Answered step by step

Verified Expert Solution

Question

1 Approved Answer

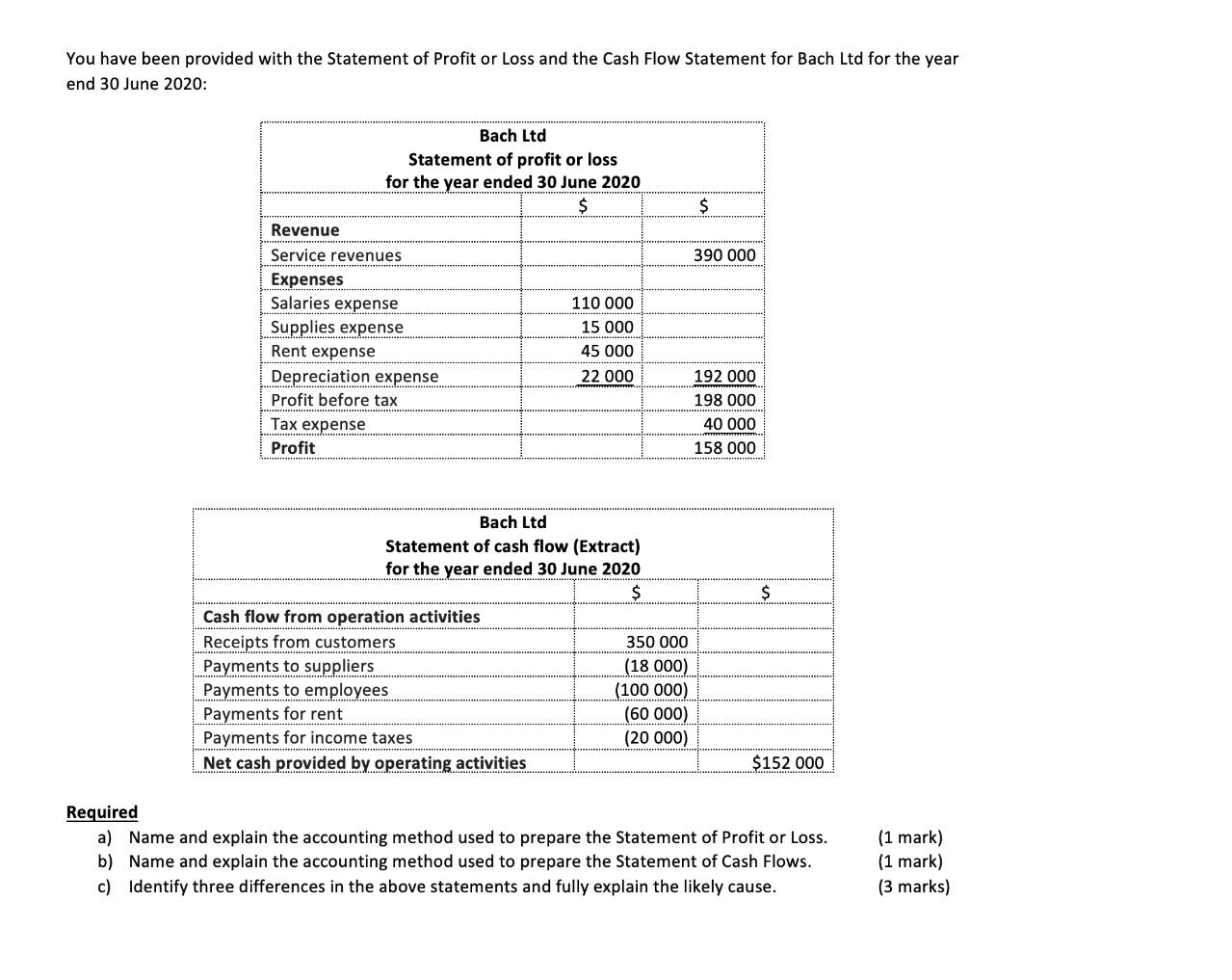

You have been provided with the Statement of Profit or Loss and the Cash Flow Statement for Bach Ltd for the year end 30

You have been provided with the Statement of Profit or Loss and the Cash Flow Statement for Bach Ltd for the year end 30 June 2020: Bach Ltd Statement of profit or loss for the year ended 30 June 2020 $ Revenue Service revenues Expenses Salaries expense Supplies expense Rent expense Depreciation expense Profit before tax Tax expense Profit 110 000 15 000 45 000 22 000 Bach Ltd Statement of cash flow (Extract) for the year ended 30 June 2020 $ Cash flow from operation activities Receipts from customers Payments to suppliers Payments to employees Payments for rent Payments for income taxes Net cash provided by operating activities 350 000 (18 000) (100 000) (60 000) (20 000) $ 390 000 192 000 198 000 40 000 158 000 $152 000 Required a) Name and explain the accounting method used to prepare the Statement of Profit or Loss. b) Name and explain the accounting method used to prepare the Statement of Cash Flows. c) Identify three differences in the above statements and fully explain the likely cause. (1 mark) (1 mark) (3 marks)

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The accounting method used to prepare the Statement of Profit or Loss is the accrual basis of acco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started