In this case study, you will be applying Markowitzs Bi-criteria Quadratic Programming model to generate the entire

Question:

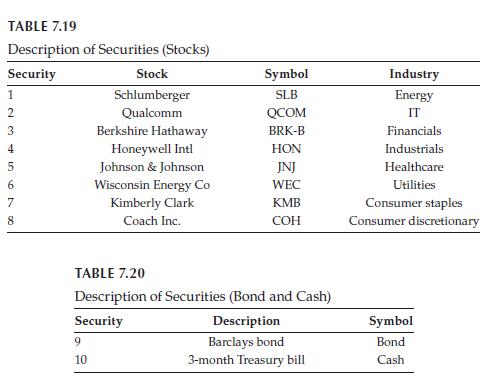

In this case study, you will be applying Markowitz’s Bi-criteria Quadratic Programming model to generate the entire set of efficient portfolios. An investor is considering 10 potential securities for investment. They are listed in Tables 7.19 and 7.20. His objectives are to maximize the average portfolio return and, at the same time, minimize the portfolio risk as measured by the variance of the portfolio return. The securities include eight stocks in a variety of industries, a bond, and a 3-month Treasury bill for cash to achieve diversification.

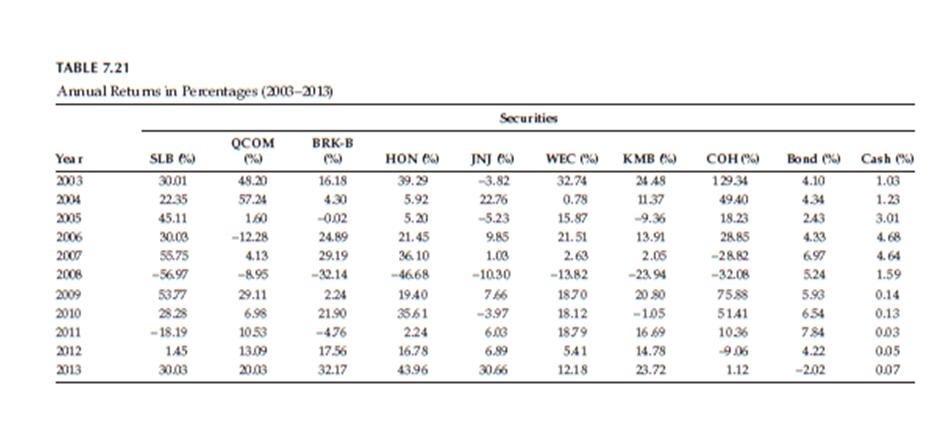

In addition, the investor wants to limit his investment to any one security to 30%. Table 7.21 gives the historical annual returns of the 10 securities for the 11-year period, 2003–2013.

Questions

a. Compute the average annual return (statistical average) and its standard deviation (STD) for each security expressed as a percentage.

b. Determine the variance–covariance matrix of the 10 securities.

c. Formulate a bi-criteria model that will maximize the average return and minimize the variance of the portfolio. You must define all the decision variables and explicitly write out the constraints and the two objective functions.

d. Determine the ideal solution and the bounds on the portfolio return (%) and portfolio risk, represented by its standard deviation (STD%).

e. Determine the minimum variance portfolio that will achieve an average return of at least

(i) 10%

(ii) 12%

(iii) 14%

(iv) 16%

(v) 18%

(vi) 20%

For each part, you must give the optimal portfolio in terms of percent invested in each security, portfolio return (%), and portfolio risk (STD%).

f. Using part

(e) results, draw the efficient frontier with x-axis representing portfolio risk (STD%) and y-axis representing portfolio return (%).

g. Based on the efficient portfolio frontier, what portfolio will you select and why?

Step by Step Answer:

Service Systems Engineering And Management

ISBN: 978-0367781323

1st Edition

Authors: A. Ravi Ravindran ,Paul M. Griffin ,Vittaldas V. Prabhu