Answered step by step

Verified Expert Solution

Question

1 Approved Answer

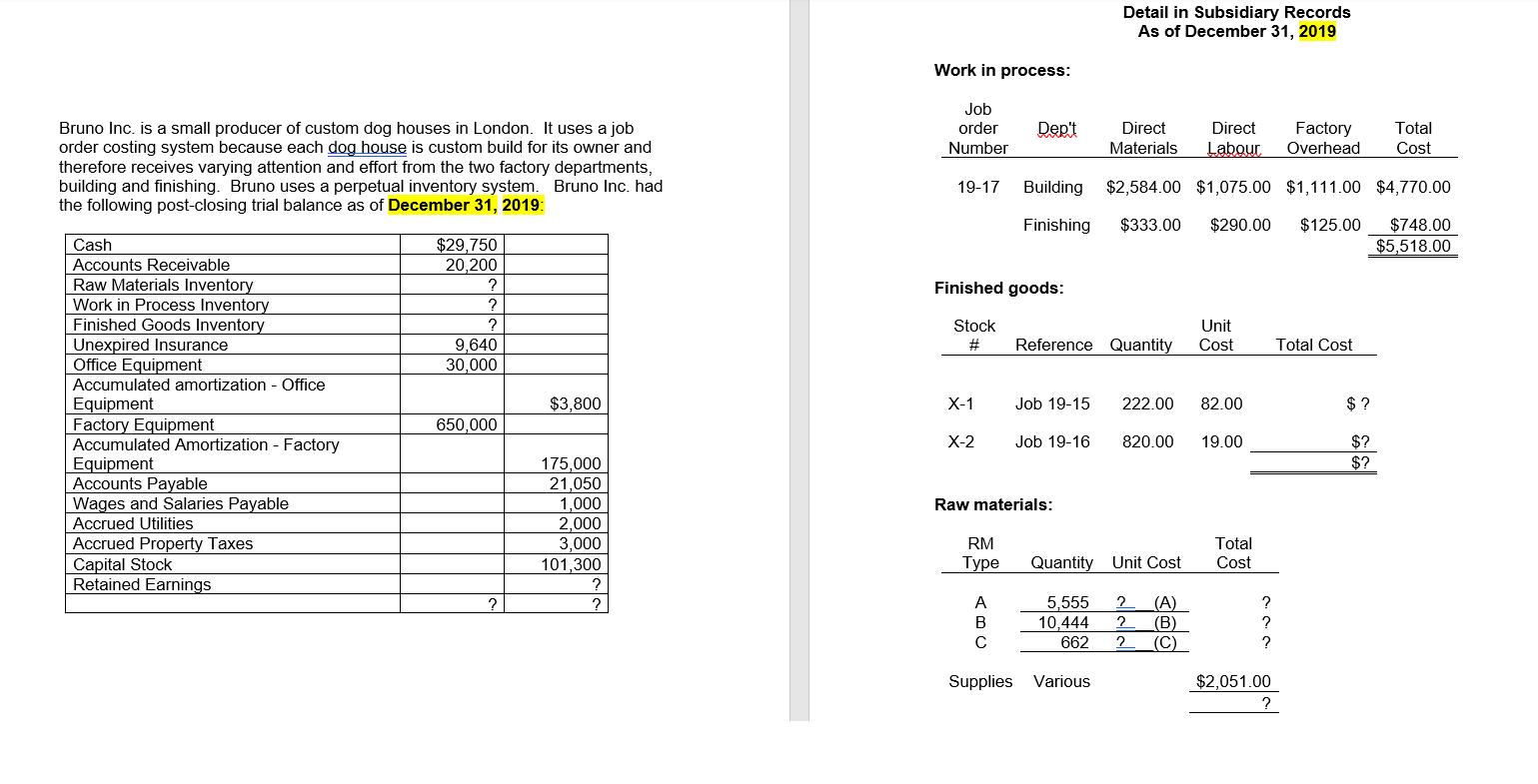

Work in process: Job Detail in Subsidiary Records As of December 31, 2019 $29,750 20,200 ? Bruno Inc. is a small producer of custom

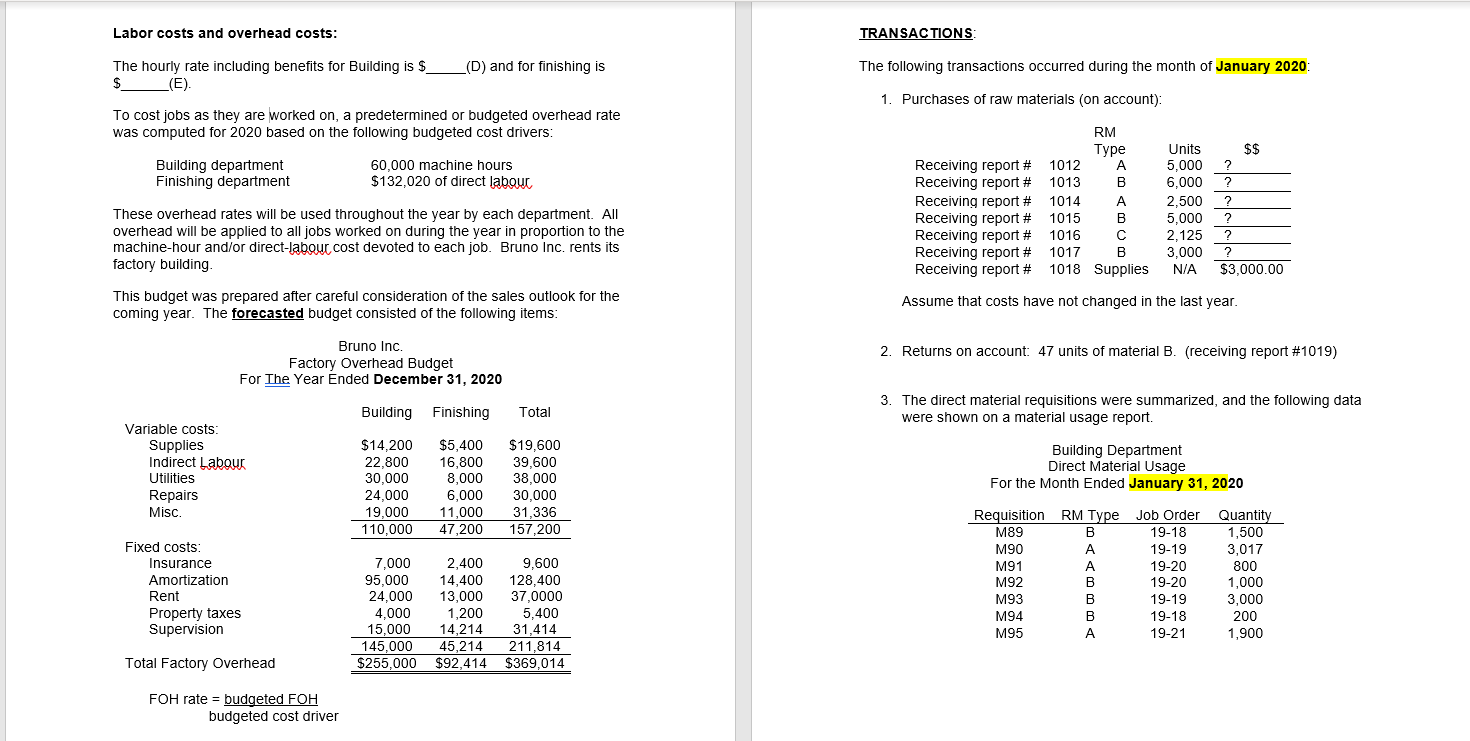

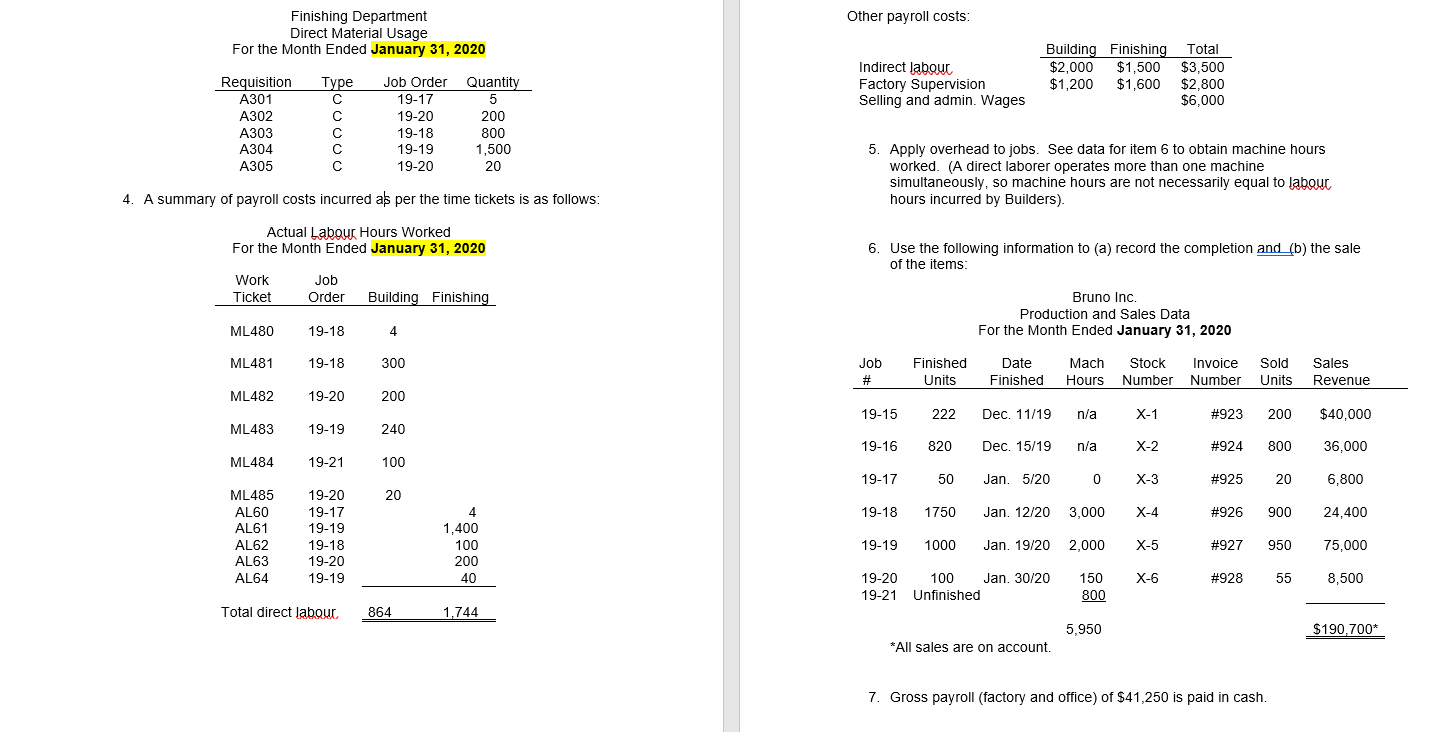

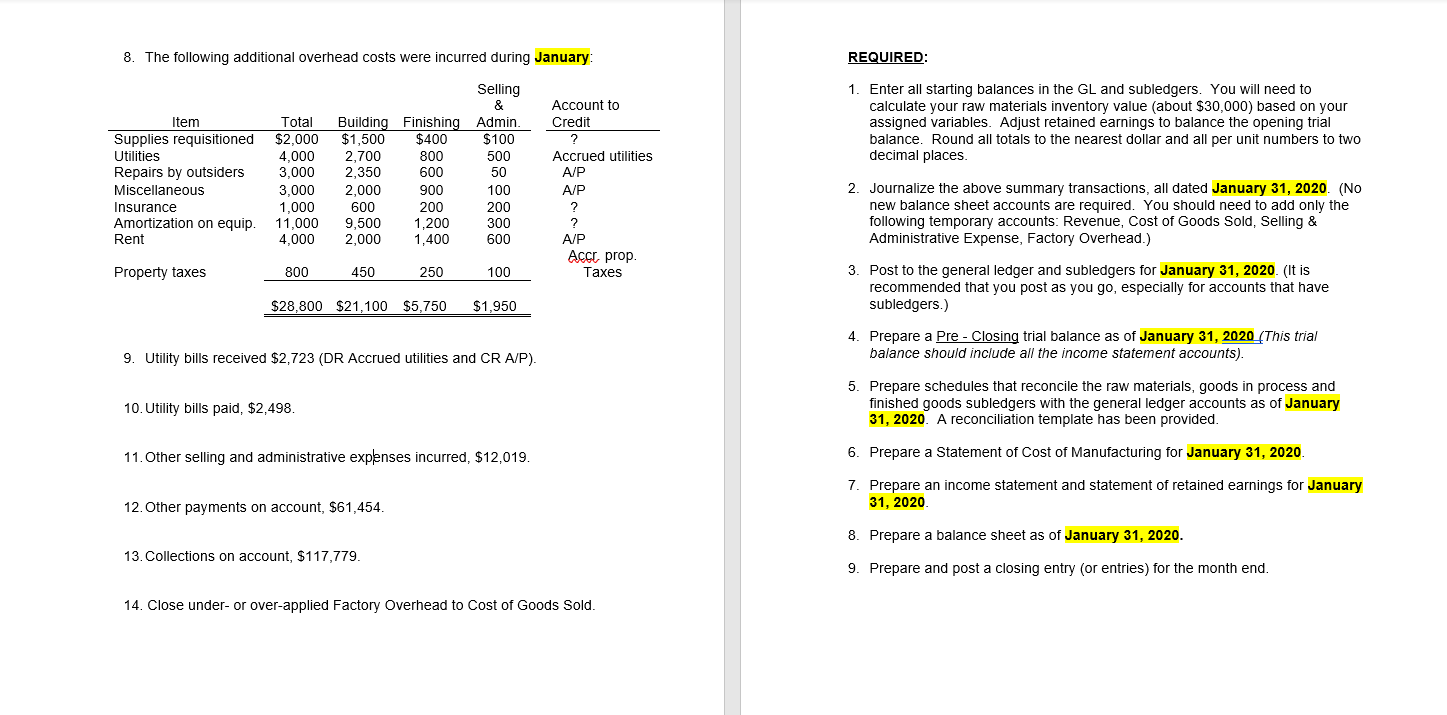

Work in process: Job Detail in Subsidiary Records As of December 31, 2019 $29,750 20,200 ? Bruno Inc. is a small producer of custom dog houses in London. It uses a job order costing system because each dog house is custom build for its owner and therefore receives varying attention and effort from the two factory departments, building and finishing. Bruno uses a perpetual inventory system. Bruno Inc. had the following post-closing trial balance as of December 31, 2019: Cash Accounts Receivable Raw Materials Inventory order Dep't Number Direct Direct Factory Total Materials Labour Overhead Cost Finishing $2,584.00 $1,075.00 $1,111.00 $4,770.00 $333.00 $290.00 $125.00 $748.00 $5,518.00 19-17 Building Work in Process Inventory ? Finished Goods Inventory ? Unexpired Insurance 9,640 Finished goods: Stock # Unit Reference Quantity Cost Total Cost Office Equipment 30,000 Accumulated amortization - Office Equipment $3,800 X-1 Job 19-15 222.00 82.00 $ ? Factory Equipment 650,000 Accumulated Amortization - Factory X-2 Job 19-16 820.00 19.00 $? Equipment 175,000 $? Accounts Payable 21,050 Wages and Salaries Payable 1,000 Raw materials: Accrued Utilities 2,000 Accrued Property Taxes 3,000 Capital Stock Retained Earnings 101,300 ? ? ? ABC RM Type Total Quantity Unit Cost Cost 5,555 2 (A) 10,444 2 (B) ? ? 662 2 (C) ? Supplies Various $2,051.00 ? To cost jobs as they are worked on, a predetermined or budgeted overhead rate was computed for 2020 based on the following budgeted cost drivers: Labor costs and overhead costs: TRANSACTIONS: The hourly rate including benefits for Building is $ $_ (E). (D) and for finishing is The following transactions occurred during the month of January 2020: 1. Purchases of raw materials (on account): RM Type Units $$ Building department Receiving report # Receiving report # 1012 A 5,000 1013 B 6,000 ? Receiving report # 1014 A 2,500 ? Receiving report # 1015 B 5,000 ? Receiving report # 1016 C 2,125 ? Receiving report # 1017 B 3,000 ? N/A $3,000.00 Finishing department 60,000 machine hours $132,020 of direct labour These overhead rates will be used throughout the year by each department. All overhead will be applied to all jobs worked on during the year in proportion to the machine-hour and/or direct-labour cost devoted to each job. Bruno Inc. rents its factory building. This budget was prepared after careful consideration of the sales outlook for the coming year. The forecasted budget consisted of the following items: Bruno Inc. Factory Overhead Budget For The Year Ended December 31, 2020 Building Finishing Receiving report # 1018 Supplies Assume that costs have not changed in the last year. 2. Returns on account: 47 units of material B. (receiving report #1019) 3. The direct material requisitions were summarized, and the following data were shown on a material usage report. Total Variable costs: Supplies $14,200 $5,400 $19,600 Indirect Labour 22,800 16,800 39,600 Utilities 30,000 8,000 38,000 Repairs 24,000 6,000 30,000 Misc. Fixed costs: Insurance Amortization Rent Property taxes Supervision Total Factory Overhead FOH rate = budgeted FOH budgeted cost driver 19,000 11,000 31,336 110,000 47,200 157,200 7,000 95,000 14,400 2,400 9,600 128,400 37,0000 24,000 13,000 4,000 1,200 5,400 15,000 14,214 31,414 145,000 45,214 211,814 $255,000 $92,414 $369,014 Building Department Direct Material Usage For the Month Ended January 31, 2020 Requisition RM Type Job Order Quantity M89 B 19-18 1,500 M90 A 19-19 3,017 M91 A 19-20 800 M92 B 19-20 1,000 M93 B 19-19 3,000 M94 19-18 200 M95 A 19-21 1,900 Finishing Department Direct Material Usage For the Month Ended January 31, 2020 Requisition A301 A302 TIT A303 A304 A305 Type Job Order Quantity 19-17 5 19-20 200 19-18 800 19-19 19-20 1,500 20 4. A summary of payroll costs incurred as per the time tickets is as follows: Actual Labour Hours Worked For the Month Ended January 31, 2020 Other payroll costs: Indirect labout Factory Supervision Building Finishing Total $2,000 $1,500 $3,500 $1,200 $1,600 $2,800 Selling and admin. Wages $6,000 5. Apply overhead to jobs. See data for item 6 to obtain machine hours worked. (A direct laborer operates more than one machine simultaneously, so machine hours are not necessarily equal to labour hours incurred by Builders). 6. Use the following information to (a) record the completion and (b) the sale of the items: Work Job Ticket Order Building Finishing ML480 19-18 4 Bruno Inc. Production and Sales Data For the Month Ended January 31, 2020 ML481 19-18 300 Job # Finished Units Date Mach Stock Invoice Sold Sales Finished Hours Number Number Units Revenue ML482 19-20 200 19-15 222 Dec. 11/19 n/a X-1 #923 200 $40,000 ML483 19-19 240 19-16 820 Dec. 15/19 n/a X-2 #924 800 36,000 ML484 19-21 100 19-17 50 Jan. 5/20 0 X-3 #925 20 6,800 ML485 19-20 20 AL60 19-17 4 19-18 1750 Jan. 12/20 3,000 X-4 #926 900 24,400 AL61 19-19 1,400 AL62 19-18 100 19-19 1000 Jan. 19/20 2,000 X-5 #927 950 75,000 AL63 19-20 200 AL64 19-19 40 19-20 100 Jan. 30/20 150 X-6 #928 55 8,500 19-21 Unfinished 800 Total direct labour. 864 1,744 5,950 $190,700* *All sales are on account. 7. Gross payroll (factory and office) of $41,250 is paid in cash. 8. The following additional overhead costs were incurred during January: Item Selling & Account to Total Building Finishing Admin. Credit Supplies requisitioned $2,000 $1,500 $400 Utilities 4,000 2,700 Repairs by outsiders 3,000 2,350 Miscellaneous ? Accrued utilities EITTIE 3,000 2,000 1,000 800 $100 500 600 50 A/P 900 100 A/P 600 200 200 ? Amortization on equip. 11,000 9,500 1,200 300 ? Rent 4,000 2,000 1,400 600 A/P Property taxes 800 450 250 100 Insurance $28,800 $21,100 $5,750 $1,950 9. Utility bills received $2,723 (DR Accrued utilities and CR A/P). 10. Utility bills paid, $2,498. 11. Other selling and administrative expenses incurred, $12,019. 12. Other payments on account, $61,454. 13. Collections on account, $117,779. Acct prop. Taxes 14. Close under- or over-applied Factory Overhead to Cost of Goods Sold. REQUIRED: 1. Enter all starting balances in the GL and subledgers. You will need to calculate your raw materials inventory value (about $30,000) based on your assigned variables. Adjust retained earnings to balance the opening trial balance. Round all totals to the nearest dollar and all per unit numbers to two decimal places. 2. Journalize the above summary transactions, all dated January 31, 2020. (No new balance sheet accounts are required. You should need to add only the following temporary accounts: Revenue, Cost of Goods Sold, Selling & Administrative Expense, Factory Overhead.) 3. Post to the general ledger and subledgers for January 31, 2020. (It is recommended that you post as you go, especially for accounts that have subledgers.) 4. Prepare a Pre - Closing trial balance as of January 31, 2020 (This trial balance should include all the income statement accounts). 5. Prepare schedules that reconcile the raw materials, goods in process and finished goods subledgers with the general ledger accounts as of January 31, 2020. A reconciliation template has been provided. 6. Prepare a Statement of Cost of Manufacturing for January 31, 2020. 7. Prepare an income statement and statement of retained earnings for January 31, 2020. 8. Prepare a balance sheet as of January 31, 2020. 9. Prepare and post a closing entry (or entries) for the month end.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started