Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are trying to estimate the cost of equity for a privately owned cruise ship company called the Titanic Cruise Lines. You know that the

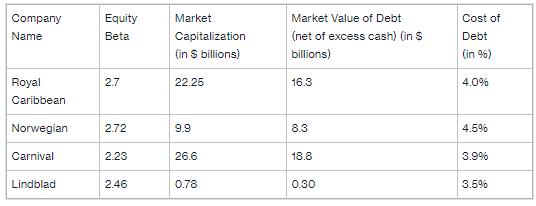

You are trying to estimate the cost of equity for a privately owned cruise ship company called the Titanic Cruise Lines. You know that the company's cost of debt is 3% and its debt-to-enterprise value ratio is 20%. You have collected the following information on publicly traded cruise lines that are comparable. You also know that the risk-free rate is 1.9% and the market risk premium in 5%.

Company Name Royal Caribbean Norwegian Carnival Lindblad Equity Beta 2.7 2.72 2.23 2.46 Market Capitalization (in $ billions) 22.25 9.9 26.6 0.78 Market Value of Debt (net of excess cash) (in S billions) 16.3 8.3 18.8 0.30 Cost of Debt (in %) 4.0% 4.5% 3.9% 3.5%

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the market value of equity for each comparable company Royal Caribbean 2225 billion 163 bi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started