Question: You work in the Finance Department for Ritter Inc. and you have been instructed to conduct financial planning for the next year to estimate the

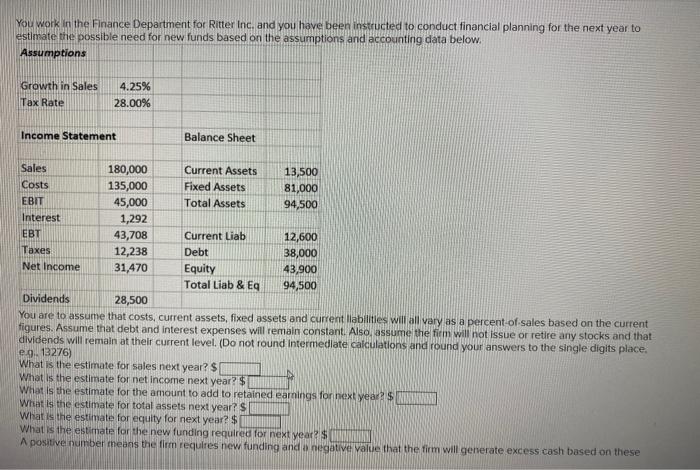

You work in the Finance Department for Ritter Inc. and you have been instructed to conduct financial planning for the next year to estimate the possible need for new funds based on the assumptions and accounting data below. Assumptions Growth in Sales Tax Rate 4.25% 28.00% Income Statement Balance Sheet Sales 180,000 Current Assets 13,500 Costs 135,000 Fixed Assets 81,000 EBIT 45,000 Total Assets 94,500 Interest 1,292 EBT 43,708 Current Liab 12,600 Taxes 12,238 Debt 38,000 Net Income 31,470 Equity 43,900 Total Liab & Eq 94,500 Dividends 28,500 You are to assume that costs, current assets, fixed assets and current liabilities will all vary as a percent of sales based on the current figures. Assume that debt and interest expenses will remain constant. Also assume the firm will not Issue or retire any stocks and that dividends will remain at their current level. (Do not round Intermediate calculations and round your answers to the single digits place, eg. 13276) What is the estimate for sales next year? $ What is the estimate for net income next year? $ What is the estimate for the amount to add to retained earnings for next year $ What is the estimate for total assets next year? What is the estimate for equity for next year? $ What is the estimate for the new funding required for next year? $ A positive number means the firm requires new funding and a negative value that the firm will generate excess cash based on these

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts