Answered step by step

Verified Expert Solution

Question

1 Approved Answer

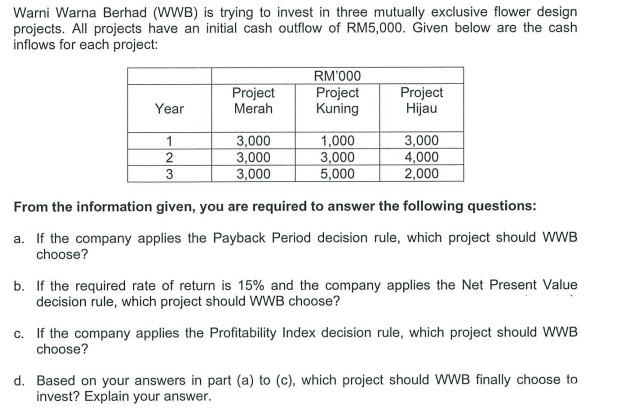

Warni Warna Berhad (WWB) is trying to invest in three mutually exclusive flower design projects. All projects have an initial cash outflow of RM5,000.

Warni Warna Berhad (WWB) is trying to invest in three mutually exclusive flower design projects. All projects have an initial cash outflow of RM5,000. Given below are the cash. inflows for each project: Year 1 2 3 Project Merah 3,000 3,000 3,000 RM'000 Project Kuning 1,000 3,000 5,000 Project Hijau 3,000 4,000 2,000 From the information given, you are required to answer the following questions: a. If the company applies the Payback Period decision rule, which project should WWB choose? b. If the required rate of return is 15% and the company applies the Net Present Value decision rule, which project should WWB choose? c. If the company applies the Profitability Index decision rule, which project should WWB choose? d. Based on your answers in part (a) to (c), which project should WWB finally choose to invest? Explain your answer.

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate Payback period Payback Period Initial Investment Annual Cash Inflow For Project Merah Initial Investment RM5000 Annual Cash Inflows Year 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started