As an investment advisor for MREAF (Momentum Real Estate Advisory Fund), you are about to make a

Question:

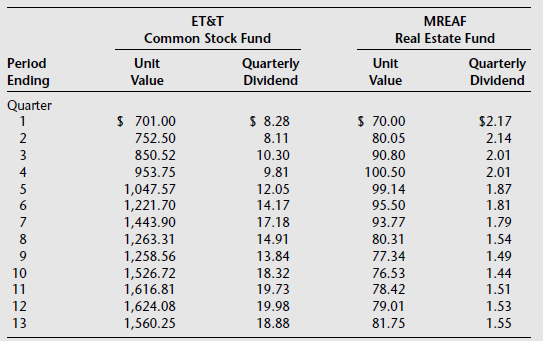

a. Calculate the quarterly HPR for each investment.

b. Calculate the arithmetic mean HPR, the standard deviation of the HPRs, and the geometric mean for each fund. Which fund contained more risk per unit of return?

c. Was there any correlation between returns on the ET&T fund and MREAF?

d. Would a portfolio that contained equal amounts of ET&T securities and MREAF have provided any investment diversification? Why?

e. Assume each investment could have been combined in a portfolio with weights ranging from 0 percent to 100 percent. What pattern of risk and return would result if each investment were added (deleted) in increments of 10 percent (remember that the sum of the two proportions must always sum to 100 percent)? What combination of securities would have constituted the €œefficient frontier€ (if any)?

f. If the manager of ET&T is considering making an investment in MREAF, of what use is this analysis?

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Real Estate Finance and Investments

ISBN: 978-0073377339

14th edition

Authors: William Brueggeman, Jeffrey Fisher