Question

The Light Company manufactures a single type of desk-lamp which has a selling price of 49 per un Annual sales volume is 8,000 units.

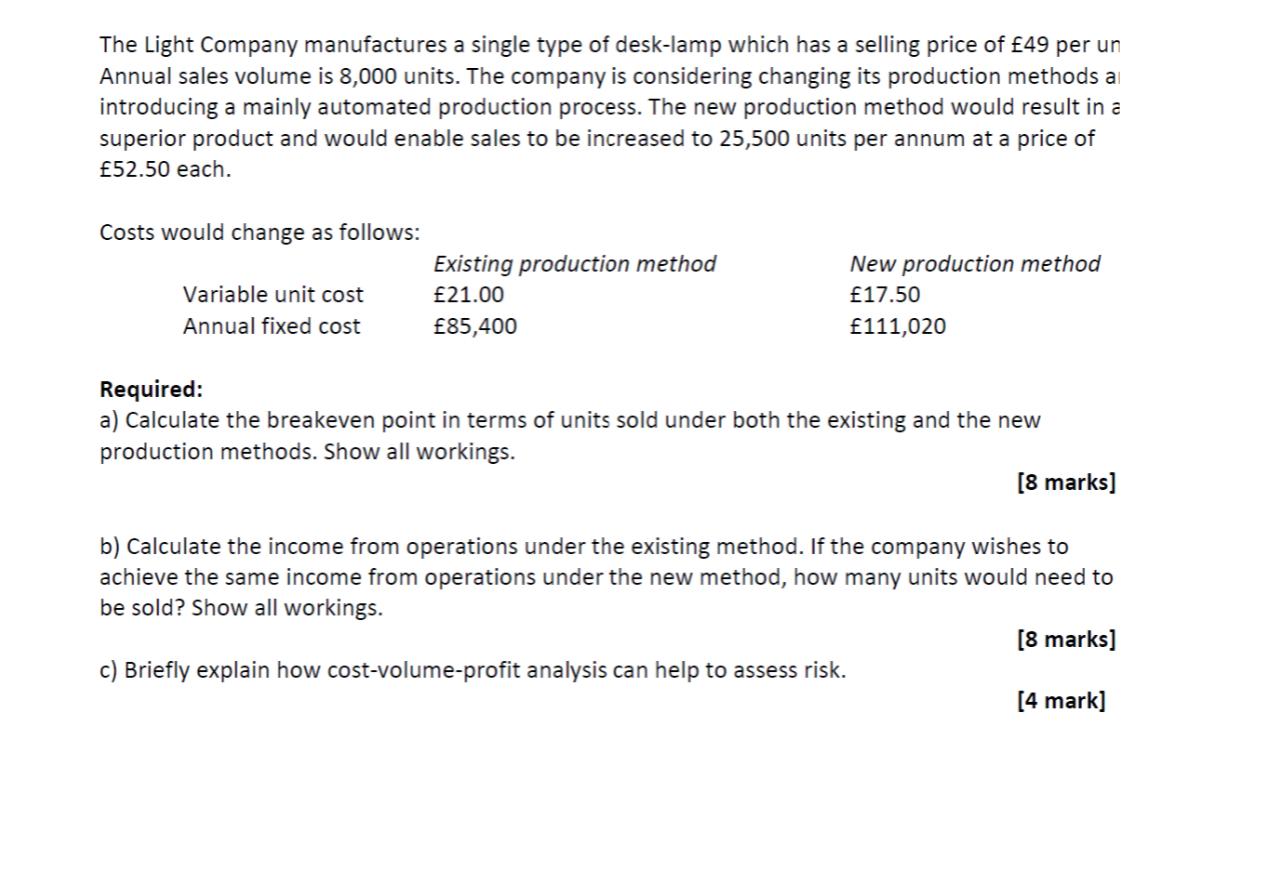

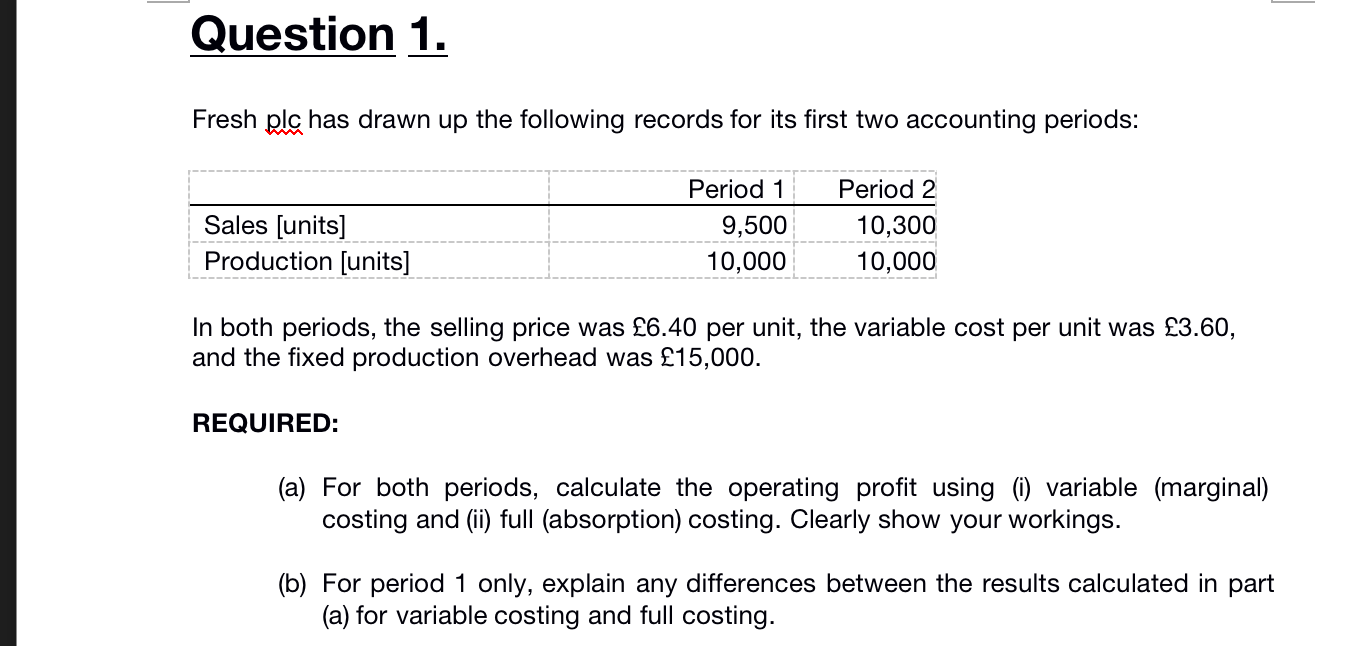

The Light Company manufactures a single type of desk-lamp which has a selling price of 49 per un Annual sales volume is 8,000 units. The company is considering changing its production methods ar introducing a mainly automated production process. The new production method would result in a superior product and would enable sales to be increased to 25,500 units per annum at a price of 52.50 each. Costs would change as follows: Existing production method New production method Variable unit cost 21.00 17.50 Annual fixed cost 85,400 111,020 Required: a) Calculate the breakeven point in terms of units sold under both the existing and the new production methods. Show all workings. [8 marks] b) Calculate the income from operations under the existing method. If the company wishes to achieve the same income from operations under the new method, how many units would need to be sold? Show all workings. [8 marks] c) Briefly explain how cost-volume-profit analysis can help to assess risk. [4 mark] Question 1. Fresh plc has drawn up the following records for its first two accounting periods: Period 1 Period 2 Sales [units] Production [units] 9,500 10,300 10,000 10,000 In both periods, the selling price was 6.40 per unit, the variable cost per unit was 3.60, and the fixed production overhead was 15,000. REQUIRED: (a) For both periods, calculate the operating profit using (i) variable (marginal) costing and (ii) full (absorption) costing. Clearly show your workings. (b) For period 1 only, explain any differences between the results calculated in part (a) for variable costing and full costing.

Step by Step Solution

3.54 Rating (134 Votes )

There are 3 Steps involved in it

Step: 1

Answer 5a Formula for BEP units total fixed cost selling pr...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started