Question

You are considering a Bond that is selling in the market. The bond has a $1,000 par value, pays interest at 13%, and is

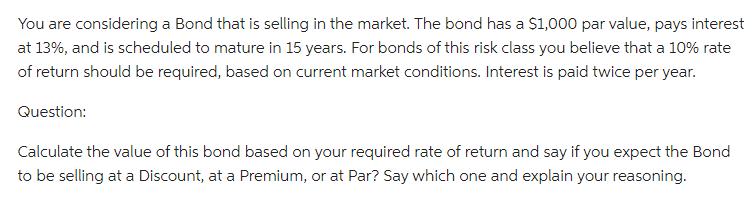

You are considering a Bond that is selling in the market. The bond has a $1,000 par value, pays interest at 13%, and is scheduled to mature in 15 years. For bonds of this risk class you believe that a 10% rate of return should be required, based on current market conditions. Interest is paid twice per year. Question: Calculate the value of this bond based on your required rate of return and say if you expect the Bond to be selling at a Discount, at a Premium, or at Par? Say which one and explain your reasoning.

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investment Management

Authors: Geoffrey Hirt, Stanley Block

10th edition

0078034620, 978-0078034626

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App