Chee, single, age 40, had the following income and expenses during 2017: Calculate Chee's taxable income for

Question:

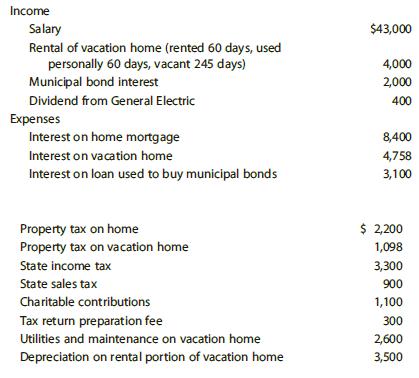

Chee, single, age 40, had the following income and expenses during 2017:

Calculate Chee's taxable income for the year before personal exemptions. If Chee has any options, choose the method that maximizes his deductions.

Transcribed Image Text:

Income $43,000 Salary Rental of vacation home (rented 60 days, used personally 60 days, vacant 245 days) Municipal bond interest 4,000 2,000 Dividend from General Electric 400 Expenses Interest on home mortgage 8,400 Interest on vacation home 4,758 Interest on loan used to buy municipal bonds 3,100 Property tax on home Property tax on vacation home $ 2,200 1,098 State income tax 3,300 State sales tax 900 Charitable contributions 1,100 Tax return preparation fee Utilities and maintenance on vacation home 300 2,600 Depreciation on rental portion of vacation home 3,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

Notes 1 The municipal bond interest of 2000 is excludible from gross income and the interest expense ...View the full answer

Answered By

Muhammad Ahtsham Shabbir

I am a professional freelance writer with more than 7 years’ experience in academic writing. I have a Bachelor`s Degree in Commerce and Master's Degree in Computer Science. I can provide my services in various subjects.

I have professional excellent skills in Microsoft ® Office packages such as Microsoft ® Word, Microsoft ® Excel, and Microsoft ® PowerPoint. Moreover, I have excellent research skills and outstanding analytical and critical thinking skills; a combination that I apply in every paper I handle.

I am conversant with the various citation styles, among them; APA, MLA, Chicago, Havard, and AMA. I also strive to deliver the best to my clients and in a timely manner.My work is always 100% original. I honestly understand the concern of plagiarism and its consequences. As such, I ensure that I check the assignment for any plagiarism before submission.

4.80+

392+ Reviews

587+ Question Solved

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Ken (age 31) and Amy (age 28) Booth have brought you the following information regarding their income, expenses, and withholding for the year. They are unsure which of these items must be used to...

-

Russell (age 50) and Linda (age 45) Long have brought you the following information regarding their income and expenses for the current year. Russell owns and operates a landscaping business called...

-

Chee, single, age 40, had the following income and expenses during 2018: Income Salary ....................................................................................$43,000 Rental of vacation...

-

An analysis of spending by a sample of credit card bank cardholders shows that spending by cardholders in January (Jan) is related to their spending in December ( Dec): The assumptions and conditions...

-

1. Keckye Co. is a calendar year C corporation. When is Keckye's 2017 tax return due? a. March 15, 2018 b. April 16, 2018 c. June 15, 2018 d. October 15, 2018 2. Keckye Co. is a C corporation with a...

-

Derive a differential equation (do not solve) for the temperature distribution in a straight triangular fin. For convenience, take the coordinate axis as shown in Figure P2-83 and assume...

-

Playing a gambling game costs $10. The table shows the probability of winning various prizes on the game. Find the expected net gain to the player for one play of the game. Prize Probability 1 $200...

-

Minsoo Ltd. is a retailer operating in Edmonton, Alberta. Minsoo uses the perpetual inventory method. All sales returns from customers result in the goods being returned to inventory; the inventory...

-

d Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and c unit over the relevant range of 30,000 to 50,000 units is given below:...

-

Use information on the endpapers of this book to calculate the average density of the Earth. Where does the value fit among those listed in Tables 1.5 and 14.1? Look up the density of a typical...

-

Using information from this chapter as well as information from the tax agency in your state (likely called the Department of Revenue) and your local government, find all of the taxes to which a sole...

-

Aman, a sole proprietor and rental property owner, had the following expenses in 2017: Specify whether each expense would be deducted for adjusted gross income (AGI) or from AGI on Amans 2017 tax...

-

Beachside Beverages Company manufactures soft drinks. Information about two products is as follows: It is known that both products have the same direct materials and direct labor costs per case....

-

International Foods Corporation (IFC) currently processes seafood with a unit it purchased several years ago. The unit, which originally cost $500,000, currently has a book value of $270,000. IFC is...

-

Explain the concept of monoalphabetic substitution and its application in decryption.

-

Differentiate between Lumpsum contract and Item Rate Contract.

-

What is Design Thinking? Explain the principles of Design Thinking.

-

Explain the key responsibilities of chemical engineers in ensuring process safety and efficiency. Provide examples of how chemical engineers contribute to environmental sustainability and the...

-

Consider the graph of the function f shown in the figure. Answer the following questions by referring to the points AI. a. Which points correspond to the roots (zeros) of f? b. Which points on the...

-

Floyd Distributors, Inc., provides a variety of auto parts to small local garages. Floyd purchases parts from manufacturers according to the EOQ model and then ships the parts from a regional...

-

In the current year, Jeanette, an individual in the 25% marginal tax bracket, recognized a $20,000 long-term capital gain. Also in the current year, Parrot Corporation, a C corporation in the 25%...

-

In the current year, Jeanette, an individual in the 25% marginal tax bracket, recognized a $20,000 long-term capital gain. Also in the current year, Parrot Corporation, a C corporation in the 25%...

-

John (a sole proprietor) and Eagle Corporation (a C corporation) each recognize a long-term capital gain of $10,000 and a short-term capital loss of $18,000 on the sale of capital assets. Neither...

-

If you were to enter the banking industry, you might find yourself approving or not approving loans. The following is a good example of a common event you could encounter. Company X is looking for...

-

You see a two year bond with annual coupon rate of 8% that has these flows. Years ahead Cashflows 0 ?? 0.25 0 0.5 0 0.75 1 1.25 1.5 1.75 2 8 0 0 0 108 You will be asked to calculate its price at...

-

Use synthetic division and the Remainder Theorem to evaluate P(c). P(x) = 6x + 5x +9, c = 11/1 P(1) =

Study smarter with the SolutionInn App