Although most readers of this book probably have never heard of AGRANA, virtually everybody has heard of

Question:

Although most readers of this book probably have never heard of AGRANA, virtually everybody has heard of Coca-Cola, Danone, Hershey Foods, Nestlé, PepsiCo, and Tyson Foods. Headquartered and listed in Vienna, Austria, AGRANA was one of the leading suppliers to these multinational brands around the world. With revenues of $3.4 billion and capitalization of $1.4 billion, AGRANA was the world’s leader in fruit preparations and one of Central Europe’s leading sugar and starch companies.

AGRANA was formed in 1988 as a holding company for three sugar factories and two starch factories in Austria. In the last three decades, it has become a global player, with 54 production plants in 26 countries with three strategic pillars: sugar, starch, and fruit. AGRANA supplied most of its fruit preparations and fruit juice concentrates to the dairy, baked products, ice-cream, and soft-drink industries. In fact, its fruit preparations were in one-third of the world’s yoghurt. AGRANA saw its fruit preparations rise alongside the growing popularity of Greek yoghurt, which used twice as much fruit as traditional yoghurt.2 In other words, you may not know AGRANA, but you have probably enjoyed many AGRANA products. So, just how did AGRANA grow from a small local supplier serving primarily the small Austrian market to a global player?

From Central and Eastern Europe to the World In many ways, the growth of AGRANA mirrored the challenges associated with regional integration in Europe and then with global integration of multinational production over the last three decades. There were two components of European integration. First, European Union (EU) integration accelerated throughout Western Europe in the 1990s.

This meant that a firm such as AGRANA, based in a relatively smaller country, Austria (with a population of 8.4 million), needed to grow its economies of scale to fend off the larger rivals from other European countries blessed with larger home country markets and hence larger economies of scale.

Second, since 1989, Central and Eastern European (CEE) countries, formerly off limits to Western European firms, have opened their markets.3 For Austrian firms such as AGRANA, the timing of CEE’s arrival as potential investment sites was fortunate. Facing powerful rivals from larger Western European countries but being constrained by its smaller home market, AGRANA aggressively expanded its foreign direct investment (FDI) throughout CEE. Most CEE countries have become EU members since then. As a result, CEE provided a much larger playground for AGRANA, allowing it to enhance its scale, scope, and thus competitiveness

At the same time, multinational production by global giants such as Coca-Cola, ConAgra, Danone, Nestlé, and PepsiCo had grown by leaps and bounds, thus reaching more parts of the world. Emerging as a strong player not only in Austria and CEE but also in the EU, AGRANA further “chased” its corporate buyers by investing in and locating supplier operations around the world. This strategy allowed AGRANA to better cater to the expanding needs of its corporate buyers.

Until 1918, Vienna had been the capital of the Austro-Hungarian Empire, whose territory not only included today’s Austria and Hungary, but also numerous CEE regions. Although formal ties were lost (and, in fact, cut during the Cold War), informal ties through cultural, linguistic, and historical links had never disappeared. These ties had been reactivated since the end of the Cold War, fueling a rising interest among Austrian firms to enter CEE.

Overall, from an institution-based view, it seems natural that Austrian firms would be pushed by pressures arising from the EU integration and pulled by the attractiveness of CEE. However, among hundreds of Austrian firms that have invested in CEE, not all are successful and some have failed miserably. So how can AGRANA emerge as a winner from its forays into CEE? The answer boils down to AGRANA’s firm-specific resources and capabilities, a topic we turn to next.

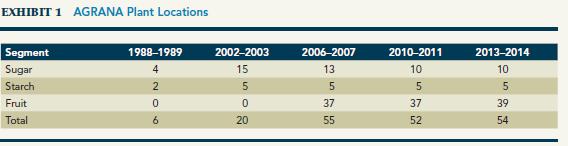

Product-Related Diversification AGRANA had long been associated with sugar and starch production in CEE. Until 2003, AGRANA’s focus on the sugar and starch industries worked well. However, the reorganization of the European sugar market by the EU Commission in 2006 motivated AGRANA to look in new directions for future growth opportunities.4 This new direction—fruit—became the third and largest division at AGRANA (see Exhibit 1), and in less than ten years, AGRANA became the world market leader in the production of fruit preparations. But the question remained as to how to diversify.

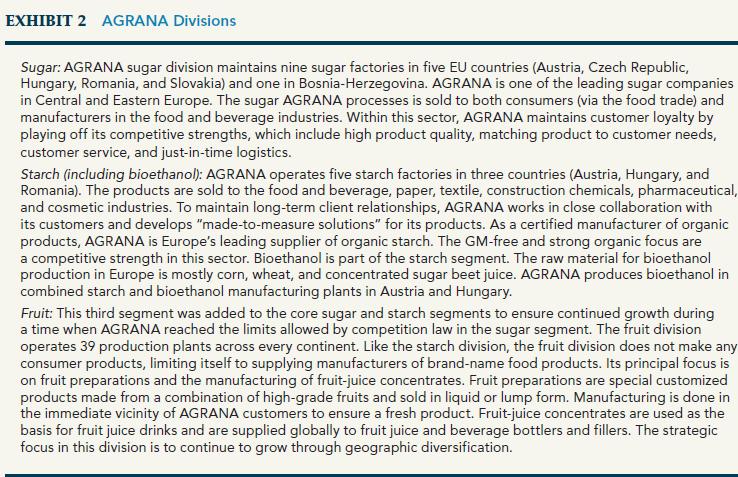

As a well-known processor in the sugar and starch industries, AGRANA wanted to capitalize on its core competence—the refining and processing of agricultural raw materials (sugar beets, cereals, and potatoes). To capitalize on its accumulated knowledge of the refinement process, AGRANA decided to diversify into the fruit-processing sector (Exhibit 2 gives a brief description of each of the three current divisions). First, entry into the fruit sector ensured additional growth and complemented AGRANA’s position in the starch sector. Since the starch division was already a supplier to the food and beverage industry, this allowed AGRANA to benefit from those relationships previously developed when it entered the fruit sector. Second, because the fruit sector is closely related to AGRANA’s existing core sugar and starch businesses, AGRANA could employ the

expertise and market knowledge it had accumulated over time, thus benefiting its new fruit division. AGRANA’s core competence of the refinement process allowed it to diversify into this new segment smoothly.

Johann Marihart, AGRANA’s CEO since 1992, believes that growth is an essential requirement for the manufacturing of high-grade products at competitive prices. Economies of scale have become a decisive factor for manufacturers in an increasingly competitive environment. In both the sugar and starch segments, AGRANA developed from a locally active company to one of Central Europe’s major manufacturers in a very short span of time. Extensive restructuring in the sugar and starch divisions allowed AGRANA to continue to operate efficiently and competitively in the European marketplace. Since its decision to diversify into the fruitprocessing industry in 2003, Marihart had pursued both an aggressive acquisition policy to exploit strategic opportunities in the fruit-preparation and fruit-juice concentrates sectors as well as an emphasis on organic growth through expansion.

Acquisitions How did AGRANA implement its expansion strategy?

Through acquisitions and organic growth. Between 1990 and 2001, AGRANA focused on dynamic expansion into CEE sugar and starch markets by expanding from five plants to 13 and almost tripling its capacity. As the sugar division reached a ceiling to its growth potential due to EU sugar reforms, AGRANA began searching for a new opportunity for growth. Diversifying into the fruit industry aligned with AGRANA’s goal to be a leader in the industrial refinement of agricultural raw materials.

AGRANA began its diversification into the fruit segment in 2003 with the acquisitions of Denmark’s Vallø Saft and Austria’s Steirerobst. By July 2006, AGRANA’s fruit division had acquired three additional holding firms and was reorganized so all subsidiaries were operating under the AGRANA brand.

AGRANA diversified into the fruit segment in 2003 through the acquisition of five firms. With the acquisition of Denmark’s Vallø Saft Group (fruit-juice concentrates) in April 2003, AGRANA gained a presence in Denmark and Poland.

The acquisition of an interest (33%) in Austria’s Steirerobst (fruit preparations and fruit-juice concentrates) in June 2003 gave AGRANA an increased presence in Austria, Hungary, and Poland, while also establishing a presence in Romania, Ukraine, and Russia. AGRANA fully acquired Steirerobst in February 2006. The acquisition of France’s Atys Group (fruit preparations) in December 2005 was AGRANA’s largest acquisition because Atys had 20 plants across every continent.

Within a short period, AGRANA had fruit preparation facilities in 23 countries. In June 2006, with the 50/50 joint

venture between the Vallø Saft Group and Xianyang Andre Juice Co. Ltd. (fruit-juice concentrates), AGRANA extended its reach to China. These acquisitions allowed AGRANA to quickly (within two years!) become a global player in the fruit segment. Exhibit 3 provides an overview of AGRANA’s current locations around the globe.

After this initial “acquisition spree,” AGRANA focused on select acquisitions and expansions into markets that would bring it closer to customers and allow it to take advantage of favorable market conditions. From 2010 to 2012, AGRANA expanded its fruit preparations in four emerging markets—China, Egypt, Russia, and South Africa—to take advantage of future growth expectations. In May 2014, AGRANA opened its fourth US fruit-preparations plant in Lysander, New York, to serve the rising customer demand in Canada and the Northeastern region of the United States and to counterbalance the flat growth in Europe. US markets offered strong growth mostly because of the trend toward Greek yoghurt, which contained double the fruit preparations of regular yoghurt.

In addition to acquisitions and organic growth, AGRANA focused on streamlining and restructuring its operations to increase efficiencies, reduce costs, and create synergies. The merger in 2012 between AGRANA Juice Holding GmbH and Ybbstaler Fruit Austria GmbH that formed YBBSTALER AGRANA Juice GmbH was expected to increase synergies and create further opportunities for growth. AGRANA further consolidated operations in 2014, when

(a) food-preparation production in Austria was moved to Gleisdorf,

(b) the plant in Cape Town was closed and all South African production was moved to the plant in Johannesburg, and

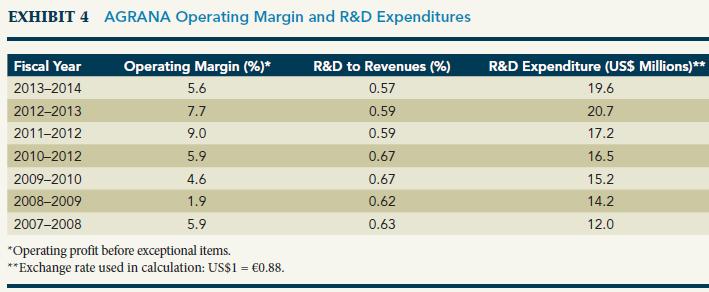

(c) two separate research and innovation facilities in Tulln, Austria, were combined to form the new AGRANA Research and Innovation Center. Research-and development (R&D) spending had increased every year— from $12 million in 2007–2008 to almost $20 million in 2013–2014 (Exhibit 4). The new research center was tasked with exploiting synergies through research across divisions and through networking with other institutions

The strategy of AGRANA was clearly laid out in its 2013–2014 annual report: “Through organic (nonacquisitive) growth and with the help of acquisitions and cooperative new ventures, the Group aims to consolidate and steadily add to its worldwide market position.” AGRANA’s growth strategy, consistent improvement in productivity, and value-added approach enabled it to provide continual increases in its enterprise value and dividend distributions to shareholders. The key to AGRANA’s global presence in the fruit segment was not only its many acquisitions, but also its ability to quickly integrate those acquired into the group to realize synergistic effects.

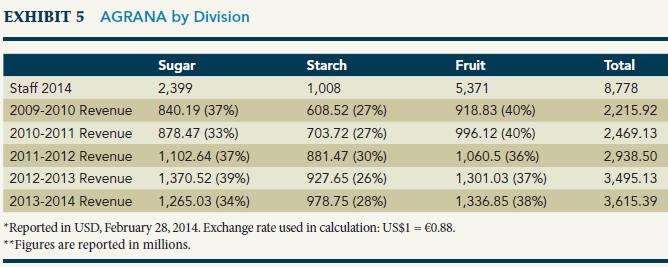

In Exhibit 5, the annual revenue is given for each sector. Although the sugar division was the leader in 2005–2006, the fruit division had been the revenue leader for most years since it was established. The latest annual report (2013– 2014) showed that the fruit division made up 38% of total revenue. AGRANA attributed its growth in the fruit sector to increases in dietary awareness and per capita income, two trends that were projected to continue to rise in the future.

Diversifying into Biofuel In light of further EU sugar reforms, AGRANA continually looked for new growth opportunities. In May 2005, the supervisory board of AGRANA gave the go-ahead for the construction of an ethanol facility in Pichelsdorf, Austria, and production began in 2008. AGRANA first began making alcohol in 2005 in addition to starch and isoglucose at its Hungrana, Hungary, plant in a preemptive move to accommodate forthcoming EU biofuel guidelines.

This move into ethanol was seen as a logical step by CEO Marihart. Similar to its move into the fruit sector, the production of ethanol allowed AGRANA to combine its extensive know-how of processing agricultural raw materials with its technological expertise and opened the door for further growth. Even though AGRANA became a major manufacturer of bioethanol in Europe, this segment was dealing with low prices and a continuing difficult market situation.

Case Discussion Questions

1. From an industry-based view, how would you characterize competition in this industry?

2. From a resource-based view, what is behind AGRANA’s impressive growth?

3. From an institution-based view, what opportunities and challenges have been brought by the integration of EU markets in both Western Europe and CEE?

4. From an international perspective, what challenges do you foresee AGRANA facing as it continues its expansion into other regions? Where and how should it expand?

Step by Step Answer: