Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Internal Revenue Code at times, seems to provide different tax treatment to similar situations. In the following situations, explain why the tax treatment

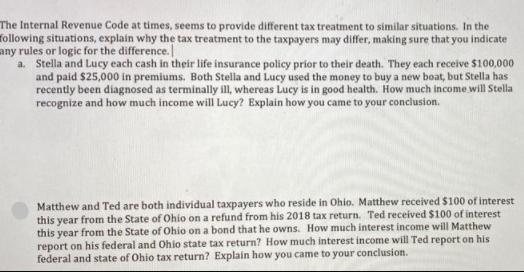

The Internal Revenue Code at times, seems to provide different tax treatment to similar situations. In the following situations, explain why the tax treatment to the taxpayers may differ, making sure that you indicate any rules or logic for the difference. a. Stella and Lucy each cash in their life insurance policy prior to their death. They each receive $100,000 and paid $25,000 in premiums. Both Stella and Lucy used the money to buy a new boat, but Stella has recently been diagnosed as terminally ill, whereas Lucy is in good health. How much income will Stella recognize and how much income will Lucy? Explain how you came to your conclusion. Matthew and Ted are both individual taxpayers who reside in Ohio. Matthew received $100 of interest this year from the State of Ohio on a refund from his 2018 tax return. Ted received $100 of interest this year from the State of Ohio on a bond that he owns. How much interest income will Matthew report on his federal and Ohio state tax return? How much interest income will Ted report on his federal and state of Ohio tax return? Explain how you came to your conclusion.

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer A iBoth Stella and Lucy have same occupation and gotten 100000 in lost wages for this situation Yet the idea of pay got by them isnt something ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started