Answered step by step

Verified Expert Solution

Question

1 Approved Answer

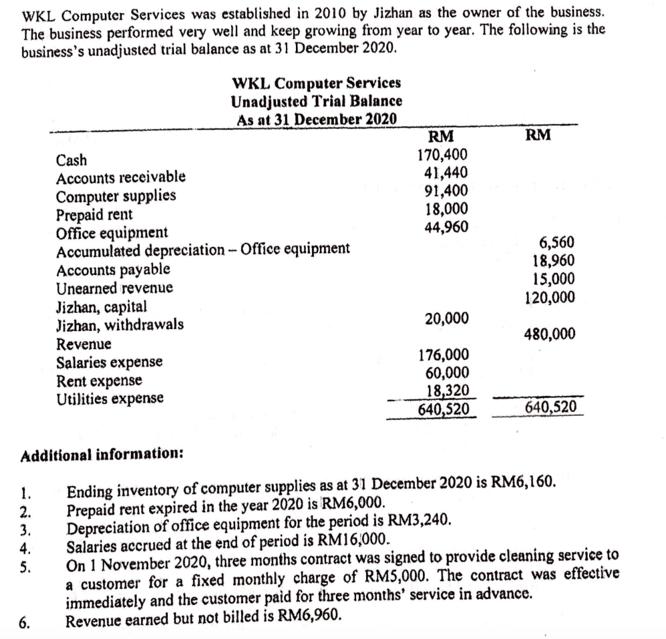

WKL Computer Services was established in 2010 by Jizhan as the owner of the business. The business performed very well and keep growing from

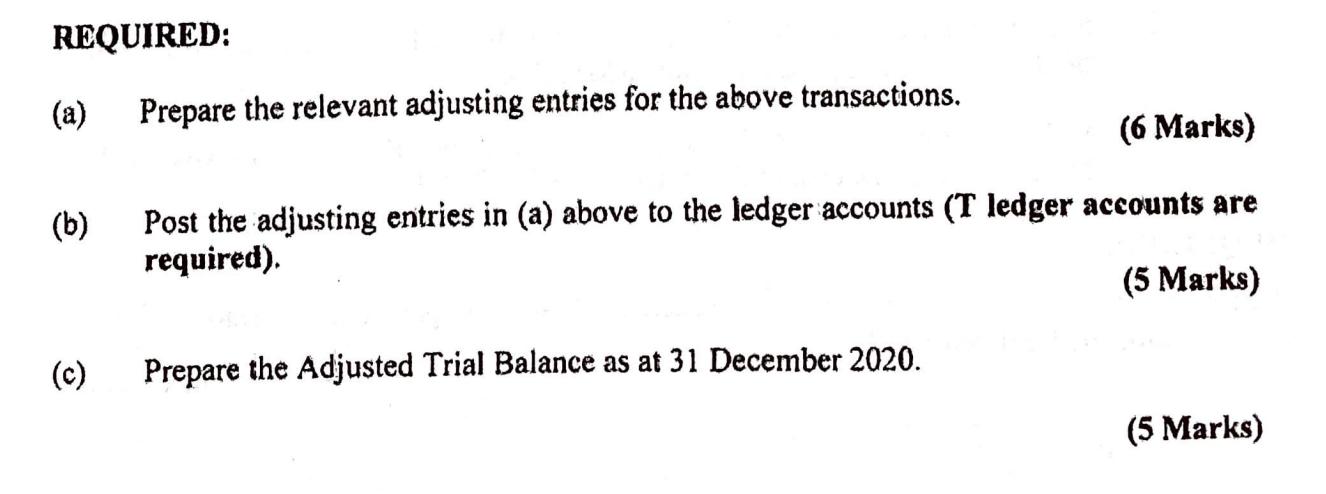

WKL Computer Services was established in 2010 by Jizhan as the owner of the business. The business performed very well and keep growing from year to year. The following is the business's unadjusted trial balance as at 31 December 2020. 1. 12445 3. 4. Cash Accounts receivable Computer supplies Prepaid rent Office equipment 6. Accumulated depreciation - Office equipment Accounts payable Unearned revenue Jizhan, capital Jizhan, withdrawals Revenue Salaries expense WKL Computer Services Unadjusted Trial Balance As at 31 December 2020 Rent expense Utilities expense RM 170,400 41,440 91,400 18,000 44,960 20,000 176,000 60,000 18,320 640,520 Additional information: Ending inventory of computer supplies as at 31 December 2020 is RM6,160. Prepaid rent expired in the year 2020 is RM6,000. Depreciation of office equipment for the period is RM3,240. Salaries accrued at the end of period is RM16,000. On 1 November 2020, three months contract was signed to provide cleaning service to a customer for a fixed monthly charge of RM5,000. The contract was effective immediately and the customer paid for three months' service in advance. Revenue earned but not billed is RM6,960. RM 6,560 18,960 15,000 120,000 480,000 640,520 REQUIRED: (a) (b) (c) Prepare the relevant adjusting entries for the above transactions. (6 Marks) Post the adjusting entries in (a) above to the ledger accounts (T ledger accounts are required). (5 Marks) Prepare the Adjusted Trial Balance as at 31 December 2020. (5 Marks) (d) Prepare the following statements for WKL Computer Service: (i) Statement of Comprehensive Income for the year ended 31 December 2020. (3 Marks) (ii) Statement of Owner's Equity for the year ended 31 December 2020. (iii) Statement of Financial Position as at 31 December 2020. (2 Marks) (4 Marks)

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started