Assume an elderly couple owns a $140,000 home that is free and clear of mortgage debt. A

Question:

a. What is the monthly payment on this RAM?

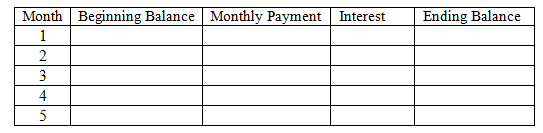

b. Fill in the following partial loan amortization table

c. What will be the loan balance at the end of the 12-year term?

d. What portion of the loan balance at the end of year 12 represents principal? What portion represents interest?

An annuity is a series of equal payment made at equal intervals during a period of time. In other words annuity is a contract between insurer and insurance company in which insurer make a lump-sum payment or a series of payment and, in return,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Real Estate Principles A Value Approach

ISBN: 978-0077836368

5th edition

Authors: David C Ling, Wayne Archer

Question Posted: