Question

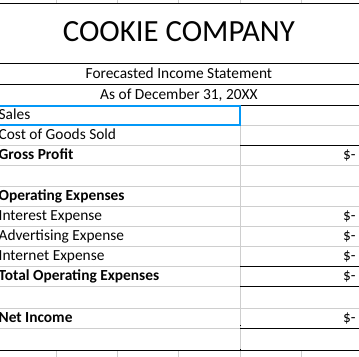

Your goal is to complete the following for your first year of operations: A 12-month cash budget A forecasted income statement for your first year

Your goal is to complete the following for your first year of operations:

A 12-month cash budget

A forecasted income statement for your first year

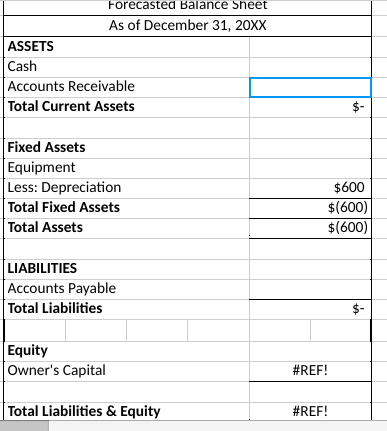

A forecasted balance sheet as of the end of your first year

For this last activity, you will not be using the information you've collected in your first two activities. Rather, you will use the information given below to complete this last assignment.

As you prepare your cash budget, forecasted income statement, and forecasted balance sheet, make the following assumptions regarding your first year of business:

You will begin your cookie company on January 1

You will begin your cookie company with a $2,000 loan. Assume this is your starting cash balance.

Assume an interest rate of 1% per month on this loan.

Assume you need to pay cash interest each month on the loan balance outstanding as of the beginning of the month

Assume once your company has a "Preliminary Cash Balance" of $4,000 or more for a particular month, it will pay off the $2,000 loan balance in full that month

You will have initial start-up costs that you will pay for at the beginning of January. These are 1-time costs that include the following:

Commercial Oven = $1,000

Laptop = $300

Implements (pans, bowls, mixers, etc.) = $200

Assume the cookies you are making are very large chocolate chip cookies. Therefore, you only sell these cookies individually.

The total cost of making one very large cookie = $10

Direct Materials/cookie = $4

Direct Labor/cookie = $4

Overhead/cookie = $2

Your selling price = $20

Assume you forecast to sell 100 cookies in January and you forecast to sell 25 more cookies than the previous month throughout your first year. (Example: 125 cookies in February, 150 cookies in March, 175 cookies in April, etc.)

Assume your maximum capacity for making cookies each month is 300. Therefore, that is the most you can make and sell in a month. Keep this in mind for your sales forecasts in the later months of the year.

Assume you sell all of the cookies you make in a month

Assume 80% of your sales are for cash and 20% are on credit

Your credit customers always pay you in full in the following month

Assume you pay for all of your direct materials on credit, and you pay for direct materials purchases in the following month

Example: In January you estimate making 300 cookies at a $4 direct labor cost per cookie. Therefore the cash you pay for direct materials in

January is $0, and $1,200 in February

Assume you pay your direct labor in cash during the month the cookies were made

Example: In January you estimate making 300 cookies at a $4 direct labor cost per cookie. Therefore the cash you pay for direct labor in January is $1,200

Assume you rent a kitchen space with a fixed monthly cost of $400

Assume a monthly fixed advertising fee of $200

Assume a monthly internet hosting fee of $50

Assume no returns or refunds of product.

When you make your forecasted balance sheet, assume $600 depreciation on your equipment.

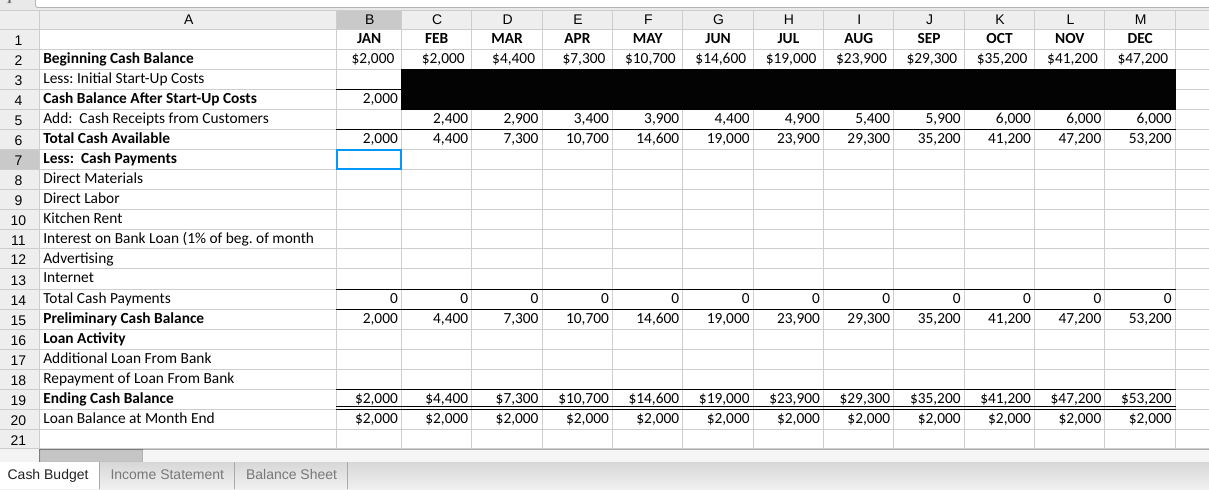

A B 1 JAN FEB 2 Beginning Cash Balance $2,000 MAR APR $2,000 $4,400 $7,300 $10,700 $14,600 $19,000 $23,900 SEP OCT NOV DEC $29,300 $35,200 $41,200 $47,200 E F G J K L M MAY JUN JUL AUG 3 Less: Initial Start-Up Costs 4 Cash Balance After Start-Up Costs 2,000 5 Add: Cash Receipts from Customers 6 Total Cash Available 2,000 2,400 4,400 2,900 3,400 3,900 4,400 4,900 5,400 7,300 10,700 14,600 19,000 23,900 29,300 35,200 41,200 47,200 53,200 5,900 6,000 6,000 6,000 7 Less: Cash Payments 8 Direct Materials 9 Direct Labor 10 Kitchen Rent 11 Interest on Bank Loan (1% of beg. of month 12 Advertising 13 Internet 14 Total Cash Payments 15 Preliminary Cash Balance 0 2,000 0 4,400 0 7,300 0 10,700 0 0 0 0 0 0 0 0 14,600 19,000 23,900 29,300 35,200 41,200 47,200 53,200 16 Loan Activity 17 Additional Loan From Bank 18 Repayment of Loan From Bank 19 Ending Cash Balance 20 Loan Balance at Month End $2,000 $4,400 $2,000 $2,000 $7,300 $10,700 $14,600 $19,000 $23,900 $29,300 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $35,200 $41,200 $47,200 $53,200 $2,000 $2,000 $2,000 $2,000 21 Cash Budget Income Statement Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started