Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fiz Pte Ltd (Fiz) is a service-provider based in Singapore and adopts the Singapore Financial Reporting Standards. It makes adjusting and closing entries every

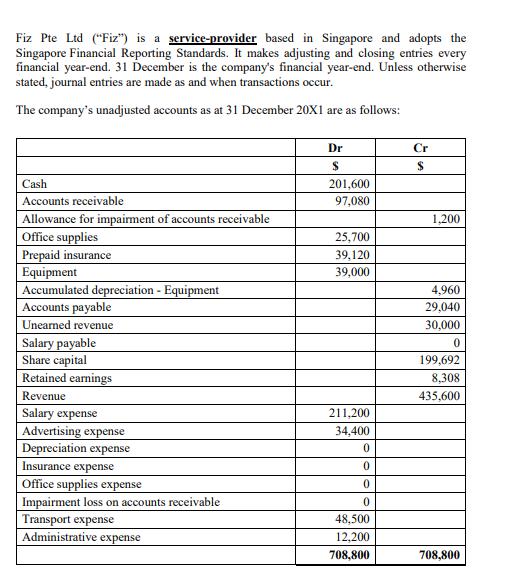

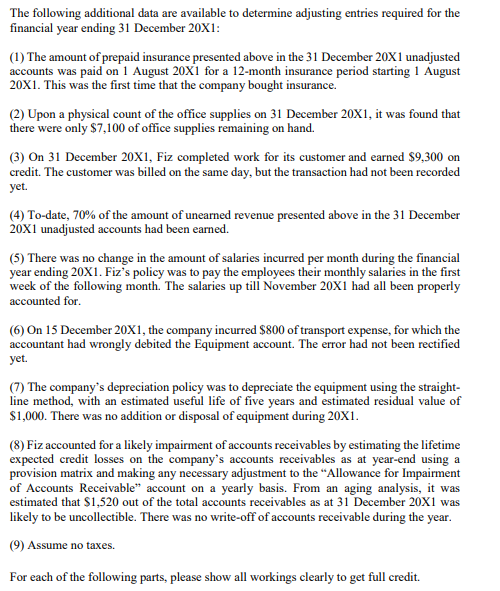

Fiz Pte Ltd ("Fiz") is a service-provider based in Singapore and adopts the Singapore Financial Reporting Standards. It makes adjusting and closing entries every financial year-end. 31 December is the company's financial year-end. Unless otherwise stated, journal entries are made as and when transactions occur. The company's unadjusted accounts as at 31 December 20X1 are as follows: Dr Cr $ $ Cash 201,600 Accounts receivable 97,080 Allowance for impairment of accounts receivable 1,200 Office supplies 25,700 Prepaid insurance 39,120 Equipment 39,000 Accumulated depreciation - Equipment Accounts payable 4,960 29,040 Unearned revenue 30,000 Salary payable Share capital Retained earnings Revenue Salary expense Advertising expense 0 199,692 8,308 435,600 211,200 34,400 Depreciation expense 0 Insurance expense 0 Office supplies expense 0 Impairment loss on accounts receivable 0 Transport expense 48,500 Administrative expense 12,200 708,800 708,800 The following additional data are available to determine adjusting entries required for the financial year ending 31 December 20X1: (1) The amount of prepaid insurance presented above in the 31 December 20X1 unadjusted accounts was paid on 1 August 20X1 for a 12-month insurance period starting 1 August 20X1. This was the first time that the company bought insurance. (2) Upon a physical count of the office supplies on 31 December 20X1, it was found that there were only $7,100 of office supplies remaining on hand. (3) On 31 December 20X1, Fiz completed work for its customer and earned $9,300 on credit. The customer was billed on the same day, but the transaction had not been recorded yet. (4) To-date, 70% of the amount of unearned revenue presented above in the 31 December 20X1 unadjusted accounts had been earned. (5) There was no change in the amount of salaries incurred per month during the financial year ending 20X1. Fiz's policy was to pay the employees their monthly salaries in the first week of the following month. The salaries up till November 20X1 had all been properly accounted for. (6) On 15 December 20X1, the company incurred $800 of transport expense, for which the accountant had wrongly debited the Equipment account. The error had not been rectified yet. (7) The company's depreciation policy was to depreciate the equipment using the straight- line method, with an estimated useful life of five years and estimated residual value of $1,000. There was no addition or disposal of equipment during 20X1. (8) Fiz accounted for a likely impairment of accounts receivables by estimating the lifetime expected credit losses on the company's accounts receivables as at year-end using a provision matrix and making any necessary adjustment to the "Allowance for Impairment of Accounts Receivable" account on a yearly basis. From an aging analysis, it was estimated that $1,520 out of the total accounts receivables as at 31 December 20X1 was likely to be uncollectible. There was no write-off of accounts receivable during the year. (9) Assume no taxes. For each of the following parts, please show all workings clearly to get full credit. Question 1a Apply accrual accounting concepts and prepare all necessary and adjusting entries (journal narratives and dates NOT required) as required based on the additional data provided in points (1) to (9) above to aid in the preparation of the financial statements for the financial year ended 31 December 20X1. (16 marks) Question 1b After passing the necessary adjusting entries required in part (a) above, present the Statement of Comprehensive Income, in a single-statement format, for the entity for the financial year ended 31 December 20X1. (12 marks) Question le After passing the necessary adjusting entries required in part (a) above, present the Statement of Financial Position for the entity as at 31 December 20X1. (17 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started