Question

Your company needs fresh cash (10 Mio ). In the board meeting the CFO was proposing 10,000 bonds with yield to maturity of 100

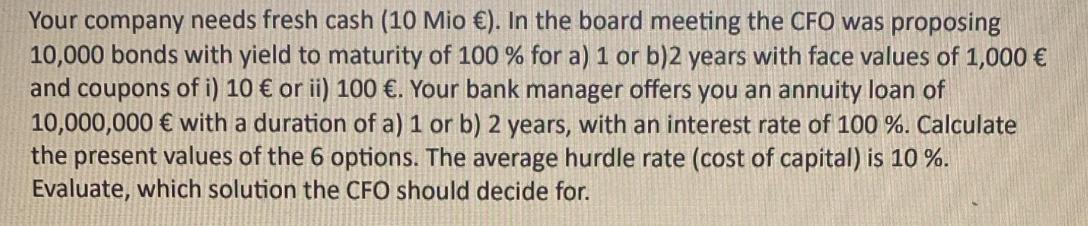

Your company needs fresh cash (10 Mio ). In the board meeting the CFO was proposing 10,000 bonds with yield to maturity of 100 % for a) 1 or b)2 years with face values of 1,000 and coupons of i) 10 or ii) 100 . Your bank manager offers you an annuity loan of 10,000,000 with a duration of a) 1 or b) 2 years, with an interest rate of 100 %. Calculate the present values of the 6 options. The average hurdle rate (cost of capital) is 10%. Evaluate, which solution the CFO should decide for.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Basic Business Statistics Concepts And Applications

Authors: Mark L. Berenson, David M. Levine, Kathryn A. Szabat, David F. Stephan

14th Edition

134684842, 978-0134684840

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App