Question: The service division of Culver Industries reported the following results for 2022. Sales $580,000 Variable costs 348,000 Controllable fixed costs 72,500 Average operating assets

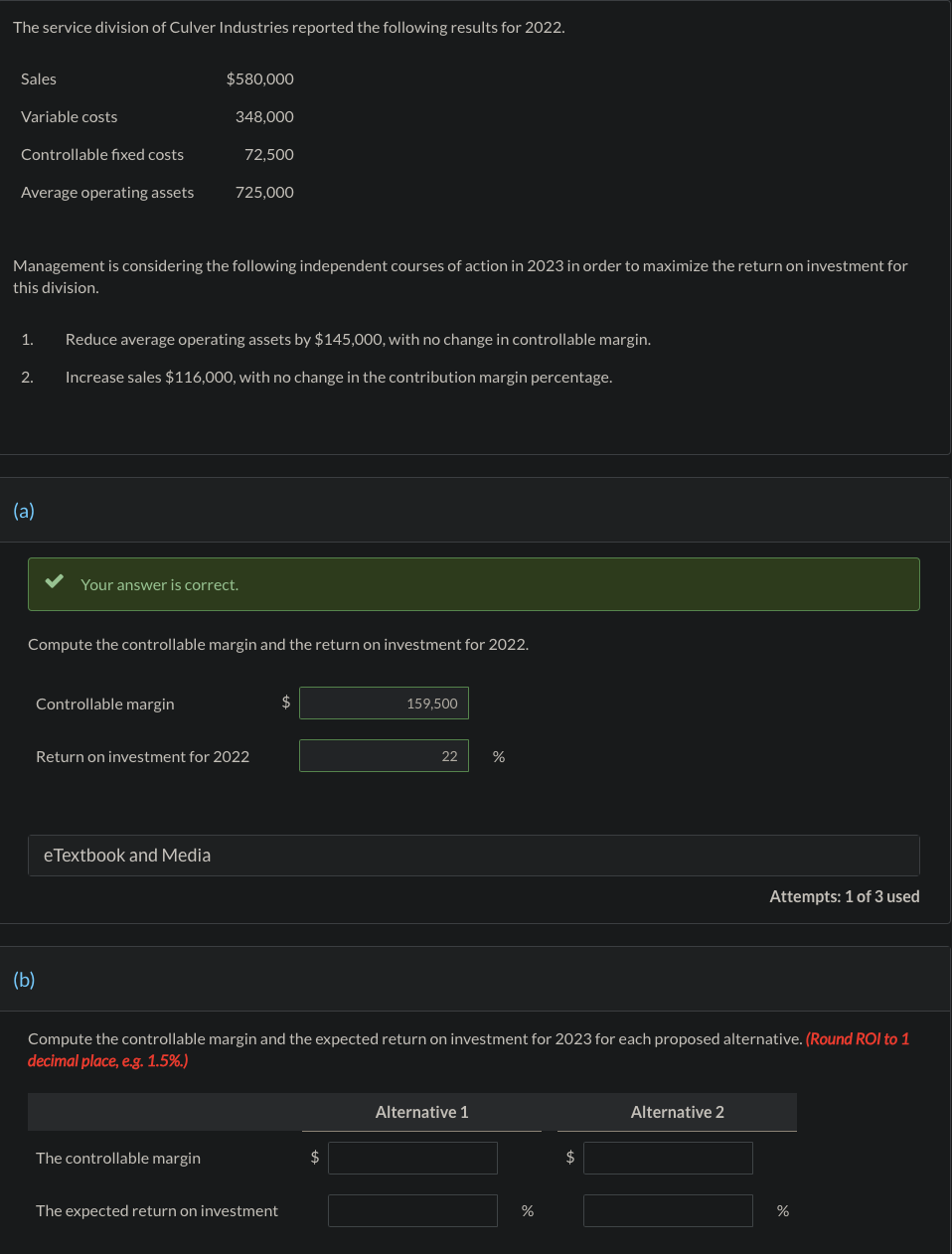

The service division of Culver Industries reported the following results for 2022. Sales $580,000 Variable costs 348,000 Controllable fixed costs 72,500 Average operating assets 725,000 Management is considering the following independent courses of action in 2023 in order to maximize the return on investment for this division. 1. Reduce average operating assets by $145,000, with no change in controllable margin. 2. Increase sales $116,000, with no change in the contribution margin percentage. (a) (b) Your answer is correct. Compute the controllable margin and the return on investment for 2022. Controllable margin Return on investment for 2022 eTextbook and Media 159,500 22 % Attempts: 1 of 3 used Compute the controllable margin and the expected return on investment for 2023 for each proposed alternative. (Round ROI to 1 decimal place, e.g. 1.5%.) The controllable margin The expected return on investment Alternative 1 % Alternative 2 %

Step by Step Solution

There are 3 Steps involved in it

a Compute the controllable margin and the return on investment for 2022 Controllable Margin Sales Va... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

663de86cb0c5c_961163.pdf

180 KBs PDF File

663de86cb0c5c_961163.docx

120 KBs Word File