Reba is a single taxpayer. Lawrence, Rebas 84-year-old dependent grandfather, lived with Reba until this year, when

Question:

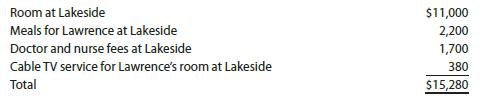

Reba is a single taxpayer. Lawrence, Reba’s 84-year-old dependent grandfather, lived with Reba until this year, when he moved to Lakeside Nursing Home because he needs specialized medical and nursing care. During the year, Reba made the following payments on behalf of Lawrence:

Lakeside has medical staff in residence. Disregarding the AGI floor, how much, if any, of these expenses qualify for a medical expense deduction by Reba?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2022 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357519431

25th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young, David M. Maloney

Question Posted: