Question

The local bank that you are a risk manager has a portfolio of options on a traded asset. The delta of the options is

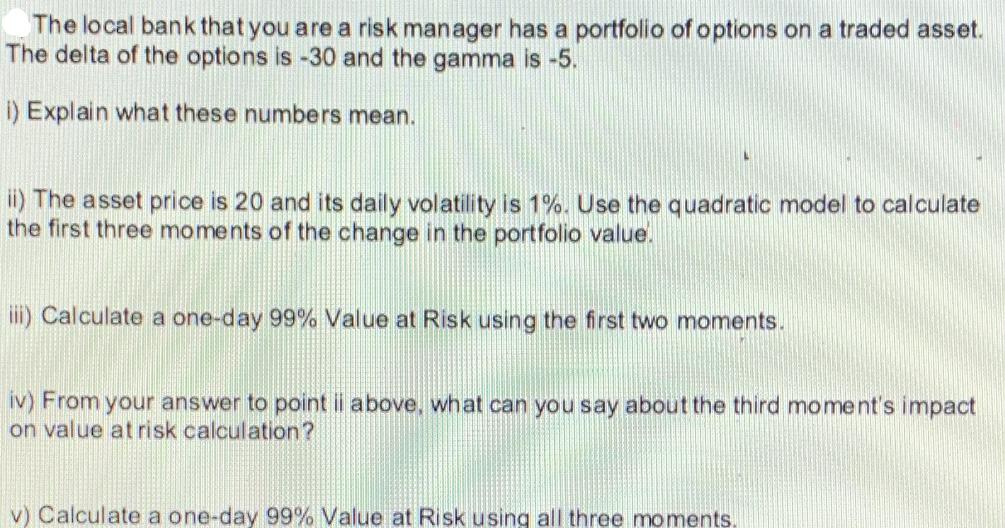

The local bank that you are a risk manager has a portfolio of options on a traded asset. The delta of the options is -30 and the gamma is -5. i) Explain what these numbers mean. ii) The asset price is 20 and its daily volatility is 1%. Use the quadratic model to calculate the first three moments of the change in the portfolio value. iii) Calculate a one-day 99% Value at Risk using the first two moments. iv) From your answer to point il above, what can you say about the third moment's impact on value at risk calculation? v) Calculate a one-day 99% Value at Risk using all three moments.

Step by Step Solution

3.33 Rating (117 Votes )

There are 3 Steps involved in it

Step: 1

I In choices exchanging delta addresses the awareness of the choices cost to changes in the hidden resources cost A delta of 30 truly intends that for each 1 expansion in the hidden resources value th...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started