Question: Wall Paper Sdn Bhd (Wall Paper) is considering a proposal to replace its old printing machine with a new sophisticated and latest model. The

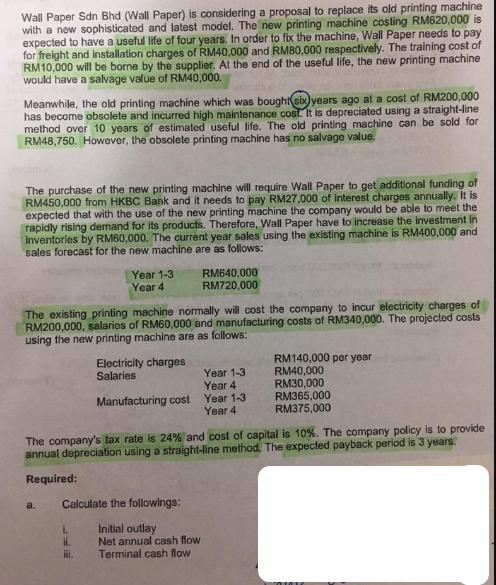

Wall Paper Sdn Bhd (Wall Paper) is considering a proposal to replace its old printing machine with a new sophisticated and latest model. The new printing machine costing RM620,000 is expected to have a useful life of four years. In order to fix the machine, Wall Paper needs to pay for freight and installation charges of RM40,000 and RM80,000 respectively. The training cost of RM10,000 will be borne by the supplier. At the end of the useful life, the new printing machine would have a salvage value of RM40,000. Meanwhile, the old printing machine which was bought six years ago at a cost of RM200,000 has become obsolete and incurred high maintenance cost. It is depreciated using a straight-line method over 10 years of estimated useful life. The old printing machine can be sold for RM48,750. However, the obsolete printing machine has no salvage value. The purchase of the new printing machine will require Wall Paper to get additional funding of RM450,000 from HKBC Bank and it needs to pay RM27,000 of interest charges annually. It is expected that with the use of the new printing machine the company would be able to meet the rapidly rising demand for its products. Therefore, Wall Paper have to increase the investment in Inventories by RM60,000. The current year sales using the existing machine is RM400,000 and sales forecast for the new machine are as follows: Year 1-3 Year 4 The existing printing machine normally will cost the company to incur electricity charges of RM200,000, salaries of RM60,000 and manufacturing costs of RM340,000. The projected costs using the new printing machine are as follows: a. Electricity charges Salaries L ii. ii. RM640,000 RM720,000 Year 1-3- Year 4 Manufacturing cost Year 1-3 Year 4 The company's tax rate is 24% and cost of capital is 10%. The company policy is to provide annual depreciation using a straight-line method. The expected payback period is 3 years. Required: Calculate the followings: Initial outlay Net annual cash flow Terminal cash flow RM140,000 per year RM40,000 RM30,000 RM365,000 RM375,000 oux

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

To calculate the initial outlay we need to consider the cost of the new printing machine freight and ... View full answer

Get step-by-step solutions from verified subject matter experts