Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 2021, Pyro Ltd launched the 'Sales' rewards program to encourage employees to focus on increasing sales revenue. Under this program, 32 sales

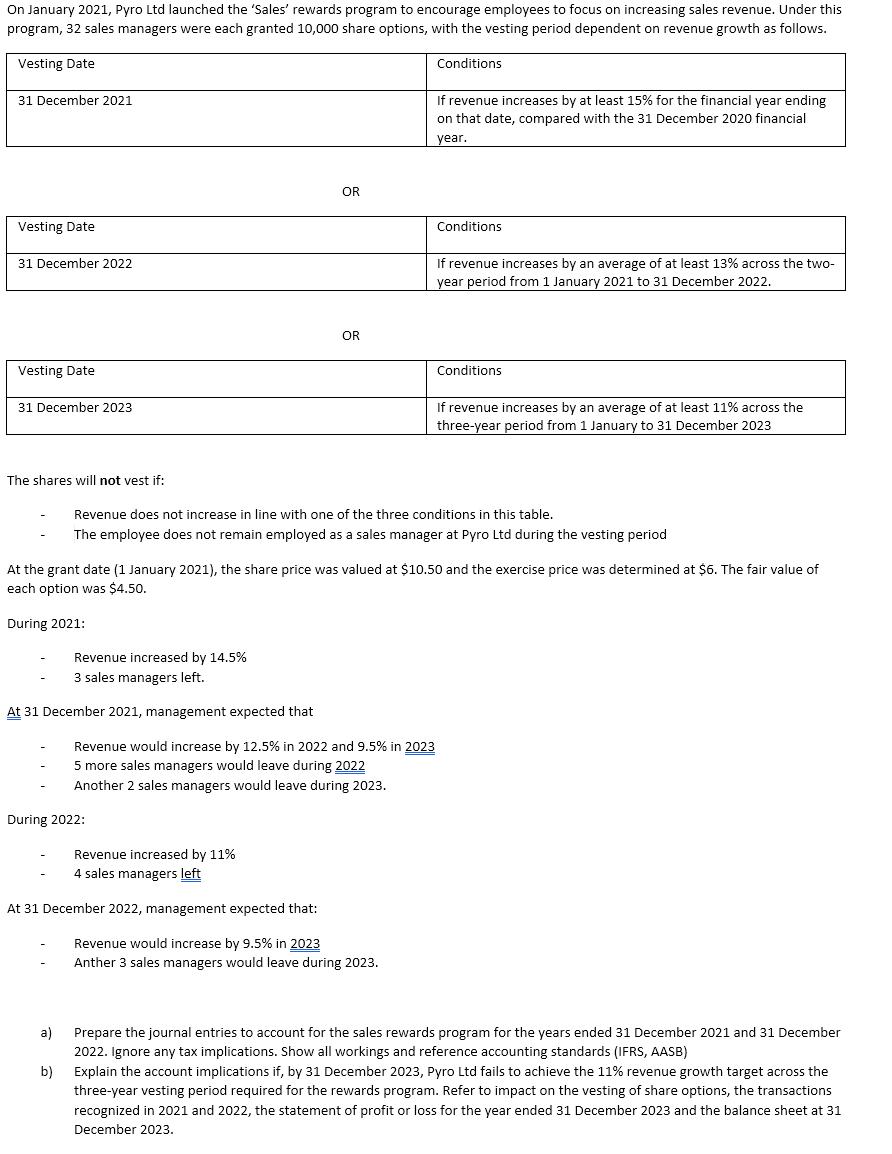

On January 2021, Pyro Ltd launched the 'Sales' rewards program to encourage employees to focus on increasing sales revenue. Under this program, 32 sales managers were each granted 10,000 share options, with the vesting period dependent on revenue growth as follows. Vesting Date 31 December 2021 Vesting Date 31 December 2022 Vesting Date 31 December 2023 The shares will not vest if: Revenue increased by 14.5% 3 sales managers left. At 31 December 2021, management expected that OR OR During 2022: a) Revenue would increase by 12.5% in 2022 and 9.5% in 2023 5 more sales managers would leave during 2022 Another 2 sales managers would leave during 2023. Conditions Revenue increased by 11% 4 sales managers left At 31 December 2022, management expected that: Revenue would increase by 9.5% in 2023 Anther 3 sales managers would leave during 2023. If revenue increases by at least 15% for the financial year ending on that date, compared with the 31 December 2020 financial. year. Conditions Revenue does not increase in line with one of the three conditions in this table. The employee does not remain employed as a sales manager at Pyro Ltd during the vesting period At the grant date (1 January 2021), the share price was valued at $10.50 and the exercise price was determined at $6. The fair value of each option was $4.50. During 2021: If revenue increases by an average of at least 13% across the two- year period from 1 January 2021 to 31 December 2022. Conditions If revenue increases by an average of at least 11% across the three-year period from 1 January to 31 December 2023 Prepare the journal entries to account for the sales rewards program for the years ended 31 December 2021 and 31 December 2022. Ignore any tax implications. Show all workings and reference accounting standards (IFRS, AASB) b) Explain the account implications if, by 31 December 2023, Pyro Ltd fails to achieve the 11% revenue growth target across the three-year vesting period required for the rewards program. Refer to impact on the vesting of share options, the transactions recognized in 2021 and 2022, the statement of profit or loss for the year ended 31 December 2023 and the balance sheet at 31 December 2023.

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION According to collect from the data Let us assume that the data as followed by a Journal entries for the sales rewards program 31 December 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started