 8 Accounts Cost of goods sold 9 Operating expenses 10 Equity in earnings of Wesson 11 Company net income 12 Consolidated net income 13 To noncontrolling interest 14 To Smith Company 15 RE, 1/1-Orville 16 RE, 1/1-Wilbur 17 18 19 20 Net income (above) 21 Dividends declared 22 Retained earnings, 12/31 23 Cash 24 Accounts receivable 25 Inventory 26 Investment in Wilbur 27 28 29 30 Land 31 Buildings & equipment (net) 32 Goodwill 33 Total assets 34 Liabilities 35 Common stock 36 Additional paid-in capital 37 Retained earnings, 12/31 38 NCI in Wilbur, 1/1 39 40 NCI in Wilbur, 12/31 41 Total liabilities & equity 12 B Orville (Parent) Wilbur (Subsidiary) $ (800,000.00) S (500,000.00) 300,000.00 $ 500,000.00 $ $ 100,000.00 $ $ (110,400.00) $ $ (310,400.00) $ $ (1,116,000.00) $ $ (310,400.00) $ $ 115,000.00 $ $ (1,311,400.00) $ $ 186,000.00 $ 377,000.00 $ $ $ 720,000.00 $ $ 942,400.00 $ 180,000.00 $ $ 496,000.00 $ $ 2,901,400.00 $ $ (980,000.00) $ $ (610,000.00) $ $ $ (1,311,400.00) $ ORVILLE & WILBUR Consolidation Worksheet FYE December 31, 2018 $ (2,901,400.00) $ 60,000.00 (140,000.00) (620,000.00) (140,000.00) 60,000.00 (700,000.00) 90,000.00 410,000.00 320,000.00 390,000.00 300,000.00 1,510,000.00 (400,000.00) (320,000.00) (90,000.00) (700,000.00) (1,510,000.00) E Debit | G Consolidation Entries Credit H Noncontrolling Consolidated Interest Totals Orville > Wilbur 80% for NCI FV Wilbur BV $760,000.00 $ 190,000.00 $ 820,000.00

Step by Step Solution

★★★★★

3.49 Rating (185 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started